We continue to tell you how to fill out 3 personal income taxes in the Federal Tax Service “Declaration” program. Tax deductions are divided into, and, therefore, the developers of the “Declaration” program made tabs with the same names. This article will look at how...

Read morePersonal income tax

Are maternity payments subject to personal income tax, according to the law?

When planning a family budget for the period of pregnancy and childbirth, as well as subsequent child care, expectant mothers always think about what payments and in what amount they will receive during this period. At the same time, how and in what amount will it be necessary...

Read more

Deadline for transferring personal income tax from vacation pay

In 2015, changes were made to the Tax Code of the Russian Federation regarding the deadlines for paying personal income tax. They came into force on 01/01/16. What is the deadline for transferring personal income tax from wages and other income? New deadlines According to the new rules, the deadline for transferring personal income tax is limited to the day following...

Read more

Certificate of family composition

Surely, many citizens have heard the name of the document as “certificate of family composition.” Another name for the certificate is an extract from the house register, the document is approved by government agencies and contains a list of people registered in the square....

Read more

Validity period for personal income tax certificate 2

The main document that allows a citizen to prove his official income is the 2-NDFL certificate. As a rule, the question arises not only about how to draw up this document, but also how long the 2-NDFL certificate is valid. Its validity period is formal...

Read more

Is the premium taxable? - the specialist answers

A bonus is a payment in the form of cash as an incentive for conscientious employees who perform their job duties efficiently or beyond the norm. They are optional payments, so the employer has the right to independently...

Read more

Documents for a tax deduction for the purchase of an apartment with a mortgage

If you purchased an apartment or a separate room in it, then you have every right to claim a property tax deduction. The amount of property deduction will be identical to the actual costs incurred for the purchase of a residential...

Read more

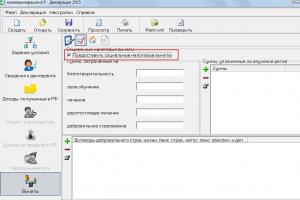

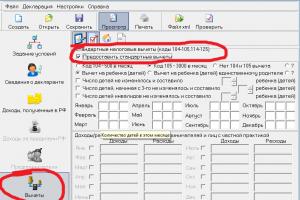

Filling out a declaration for the standard deduction

We continue filling out the declaration for the standard tax deduction. Go to the “Deductions” tab (bottom left). A window has opened: Fill out this window. It corresponds to sheet G1 of the declaration form. Check the box "Provide standard deductions"...

Read more

Documents for tax refund when purchasing an apartment

Each person who decides to buy an apartment, by law, can return a certain amount from the state budget. But only if he is officially employed and pays income tax monthly. This is easy to do by following the instructions and tips...

Read more

Procedure and deadlines for tax payment by tax agents

Art. 226 of the Tax Code of the Russian Federation (in the new edition) establishes the features of personal income tax accrual by agents, the periods and procedure for transferring mandatory payments by them. The Code establishes that tax is paid to the budget according to special rules. Typically, personal income tax is calculated...

Read more

Application for refund of overpaid tax

Typically, an application for a refund of overpaid tax is drawn up after the completion of the periods for submitting tax reports and transfers, when, as a result of re-checking the amounts sent to the tax office, it turns out that for some reason...

Read more

Penalties for personal income tax

If you do not pay on time Every employer, regardless of whether he is an individual entrepreneur or a legal entity, is obliged to pay tax to the state treasury for his employees. After all, every company acts for its employees as...

Read more

226 of the Tax Code of the Russian Federation with comments

The specifics of tax calculation by agents are described in Art. 226 Tax Code of the Russian Federation. The same norm defines the procedure and terms for payment of calculated amounts to the budget by these entities. Let's take a closer look at the article. Subjects Tax agents under Art. 226 of the Tax Code of the Russian Federation recognize...

Read more

List of documents for tax refund when purchasing an apartment

Many people who buy a home are not aware that there is a legal opportunity to return part of its cost from the budget. The amount of such a refund is called a property tax deduction, and the mechanism for receiving it is determined by Art. 220 Tax Code. U...

Read more

Features of registration of sick leave in 6-NDFL

Both individuals and legal entities must pay taxes in accordance with the requirements of current tax legislation. For example, employees who carry out activities on the basis of an employment agreement must pay...

Read more

Registration of a tax deduction when purchasing an apartment

Today we will be interested in documents for deductions for an apartment. In fact, it is not so difficult to guess what will be required of us. However, not all citizens are aware of this list. This means that you have the right to refuse a deduction. Not the most...

Read more