When you communicate with your relatives or acquaintances, it always becomes uncomfortable if you hear a new word and have absolutely no idea what it means. The word "monitor" is increasingly appearing in the lexicon modern man, but not everyone knows the true meaning of this term. Therefore, the use of this word is sometimes completely out of place. And yet, when a person says "monitor", what does it mean? Let's figure it out.

Terminology

The verb "monitor" comes from the noun "monitoring". Monitoring is the activity of collecting and processing data that can be used for subsequent analysis in order to improve the process of making production and management decisions. That is, to monitor means to observe, control, process information that may be useful for subsequent decision-making. A monitoring system is a set of measures for collecting and processing information.

In turn, these terms can be used in various fields human activity. For example, sociology, business and so on. Depending on the field of activity, the terminology of the word “monitor” also changes. What this means in various spheres of human activity, we will analyze with illustrative examples.

Monitoring in business

To run a successful business, you need to constantly monitor the market. That is, to observe the activities of direct competitors, their prices, assortment, and so on. Based on the results, the manager can make appropriate decisions regarding pricing policy company, product structure and so on.

Monitoring in business includes studying the needs, desires and preferences of the end user, observing pricing policy competing companies, identifying the disadvantages and advantages of competitors. A complex approach to all these data allows the head of the company to make informed and informed decisions aimed at improving the efficiency of the organization.

Price monitoring

Monitor prices that are constantly changing in today's market economy, is the most important event that allows a commercial company to stay afloat. When monitoring the cost, it is important to take into account the prices for similar products of competing companies, the level of income of the population, supplier discounts, existing trade allowances etc.

It is also important for the consumer to observe prices or, in other words, to monitor them. What does it mean? When planning any large purchase, it is necessary to initially study the market conditions and compare prices for similar or similar products. Often, companies tend to unreasonably inflate prices, which will result in unnecessary costs for the consumer.

Monitoring in sociology

In sociology, the word "monitor" is also used. What does this mean in this field of activity? Sociological monitoring is a type of sociological research that provides data on the state of a particular social process or situations. The monitoring results are used to solve acute sociological issues, and they can also be extremely useful in the field of marketing.

Apart from social aspects human life, the object of monitoring can also be economic, political and spiritual phenomena. The main task of monitoring in social sphere consists in the constant provision of society with reliable, verified and expertly independent information, on the basis of which the quality of the sociological support of social management processes is significantly improved.

Environmental monitoring

"Monitor" state environment means to observe the changes and the state of natural resources. The environmental monitoring system includes monitoring its individual elements, monitoring and predicting its future state, assessing its change, and also determining the level of human impact on the ecosystem. divided by:

- global;

- National;

- regional;

- local;

Environmental monitoring collects data on the ground, in the air and even in space. There are several types of environmental monitoring:

- soil monitoring;

- monitoring of surface and ground waters;

- monitoring of the atmospheric and ozone layer;

- monitoring of the animal world, etc.

Then the data collected during the monitoring is transferred to the environmental expertise, which allows you to make an expert opinion on the state of the environment.

Conclusion

So, we found out that the word "monitor" can be used in different situations and carry a different meaning. But for a simpler perception of this term, it can easily be replaced by a synonym for "observe". Then the meaning of the presented material is practically not distorted, and the thematic material becomes easier for the understanding of a simple layman.

Price monitoring refers to marketing tools companies. With it, you can find out what the cost of goods and services is currently at the nearest competitors. Such information will allow you to set a favorable and competitive price for your product.

Every entrepreneur strives to increase income - this is the main goal of any business. After monitoring, it is necessary to make a decision on establishing the most favorable price for goods and services. If set low price if it is impossible, then it is necessary to achieve leadership among competitors in other ways. This can be done through the quality of the product, service or other strengths that should be used.

The need to use

Sergei Galitsky, founder and co-owner of the Magnit retail chain, said in an interview with Forbes: “When the price of a banana drops by two rubles, we sell them 100 tons more per day.”

From this phrase alone, you can understand how important the right pricing is, especially at high competitive markets. Of course, there are many other conditions in the evaluation of the product, in addition to the price itself, but its direct impact on sales cannot be denied.

With price monitoring, you can:

- set competitive prices;

- increase sales volumes;

- negotiate with contractors on more favorable terms;

- timely respond to all changes that occur in the market;

- know the answers to the questions of buyers, if the latter require some justification of the cost.

The use of price monitoring is necessary to maintain successful business, without it it is more difficult to take a leading position in the market. No matter how unique and innovative the product is, the company will not be able to succeed without the right marketing policy.

The answer to the question of whether such a tool should be used in a company is obvious. Marketing research not just needed, they are necessary.

Price monitoring of online stores

Market ecommerce for 5 years (2011 - 2016) has doubled, by the beginning of 2018 it did not lose the trend, but only continued to grow at the same pace.

Price monitoring can make an online store more attractive and accessible to customers. There are several ways that help you monitor the cost of goods and services from competitors on the Internet.

Do-it-yourself monitoring

In order to monitor the prices of online stores, you need to regularly visit their sites, this procedure takes a lot of time and effort. If you have a lot of products and at least 5+ competitors, you will need a separate staff of employees who will deal only with this issue.

Automated information collection (parsing) is an easier way to collect and process data, but it will still need to be combined with the first, even if there will not be so many employees, nevertheless, it will most likely be necessary to check the parsing data, as well as adjust its algorithm. , regularly.

Online services

There are many services that can help the owner of an online store to make his business successful. For example, using Price-Analytic.com, you can track the prices of competitors online relatively inexpensively, there is also a trial tariff - 100 free checks on any number of sites and products. And the most expensive tariff for 29,900 rubles involves as many as 600,000 checks per month.

Competera is also one of the leaders in this segment. It provides a 14-day completely free trial period, after which the cost is based directly on your needs in the number of products, competitors and checks.

Information is presented in such services in a convenient form, there are many options for providing it and adapting it personally to your needs, flexible statistics systems also provide

Price monitoring in a retail store

In order to save money, some companies choose to conduct research in-house. In doing so, they face a number of difficulties. First, you need to monitor prices regularly. Especially when it comes to small shops, as large chains somehow sell goods cheaper than retailers, due to the distribution of costs.

In smaller organizations, the task of monitoring is sometimes handled by employees. However, often in their official duties it is not part of this task, but they have to do it. Since it is simply unprofitable for a company to hire employees to perform one task.

Due to this distribution of responsibilities, the company’s business begins to gradually deteriorate, as employees do not always have time to fulfill their direct duties, so it would be more practical to trust price monitoring to specialists.

Monitoring by yourself

You can find out the price directly in the trading floor of competitors. In this case, ordinary improvised means are used, such as a telephone, a voice recorder, or a pen with a piece of paper. But the process of copying or photographing prices is often hindered by store guards. In addition, this monitoring option requires a lot of time.

Another way is to communicate with store managers. If you establish confidential communication with competitors, then you can exchange information, although in Russian realities this is quite difficult to achieve.

Pricer project - price monitoring in supermarkets and hypermarkets

There are a number of companies that are able to monitor prices in retail stores. For example, our Pricer project offers similar services to clients. We were selected by the IIDF (Internet Initiatives Development Fund) for the 13th accelerator, and successfully passed the acceleration.

To understand how we work, watch a short two-minute video:

We guarantee a price tag recognition accuracy of 98 percent, we can monitor throughout Russia, and we are also ready (and able) to work with large volumes - up to 100,000 SKUs per day.

This article is devoted to the issues of increasing the efficiency of market monitoring and optimizing its use for formulating and implementing strategies. Many people reduce market monitoring to tracking publications on the Internet, but a properly designed and functioning market monitoring system can be much more useful for strategy formulation purposes. Good market monitoring, by definition, allows you to effectively predict the movement of the market, recognizing threats and opportunities. The usefulness of the content obtained as a result of monitoring is determined by its information content; the information must be clear and concise. The monitoring system must match the specific workflows and practices in a single company. In addition, the collaboration of end users of market analysis data further enhances the value of monitoring data.

Market monitoring is a continuous and methodical process of collecting, analyzing and disseminating information about the external business environment. "Business environment" should be understood in the broadest sense, including all relevant actors: consumers, competitors, distributors, suppliers, developers and technology providers, as well as regulators and the macroeconomic environment.

Market monitoring is based on management theory. In his landmark work, Competitive strategy”, first published in 1980, Michael Porter outlined the need for business in a mechanism for the systematic collection, analysis and dissemination of information important for companies about competitors and market conditions in general. This information is necessary for companies in order to make the right strategic and tactical decisions with an understanding of current market trends, allowing the company to outperform competitors.

The basic ideas of the original market monitoring theory still apply today, but many aspects of business have changed since then. The volume of incoming information about the market is rapidly increasing. At the same time, technological progress makes it easier to search and filter data, and also allows you to automate many elements of the process. However, no matter how much process automation and the introduction of new technologies increase the effectiveness of monitoring, market research cannot be fully automated, and a human factor will always be necessary to obtain good results.

Social interactions on the Internet are intensifying. Social networks have become not only the main source of data for market research, but also a source of new tools to improve the quality of market analytics.

Main problems of market monitoring

Many companies feel that their own market monitoring systems are not well developed. Common problems include the following:

- Information overload

- The irrelevance of the information received

- Inability to draw conclusions based on the information received

- Lack of concise and clear information

- Information delay

- Reflection of obsolete market trends by information and insufficient reflection of future ones

- Isolation of market monitoring from other company processes

- Hard-to-reach format of information

- Difficulty in accessing information.

Fortunately, all these problems can be solved with the help of publicly available methods and knowledge.

One of the main reasons for the low effectiveness of market monitoring is the incomplete understanding of the relationship between market monitoring and strategic management. The information obtained during monitoring should be clearly separated into the information used in the implementation of the strategy and the strategy that helps the company to formulate. There are many other critical factors to consider, but understanding these differences is the first step to effective monitoring.

Market monitoring and strategic management

In today's business world, most large companies have their own market monitoring systems that allow them to collect information about competitors, customers and other market participants. As a rule, the usefulness of such systems is not in doubt, but their specific benefits are often difficult to articulate. To understand how to maximize the usefulness of market monitoring, one should start by analyzing the relationship between it and strategic management.

The process of strategic management is clearly divided into two stages: strategy formulation and its implementation. At the stage of formulation strategic planning, self-assessment and analysis of strategic alternatives are carried out, on the basis of which decisions are made regarding the mission and goals of the company. This is done by the top management of the company.

At the implementation stage strategy is the attraction and use of managerial and organizational resources to achieve the goals. All employees of the company participate in the process of implementing the strategy (more about these concepts and strategic management in general, see David (2008)).

Market monitoring contributes to both the formulation and implementation of strategy, but the two purposes use completely different aspects of market monitoring. The formulation and implementation of a strategy for these purposes should be considered separately and one monitoring process should be established to begin with: experience shows that it is better to first create the process necessary for the implementation of the strategy, and after debugging it, expand the system to the process used in the formulation of the strategy.

The following chapters will describe the basic principles and optimal structure market monitoring process to implement the strategy. The process itself in this article is called the “Market Monitoring System” (SMR). Most market monitoring processes in modern companies belong to this type. At the end of this article, we will turn to a process designed to facilitate the formulation of a strategy, which, for the reasons described below, is called "Early Warning System for Threats and Opportunities"(SRO).

Briefly, a market monitoring system (SMR) is the process of monitoring the competitive environment in order to provide useful data to company executives. Thus, SMR is a means of implementing the company's strategy, since it is in the strategy that the part of the competitive environment is set in relation to which monitoring should be carried out. In addition, the relevance of information provided to decision makers is also determined in accordance with the themes and priorities set out in the strategy. It is assumed that the SMR should be able to recognize threats and opportunities for strategic priority areas.

The implementation of the strategy is carried out through the current activities of the company's divisions. The sales team wants to generate revenue, and the CMP can give direction to it. The marketing department seeks to increase the market share of the company, and CMP informs it about the behavior of competitors. The purchasing department is seeking resources from minimal cost, and the SMP helps it by monitoring suppliers and market prices. All of these are aspects of strategy implementation.

Threats and Opportunities Early Warning (EWS) is a process of scanning a broader environment than the one outlined by the current strategy. This process is designed to identify opportunities that lie outside the current strategic priority areas and respond to even subtle signals with a high degree of uncertainty. In this regard, the SRO differs significantly from the SMP. The SRO output is used to identify new strategic alternatives, helping the company formulate new strategies. For this purpose, the SRO can even issue ambiguous, dubious signals that go against the current strategic paradigm, which would be unacceptable for the SMP due to the fuzziness and unprofitability of such output data. Information from SROs is mainly used by executives in the field strategic planning or senior management.

It is important to emphasize that these two monitoring systems serve different purposes and it is not correct to compare their output data. Ideally, each company should have both systems, but in practice it is easier to first organize construction and installation works and only then - SROs.

Choosing directions for development and moments for action

It is widely believed that in order for a market monitoring system to be useful for strategic planning and strategy formulation, it must be able to predict future changes with at least a minimum degree of accuracy. business environment. However, such a function is needed not only for formulating a strategy, but also for its implementation.

The choice of directions for development and moments for action - essential function any market monitoring system. However, the acceptable level of uncertainty of outgoing information for the system is different depending on the purpose for which it provides data: to formulate or implement a strategy. The market monitoring systems used to implement the strategy are characterized by minimal uncertainty. As a matter of fact, often a company organizes market monitoring in order to find all the variables in its market equation. But for the purposes of strategy formulation, this desire for certainty can lead to gaps in the company's perception of the market. For SROs, it is even more desirable to deal with unknown factors, working with a high level of uncertainty. The SMR is designed to notify the company's leaders about what will happen and how these events will affect the company. SRO, on the other hand, provides information about what can happen (and, accordingly, about the possible consequences of these events).

The main advantage of the predictive orientation of the market monitoring system is that it allows the company's management not to react to events, but to anticipate them. Moreover, anticipation involves two aspects: beating the market (taking action before the event occurs) and, more importantly in many situations, beating the competition. Of course, ideally, a company should strive to do both.

The ability to identify one's possibilities in advance, say, when new trend consumption, change legislative framework or the advent of new technologies is important in itself. However, the ability to do it before the competition means the opportunity to capture more market share, make more profit or enhance the brand image.

Without a predictive monitoring system, a company only learns about market events after they happen. As a result, it can only take action against the consequences of an event that have already occurred and after competitors have already taken their own action. This often results in sub-optimal resource allocation, low profit margins, and below-potential market share.

With a predictive market monitoring system in place, a company can anticipate an event, take appropriate action, and allocate resources ahead of both the event itself and competitors. Thus, the company gets a head start over competitors, a larger market share and higher profits.

However, the following caveat should be taken into account: no matter how predictive potential the monitoring system has, if it does not convey the received information to the company's management or if this management is not ready to base its decisions on this information, the necessary measures will not be taken even if events are predicted. The figure below illustrates this case.

Accordingly, for the effective use of market monitoring system data, it is necessary for the company to receive and use this data, which is achieved when two conditions are met:

- Willingness of senior management to use this data

- Integration of the monitoring system and decisions made on its basis into the functional processes of the company.

The last requirement implies that the market monitoring system should be designed for interaction with various functional divisions of the company, because each of them has its own needs for market research and individual views decisions. If the market monitoring system is not integrated with the management of the organization's departments, forecasting market events will not help to take the necessary actions, and opportunities will be missed.

Basic Principles of the Market Monitoring Process

The market monitoring process is based on a number of fundamental principles, which are described below. The three main steps in the process are collecting information, processing it into output data, and forwarding that data to decision makers. Each of these stages can be organized in different ways, but the basic structure of the process is quite universal.

Let's call the basic unit of information a "market signal". Michael Porter (1980) coined the term in his book Competitive Strategy, which has become a classic in management literature. He defined it as any action by a competitor that directly or indirectly indicates its intentions, motives, goals, or internal situation. In our opinion, market signals are not limited to the actions of competitors, including also all other market events created by competitors, customers, suppliers and other market participants. Thus, a market monitoring system is a system that allows you to capture market signals from any source, convert them into a functional format and transfer them to management.

It is important to take into account that the incoming and outgoing SMR signals differ significantly from each other, since the main stage of monitoring is the processing of the former into the latter. The understanding of this fact alone can sometimes significantly improve the quality of monitoring, since often a company organizes construction and installation works based on the fact that its function is simply to redirect incoming signals to managers without any processing, and management receives “raw” data that is difficult to understand and inconvenient for use, and often are simply useless.

When organizing construction and installation works, it is useful to consistently plan these three stages. Of course, they also have common elements, and in order to successfully launch a full-fledged process, the stages must be coordinated. However, before further revealing the features of SMP, let's take a look at the main factors for the successful functioning of all three stages.

Table 1. Key success factors for a three-step market monitoring process

| Collection of information | Data processing | Referral to executives |

|---|---|---|

| You can work with sources using either the push model or the pull model. Be prepared to use both and don't assume you can only use one for all sources. | Signal processing is a labor-intensive process that requires special knowledge and tools. | The process of forwarding information should be developed taking into account the specifics of the work of the manager. |

| The relevance of the signal may not be revealed immediately, so it is better to pass more incoming signals and filter them at the processing stage than not to get enough information flow. | Incoming signals are evaluated, filtered, archived and converted into monitoring results through editing, analysis, reformatting and classification. | The preferences of each leader must be taken into account on an individual basis. |

| Incoming signals can be quite highly automated, the collection of information also involves an active search and evaluation of new sources, which requires human resources. | All outgoing market signals must point to some process or serve some purpose. | Participation in the monitoring process by the leaders themselves should be actively encouraged. Different signals can be interpreted differently by different people, and it is the receivers who place the market information in context. |

| During the processing phase, incoming signals must be placed in a context that is familiar to the manager and makes sense to him. | The formats, channels and timing of the delivery of results should be established taking into account the activities of decision makers to facilitate their assimilation and application of the information received. | |

| Formats can be different: emails, paper documents, RSS feeds, Twitter posts, text messages, SharePoint messages, and more. |

In practice, in the monitoring process, additional complications of varying degrees and types arise. One of these complications is the possible presence of closed cycles. feedback(when outgoing signals are reused in the monitoring process at one or more stages). This can happen, in particular, due to the processes co-creation documents, i.e. cooperation of users when creating them, as well as when end users enter information of their own signals into the system. Below we will explain these situations.

Technological and human resources

Each stage of the market monitoring process can be carried out in a variety of ways, depending on the size of the company, the sector of the economy in which it operates, and other factors. However, according to general rule at each stage, a combination of technical and human resources is used. To maximize the cost-effectiveness and efficiency of the process, the tasks at each step can be automated, and their efficiency can be improved through the use of technological solutions. By searching for keywords and converting various formats to text, you can automatically analyze Internet publications, sites and databases. Market signals can be automatically classified with tags, entered into databases or grouped using predefined algorithms, and sent using automated systems email or RSS feeds. However, there are tasks that cannot yet be completely entrusted to computers. Evaluation and search for new sources of information, as well as most of the tasks at the processing stage, require human resources. In addition, executives consider the results of the work of analysts to be the most valuable and useful. Accordingly, in SMP it is important to strive to optimally combine automated and human-processed elements: the former allow you to increase the productivity and efficiency of the process, and the latter increase its analytical value.

Another aspect of the ratio of automated and non-automated tasks in CMP is the direction of outgoing data. The way in which market monitoring results are communicated to decision makers can have a significant impact on the applicability and usefulness of the information. Porter (1980) noted the need for companies to "creative ways of presenting the results of market research in a concise and convenient form for use by top management." Market monitors should assist decision makers in their day to day activities, not the other way around. Accordingly, at the stage of sending materials to managers, it is necessary to take into account the preferences of the latter in relation to communication methods. If, for example, the first thing an executive checks his email when he arrives at work, he should have emailed the latest market signals by then. If it is customary for executive meetings to print and read agenda items, relevant market research results should be made available to meeting participants in printed or printed form. If Sales Representative of the company constantly meets with customers and can only use mobile phone, any analytics (for example, information about competitors' products) should be available to him in a format that is easy to read on the phone. These are just a few examples of how the smallest details may affect the effectiveness of the stage of sending the results of market monitoring to decision makers.

Case Study: Using SharePoint at TikkurilaTikkurila is a leading Northern European manufacturer of paints and coatings. The company has introduced a number of innovative ways to deliver market research results to executives, taking into account the specifics of their activities. Management gets access to various types information they need in their work with a specially designed dashboard based on Microsoft SharePoint, and the market research department decided to use this dashboard as a channel for delivering the results of their work. Thanks to the integration of the two systems, information about competitors and market conditions is available directly through the SharePoint panel. In this way, management has quick access to information through a one-stop channel, while the market research department has the opportunity to use a separate software platform to manage the monitoring process.

At the end of the conversation about the monitoring process, let's return to its structure. All stages of the market monitoring process are integrated common goal. Together, they are all designed to transform market signals into useful and understandable information for decision makers. Context retrieval is one of the most important tasks overall market monitoring. Separate market signals must be inscribed in a universal system of concepts so that managers can establish links between these signals and own work. Moreover, as a rule, the context of each incoming signal is not immediately obvious, and SMP requires a mechanism to identify the context and bring it to the attention of management.

Another important concept of market monitoring is process integration. The market monitoring system should not be isolated from other processes of the company, because it is a process of obtaining knowledge to improve the quality and efficiency of other processes. Any outgoing SMR data is input for other processes, which must be clearly understood when organizing market monitoring. They usually correspond to the functional divisions of the company, as shown in Figure 3.

The special connection between market monitoring and strategic planning, explained at the beginning of the article, should be taken into account. Accordingly, in Figure 4, the market monitoring process is subdivided into SMRs and SROs, highlighting the relationship between the two processes.

Content and context

Some of the most serious market monitoring problems are related directly to content. In the presence of a large amount of outdated information, the content that is the product of the monitoring process is seen as more of a hindrance than useful information. In order to avoid such a situation, the CMP should provide concise and up-to-date data in a timely manner and in a form accessible to recipients.

Information is valuable and useful to a manager only if it makes sense to him. The meaning of the information is revealed by the context, the absence of which often reduces the quality of the content. The context is derived directly from the company's current strategy and is a system of concepts, topics, areas and priorities that it should focus on. Of course, the representatives various departments companies work with only part of the context, while management takes into account its entirety.

It should be noted that the context defined by the strategy is wider in content than the strategy itself. The strategy determines the content of the context: for example, if a company chooses a cost leadership strategy in the market for a particular product, its context consists of competitors, current and potential buyers of the product, all participants in the supply chain, as well as production technologies and management principles that will help the company achieve leadership by costs.

The importance of context is easy to justify theoretically, but how to determine it in practice for a market monitoring system? With the help of taxonomies. Taxonomy is a system for classifying information system content, a form of business context representation. A market monitoring system is a subspecies of an information system, usually consisting of a database, various incoming information flows, tools for analyzing and processing information, as well as mechanisms for distributing outgoing data. Throughout the system, the constant element is the context given by the strategy and expressed in the taxonomy.

In practice, taxonomy is a hierarchical system of categories or classes. Each piece of content in the market monitoring system is assigned a tag, that is, a marker of belonging to one or more categories. Tagging is already common for many information systems however, in the field of market monitoring, this practice is sometimes underestimated. The main value of tags is the ability to attach business context to any piece of information, indicating to the manager its place in big picture business strategy. However, taxonomy is only useful if it is effective.

As a general rule, the context, and hence the taxonomy for market monitoring, consists of two groups of categories: the first characterizes the competitive environment, and the second - strategic issues. The first part should identify all the most important players in the competitive environment, divided by their role in the value chain into customers, competitors, suppliers, partners (eg technology providers) and regulators. In addition, if the company operates in several markets, all of them must be determined - according to geographic location, by customer segments, product lines, or all of the above. Finally, the categories of the taxonomy should include all strategic issues that represent the concepts, themes, trends, and other strategic priorities of the current strategy.

The general structure of an effective taxonomy (the list of elements of the external business environment that affect the organization) can be deduced from Figure 6, which illustrates the competitive environment.

- Competitors, customers, suppliers, partners, regulators

- Geographic regions, customer segments and product lines

- strategic questions.

Example: Monitoring Market Trends at RettigRettig is a group of companies controlled by the Rettig family for over 200 years. The group's activities cover a wide range of sectors of the economy: from the production of heating appliances to logistics. To effectively monitor the market of such a diversified structure, it is essential to accurately define the competitive environment and strategic issues. Rettig's taxonomy includes many key categories from the supply chain and the industry as a whole, such as raw material prices and consumer trends. This allows management to anticipate market events in advance and gives additional time to make decisions.

Based on considerable experience, we provide below a number of tips for creating an effective taxonomy.

- The strategy outlines the range of information relevant for market monitoring. The taxonomy should reflect the context defined by the company's strategy and should be suitable for inferring the strategy itself.

- Use a universal taxonomy tailored to the needs of individual departments of the company. The taxonomy should reflect company-wide context and give general idea about him, combining information from various departments. It should reflect the company's external business environment rather than its internal organizational structure.

- Don't create too many categories. Carefully evaluate the usefulness of each in terms of what it says to the leader. Rarely used and unused categories, as well as outdated and incomprehensible to management, it makes no sense to use. If your taxonomy has more than a hundred categories, it's worth considering.

- It is necessary to understand the difference between the processes of formulating and implementing strategies. Most market monitoring systems are designed to help implement strategies. When creating taxonomies for strategic planning, a number of special factors must be taken into account, which we will discuss in the last chapter of the article.

Taxonomy as a tool is useful at all stages of market monitoring. By reflecting the company's strategic context and priorities, it helps to identify and filter information. At the processing stage, when content is turned into an analytical result, tags allow you to effectively group content units and link pieces of information together into a more distinct structure that allows you to draw analytical conclusions. Such knowledge structures at the stage of referral to executives are drawn up in an appropriate, preferably visual form. As a matter of fact, at this stage, taxonomy plays a primary role: any piece of content must be relevant and presented in the proper form so that policymakers can search, combine and visualize content, links between separate categories and units, better understanding the business environment as a whole, not just parts of it.

Collaboration and social networks

Rapid increase in intensity social interaction on the Internet also opens up new opportunities for us in the field of market monitoring. Although base model While the monitoring outlined above is linear in structure, the exchange of information can (and ideally should) be much more complex. There are at least three reasons for the complexity of the process:

- Emergence of new types of information sources (social networking sites)

- Internal signals coming directly from end users can form a feedback loop

- Collaboration in the form of discussing market signals can lead to new conclusions

Let's take a look at each of these possibilities.

The most obvious benefit of social networks lies in the possibility of using them as additional sources of information. LinkedIn, Facebook, Twitter, and many other networks contain data on competitor activity, consumer trends, and other potentially important issues. However, it must be remembered that the information obtained from these sources is based on open discussions between people and, as such, must always be checked for reliability, which somewhat complicates the stage of its processing.

Case Study: Monitoring Outotec Blogs and ForumsOutotec is one of the world leaders in solutions, technologies and services for mining and metallurgical enterprises. Outotec's CMP system, which initially used a wide range of information sources, was to be extended to open social networks. After piloting blogs and forums on related topics, the company became convinced that they could indeed be a source of valuable information, and decided to monitor them, providing regular reports to decision-makers on the main trends, topics and opinions appearing in these sources.

In addition, in the market monitoring system itself, a cooperation mechanism can be created using the format of social networks. Certain communication channels, such as internet interfaces or mobile devices, may be equipped with communication tools that allow the user to comment or rate content, as well as conduct online discussions. This will help to involve decision makers in the market research process and get more information. Thus, channeling market signals to decision makers can generate an influx of additional or internal signals that create a closed feedback loop and enrich the monitoring process.

Example: internal signals in FujitsuFujitsu is the largest IT service provider in the world. Over the years, the European division of the company has developed its market monitoring system to maximize the effectiveness of market signaling to management. Realizing the value of internal market signals, the division's analysts have put in place mechanisms to promote collaboration and participation in the process of monitoring end users of market information. By receiving signals from the market monitoring system, end users can also send their own internal signals to it, providing management additional material for reflection.

Collaboration tools (systems for commenting or discussing market signals) not only create a flow of internal signals, but also provide additional evaluation of the original market signals. Market signals are evaluated already at the source selection stage, and then at the processing stage, but their evaluation and discussion at the stage of sending to decision makers further increases their value. Assessment tools are widely used in various online systems, but for market monitoring purposes, assessments that complement the existing tagging mechanism are especially useful. For example, additional context can be created by allowing decision makers to tag information with tags such as "competitive threats" or "business opportunities."

Threat and Opportunity Early Warning System

Let's move on to market monitoring systems designed specifically to optimize the strategy formulation phase, that is, the so-called early warning systems for threats and opportunities (EWS). As explained above, it is worth creating such a system in a company after launching a market monitoring system for strategy implementation (SMR), since both systems are based on the same structure. They differ in the volume of information sources and the criteria for the relevance of incoming market signals, as well as their attitude to uncertainty. For SROs, uncertainty is normal and even desirable; collaboration tools and social networks are likely to play more important role than in SMR.

The SRO scans a much broader environment than the one envisaged by the current strategy. This often leads to difficulties in identifying sources of information. For SROs, you can expand the definitions of sources: for example, instead of one specific site, monitor all sites of a certain type. Accordingly, SRO is sometimes considered a rather vague process.

When searching for sources, the SRO focuses on weak signals rather than signals high level certainty. These weak signals are often considered to be just “noise”, uncharacteristic exceptions, but they can also be signs of significant changes. Of course, many incoming signals are unconfirmed information, which may turn out to be unreliable and give a false alarm. This risk is taken so as not to miss potentially valuable signals of real change.

The context relevant to the SRO is also broader than the SMP context. The relevance of market signals, as well as sources, is more difficult to determine here. It is helpful to start with context and taxonomy based on the company's current strategy, but for SROs these should be broadened and complemented by new strategic themes that correspond to possible new directions and uncharted areas.

In addition, it is worth noting that the competitive environment relevant to SROs includes the broader macroeconomic environment, which is given less importance in the SRA. When developing strategies, macroeconomic trends are carefully taken into account, and therefore their monitoring and analysis are an integral part of SRO.

Processing and sending SRO market signals to executives can be carried out by more non-standard methods. Since the very process of such monitoring is aimed at revising the strategy, it is permissible to criticize the current paradigm, raise new questions without answers to them, and express new views on already known issues. In terms of the resources used, it is important to understand that the steps involved in processing information and sending it to decision makers are much more time consuming than in SITs. The tasks require large human resources and the work of the most qualified analysts, who, moreover, must be able to communicate freely with top management.

The period of time covered by SRO monitoring is longer than in SRO. For the purposes of strategy implementation, management typically operates over periods of one to three years, while formulation covers longer periods.

SRO is an excellent tool that complements other processes and tasks of strategic planning. For example, when formulating a strategy, scenario analysis is widely used, and SRO - perfect tool to track scenarios and their development factors, allowing to check their execution and add value to scenario analysis.

The table below summarizes the above by comparing the two market monitoring processes:

Table 2. Comparison of SMR and SRO

| Market monitoring system | Threat and Opportunity Early Warning System |

|---|---|

| Used to implement the strategy | Used to formulate strategy |

| "Traditional" market monitoring | Future-oriented market monitoring |

| Information that helps the company achieve strategic goals | Information to help a company determine strategic goals |

| Provides up-to-date information | Provides information that may be relevant |

| Identifies opportunities within the current strategy | Identifies opportunities beyond the current strategy |

| Clearly defined business context | Less strictly defined business context |

| Short and medium term | Medium and long term |

| Clearly defined range of sources of information | Open list of information sources |

| Determines the steps of competitors and the direction of development of the business environment | Identifies weak signals, interference and unusual phenomena |

| Minimizes uncertainty | Working with Uncertainty |

| Strictly defined procedures | Approximately defined procedures |

| Pretty strict centralized control | Large share of horizontal interactions |

| Social networks are additional source information | Social networks are one of the main sources |

| Collaboration allows you to evaluate signals | Collaboration creates new signals |

Example: Competitor Action Lists in CintasCintas develops and implements corporate identity programs through uniforms, supplies door mats, bathroom and toilet cleaners, merchandise, first aid and personal protective equipment, provides fire safety and document management services. The strategic planning department of this highly diversified firm constantly monitors the business environment for new and emerging strategic opportunities. The volume of the analyzed context is very large, because opportunities may arise in areas and segments previously unknown to the company. To improve the effectiveness of market monitoring, Cintas maintains lists of competitor actions and new potential strategic opportunities identified during the monitoring process, indicating their consequences, potential benefits, and recommendations for further investigation of the issue. These analytics are presented to the strategic planning department, which then analyzes and formulates potential strategic steps based on these data.

conclusions

Market monitoring is continuous process, including the collection of information about the competitive environment, the processing and analysis of this information, as well as sending it to the company's management to improve the efficiency of decision-making. All companies recognize that the results of market research should be useful, but many of them experience difficulties in organizing an effective and useful market monitoring process. In this article, we looked at ways to solve this problem.

When creating a market monitoring system, it is necessary first of all to understand the difference between the implementation and formulation of a strategy and the tasks of a market monitoring system corresponding to these two goals.

The strategy is implemented at the level functional divisions companies and their decision-making processes. To be effective, a market monitoring system must be integrated into these decision-making processes so that any SMR outputs are their inputs.

Formulating a strategy, on the other hand, requires a less streamlined market monitoring process, with a wider range of sources and weaker and more uncertain market signals. Market signals provided for strategic planning indicate possible scenarios, potentially dangerous or tipping events, as well as new strategic opportunities.

In either of the two types of monitoring processes, data must be processed before being sent to decision makers. Management cannot act on "raw" data; information must be placed in context and presented in a usable and logical manner. Many market monitoring tasks can be automated, but this requires the efforts of skilled analysts.

A company's strategy determines which market signals are relevant to it and why. Based on the strategy, the business context is outlined, consisting of the competitive environment and strategic issues. In market monitoring, context is expressed in the form of a taxonomy, which must be carefully developed to accurately reflect the company's strategic priorities.

Collaboration tools and social media are valuable market monitoring tools. In particular, it is possible to monitor open social networks. In addition, the collaboration tools used in many in social networks, can be integrated into the monitoring process, which will help to evaluate and supplement the received market signals through commenting and evaluation within the company, and internal signals can be sent back to the CMP.

For successful work market monitoring systems, the management of the company must be ready to support the stage of formation of the process and use its results, because it is they who play a decisive role in the implementation and in the formulation of corporate strategies.

Sources

- David, F. R. (2008) Strategic Management: Concepts and Cases. 12th edition. Prentice Hall.

- GIA (2006) Does Your Business Radar Work? Early Warning/Opportunity Systems for Intelligence. GIA White Paper series. Global Intelligence Alliance.

- GIA (2007) Market Intelligence for the Strategy & Planning Process. GIA White Paper series. Global Intelligence Alliance.

- GIA (2009) How GIA's Intelligence Plaza™ Adds Value To Microsoft SharePoint™. GIA White Paper series. Global Intelligence Alliance.

- Porter, M. E. (1980) Competitive Strategy. Techniques for Analyzing Industries and Competitors. Free Press.

In a market economy, competition is a necessary stimulus for development. To enter the market new company should assess their prospects and opportunities. Already existing organization holds regular competitor monitoring to develop your strategy. To carry out such a process, several different techniques are used.

Purpose of monitoring

Market monitoring (competitors in a specific industry) is produced for a specific purpose. It is clearly stated at the beginning of the study. This allows you to collect information in a targeted manner. To do this, at the first stage of work, the analyst determines the circle of main competitors, as well as the scope of their activities in the market.

Conducting an analysis of the main players allows you to accumulate and process information about their weak and strengths, as well as the direction of development in the future. The real opportunities and existing goals of competitors are evaluated. Such work allows you to increase the efficiency of your company.

Directions

May be required to determine your own current or strategic goals. This process is carried out when positioning own goods in the market, sales forecasting.

Also, such actions are carried out when developing a new line of goods or services, implementing an implementation policy. Based on the data obtained, prices are set, the primary characteristics of the goods are selected. This allows you to increase sales revenue and profit.

Peculiarities

It is a process of collecting and analyzing information about the company's business environment. At the same time, the behavior of not only competitors, but also consumers, suppliers, dealers, scientific developers, as well as market regulation mechanisms is considered.

The collection of information about the main subjects of the industry began to develop actively at the end of the last century. The main provisions developed by economists at that time are relevant today. The amount of information that analysts need to process to understand the situation of the business environment has changed. Automation of this process somewhat simplified the work of the analytical service. However, the human factor for this process remains very important. This allows you to obtain reliable information, increasing the effectiveness of research and strategy development in general.

Problems

IN modern world Internet competitor monitoring is becoming widespread. However, qualitative analysis cannot be based solely on data from various sites and publications. There are several main problems with monitoring. First of all, it is necessary to note the large flow of information. Filtering becomes difficult.

Also, the quality of monitoring may be affected by the irrelevance of incoming data, the impossibility of setting one's strategy based on the information received. It comes sometimes in a very expanded or fuzzy form. In some cases, market monitoring cannot reflect the real development processes of the main industry players. Closeness is also a negative factor. important information. Competitors carefully monitor the leakage of information in key strategic areas.

Existing data collection methods can reduce the impact of negative factors. Its quality is more affected by the lack of understanding of the connection between the information received and the development of the right strategy.

Management strategy

According to a certain scheme, it is produced in large companies monitoring. Competitor analysis produced according to a developed and tested system. Large companies develop their own unique methods of conducting such a process over time. If the approach developed by the organization to collect data on the business environment is effective, it is used long time. However, it is rather difficult to clearly articulate its specific benefits. In the process of doing research, it is important to understand the relationship between the management strategy and the chosen approach to analysis.

The manager conducts the strategy setting process in two main steps. At the first stage, the direction of development is formulated, an assessment of one's own capabilities is given, and alternatives are analyzed in the future. At the same time, goals are set, the mission of the company is determined.

At the second stage, the developed action plan is implemented. It is the process of monitoring the business environment that makes it possible to formulate and implement strategic goals. Initially, analysts should set up a data collection process to formulate a promising direction for development. After that, the whole system is expanded and can be implemented.

Deep Scan

Various goals can be pursued competitor monitoring. Program is developed taking into account the interests of the company and the characteristics of the market. For a global, thorough analysis, the method of M. Porter is used. It involves data collection once every 3-5 years. This is a laborious, but quite effective technique. It is divided into five stages.

Initially, the study is carried out in the direction of assessing the strengths and weaknesses of the main market players. At the second stage, their goals and motivation are determined. The third stage involves the designation of the current strategies of competitors. Its current position in the market is being studied, as well as current actions aimed at increasing profits.

The fourth stage further deepens the analyst into the essence of the structure of the competitive environment. At this stage, it is necessary to study the player's understanding of his position in the industry, his satisfaction with his position. At the fifth stage, the players' actions are predicted. This is the most responsible process, which involves using all the information received earlier.

Annual review

Monitoring of competing companies should be done not only every few years. Constant control allows you to respond in time to changing market trends. For this, a simpler technique is used. The study is carried out once a year.

During this analysis, general characteristics industry competition, its development is predicted. To do this, experts make special card business environment. Direct, key and indirect competitors are designated. They compare their own range of goods, pricing, distribution, image. The channels of product promotion are also analyzed.

When conducting an annual analysis, they study the commitment of consumers, their awareness of the company's products. The technologies used by competitors are compared with their own developments, and a SWOT analysis is made. Quality is assessed own resources. On the basis of the research carried out, strong and weak sides own organization and major market participants.

Information sources

It involves collecting information from various sources. It is not recommended to use only one direction of data acquisition. In this case, the result of the study may be incomplete or unreliable.

Consumer surveys are the main sources of information. Qualitatively and quantitatively, the opinions of various target groups. Analysts get data from points of sale. Here the quality of the display of goods, promotions, assortment and prices are determined.

On the Internet, you can also get some information about competitors. Surveys of industry experts also make it possible to draw certain conclusions about the state of the business environment. Obtaining information from sales managers is also one of the fairly reliable methods. Persons responsible for the promotion of goods in stores can provide complete information about the developments of competitors.

Industry Reviews provide reports on financial indicators, ranking companies in the industry. These are key characteristics of the industry's business environment. Visiting thematic exhibitions, seminars helps to understand the communication strategy of the main market players.

Market Signals

Can use information of varying degrees of certainty. M. Porter introduced into the management process such a concept as market signals. It means any action in the business environment that competitors take. It can indicate directly or indirectly the intentions of a market participant, his internal situation.

Market signals can also be determined by the actions of buyers, suppliers or other participants. Each event gives its resonance in the business environment. Monitoring captures these signals. They are processed, the probability of a certain event is estimated and transferred to the company's management for making strategic decisions.

Depending on the goals of monitoring, analysts can work with events that have already occurred or consider signals that indicate the possible actions of competitors in the future. Major competitors make decisions based on data that no one else in the industry has yet. This allows you to take a large share of the market before competitors do.

Price monitoring

Many companies today choose to monitor their prices from a variety of strategies for collecting data on competitors. This allows you to assess the situation in the market. This approach allows you to identify participants who seek to increase sales while reducing prices or, conversely, stimulate profits by selling expensive products. Some participants have non-price methods of expanding sales. For this, it is produced competitor store monitoring and outlets for their products.

This monitoring involves consideration of price options when the volume of the order changes (wholesale, retail price), as well as an assessment of stocks. For example, the Rettig group of companies has been operating for over 200 years. Its range of activities includes various areas (from logistics to the production of heaters). Such a diversified structure is in dire need of an accurate definition of strategic issues and trends in the business environment. To do this, the group of companies is constantly studying the prices of raw materials, terms of supply, consumer preferences. Based on monitoring prices and other methods, it is possible to predict the development of events in the future.

Scenarios

In order to monitor competitors' prices, a company may choose to use one of the data collection scenarios. In accordance with the chosen methodology, the employee learns the necessary information directly in the store.

Different levels of awareness require the researcher to competitor monitoring. Example such a scenario could be as follows. A company employee comes to a competitor's store. He reports a desire to make a large order. Based on the average level of knowledge in this area, he learns the information of interest.

Another scenario defines the role of the researcher as an inexperienced customer. It's less effective method. It allows you to learn about price, non-price ways to expand the competitor's sales market.

If the researcher turns to a competitor as a knowledgeable person, he will be able to find out deeper, more detailed information.

Considering how it happens competitor monitoring, the company can form and implement its development strategy, win a large market share.

For acceptance effective solutions in the field of sales, it is necessary to obtain and systematize all the necessary information. This contributes sales monitoring. A special role here is played by the database of the company's clients who have or have ever had with the company business relationship. Practice shows that it is advisable to divide the company's buyers into six types:

Availability of existing business connections- working customers; potential buyers; idle clients; other contractors;

The volume of average monthly purchases of products - large customers; average clients; minor clients;

Frequency of purchases of products - regularly purchasing - 2-3 times a month; constantly purchasing - 1 time per month; relatively constantly purchasing - less than once a month; periodically purchasing - 1 time in 2-3 months;

The region of the company's location - by the region of the company's location according to all-Russian classifier regions, classification is possible taking into account the index of the region's prospects for this particular product or product group;

Type of the main purchased goods - group of goods A; product group B; product group B; product group D, etc.;

The specifics of the client's distribution - wholesale companies; companies that carry out distribution to shops and other points retail; companies with mixed distribution; retail chains.

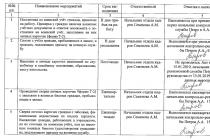

To assess the situation, the management of the sales department must, first of all, know what product and where it is sold: to which region, to which company. For these purposes, relevant reports are generated, for example, by region (Table 10.6).

Table 10.6. Sales volume of a sales manager by region

The report data allows you to see which sales of goods prevailed in a particular region, which regions were leaders in terms of sales in general and for individual groups of goods. If you have data on the market capacity of a particular region for a group of goods, you can easily calculate the company's market share in the region. As a rule, at the end of the report, two more indicators are indicated, the plan for the month and the percentage of its implementation. This data makes it possible, if the plan is not fulfilled, based on the analysis of sales in the regions, to understand where the supply failed, which region is problematic, and then find out why.

Each sales manager should have information about sales opportunities in the region - its potential. The potential of the region should be compared with the level of average monthly sales, which will determine the percentage of use of the region's potential and draw the necessary conclusions (Table 10.7).

In order to increase the level of using the potential of the region, sales managers must visit the regions assigned to the manager, in which: there are no sales at all; there was a decline in sales by more than 20%; there are potential large customers; available high potential sales.

The ability to timely receive up-to-date information about the state of affairs in the region depends on the activity of the manager, the frequency and frequency of contacts with clients. The number of manager's contacts is determined by the importance of the client for the company: for large - at least four contacts per month; for medium - at least three; for small ones - at least two; for minor ones - at least one contact per month.

Table 10.7. Using the sales potential in the regions

With successful and planned work with a client, the frequency of contacts can be regulated by the manager who oversees work with this company. Many companies place emphasis on applying the 4:2:1 principle - in large companies the manager should call four times more often than in small ones, in medium - twice as often.

Correctly chosen frequency of communication with the client allows you to "keep your finger on the pulse" regional problems, be aware of events and respond quickly to changes in the market situation. This is especially important in today's competitive markets, where there are many dynamic companies that are capable of active and effective action.

Determining the criteria for the effectiveness of sales of certain commodity items is usually carried out on the basis of a separate study on specific company data. In this case, the share of this product group in the total sales volume, the sales rate of the inventory, and the value of the profitability of sales are usually taken into account. The achievement of a certain market share in certain product groups can be considered a criterion for the success of work in a particular region. At the same time, for a more accurate assessment of the state of affairs, one should operate with several indicators, including the dynamics of turnover in a given region and the company's share in the total sales of these products in this region, the presence of products in the most famous and visited outlets etc.