Until the end of 2016, two classifiers of types of work of enterprises operated simultaneously - the old one and the new edition. Since 2017, only the second, modified and supplemented, is valid. The list of OKVED 2 household goods, valid for wholesale and retail trade, has acquired new meanings in an updated version. In this version, the choice has become wider.

Each section is divided into class, subclass, group, subgroup, and species. To determine the desired code, a specific group and subgroup are selected in the corresponding class. All together and make up the code economic activity.

The structure is arranged in such a way that you can easily find everything you need in it. The classification includes more than 100 options. This is what defines uniqueness.

The most relevant changes

The development of entrepreneurship creates the prerequisites for the approval of new encoding options. Now unknown areas are expanding, peacefully adjacent to the already familiar ones, and more modern industries are emerging. Such changes are pushing legislators to revise existing directories, make amendments and additions to them. This can explain the changes made to the document.

OKVED 2 consists of 21 sections, titled in Latin letters.

Trade is classified under Section G. It has 3 classes:

- 45 - wholesale and retail vehicles, motorcycles and their repair.

- 46 - wholesale, except for the goods provided for in paragraph 45.

- 47 - retail, according to the list stipulated by section 46.

Previously, they were designated by the numbers 50, 51 and 52. The letter names of the sections were also different.

Household goods do not have an exact division into types according to their intended purpose. This can be done conditionally, based on the purpose, properties, materials from which they are made and some other characteristics. For example, products made of metal, plastic, ceramics, glass.

They also differ in purpose: for the garden; hygiene items - napkins, paper towels, toilet paper And so on.

Features of assigning a cipher

OKVED 2 - All-Russian classifier of types of economic activity. It helps you determine what you're doing. specific enterprise. According to the assigned code, you can not only register an LLC or individual entrepreneur, but also perform other actions:

- statistics analyzes the work of the enterprise, determines the effectiveness;

- with its help, details are drawn up in the bank and OKPO;

- without it, it is impossible to clear the cargo at customs, accredit the company;

- it is required to have a code assigned to customers and suppliers who decide to take part in the auction,

- licensing, inspections by fiscal authorities - all this is possible on the basis of the code.

Note! There is no single appointment for all cases. When determining, the item that is most similar to the given activity is selected.

However, the form of ownership, commercial or other nature, forms of ownership are not classified in the directory.

Despite the non-appearance of the Internet, plastic utensils and inflatable furniture elements, well-known and familiar newspapers, books, metal household utensils and, of course, wooden furniture continue to be in demand. That is why many businessmen are in no hurry to change the type of activity they started many years ago. And now they continue to display it in tax documents code .49 OKVED decoding it just, and applies to all known household products and furniture elements.

To say that wholesale is one of the easiest steps to develop and increase business profitability, in reality, will not work. Yes, many businessmen do not seek to conduct retail trade, preferring only wholesale sales. But everywhere there are pitfalls. And in this case, they refer to the search potential client. Yes, now there are many manufacturers producing unusual, high-quality and even universal furniture items and household appliances.

The same can be said about printed materials and stationery. Of course, on the one hand, the opportunity to choose is good, but on the other hand, running a business related to wholesale sales is a rather difficult task with a lot of risks. Although if we take into account that the goods related to the OKVED code .49 have a long shelf life, then the magnitude of these risks is not so great. Ultimately, for each product there is a buyer, the main thing is to find him in time.

What goods are displayed by OKVED code 46.49

First of all, it is used by firms engaged in the sale of wooden items. But in addition to wholesale of the usual furniture elements, OKVED .49 is also used by companies where one of the activities is the sale of wicker and cork products. This code is also displayed in documents by firms whose activities are related to the printed type of products and stationery. This applies not only to books, but also to magazines.

It is also often used by firms that decide to engage in wholesale and leather products, tourist equipment. This code is also used in activities such as selling bicycles. Refer to the OKVED code .49 and the sale of accessories for this type of transport. Household-style metal utensils and cutlery sold in bulk also belong to the .49 code.

In the case of doing business related to the sale of toys, games and even musical instruments in bulk, this type of activity should also be displayed with the .49 code. It is also indicated in tax documents by companies that are closely involved in the wholesale trade of sporting goods. It is worth noting that this code is also suitable for reflecting sales of special sports shoes, in the form of skates or skis.

- resale (sale without conversion) of new and used goods for personal or household use, or use by shops, department stores, stalls, postal businesses, door-to-door deliveries, merchants, consumer cooperatives etc. Retail classified primarily by type trade enterprises(retail sale in department stores - groupings 47.1 to 47.7, retail sale outside stores - groupings 47.8 to 47.9). Retailing in general goods stores includes: retail sales second-hand goods (group 47.79). For retail sales in department stores, a further distinction is made between retail sales in specialized stores (groups 47.2 to 47.7) and retail sales in non-specialized stores (group 47.1). The above groupings are further subdivided according to the range of products sold. Sales other than general stores are classified according to the form of trade, such as retail sale in stalls and markets (group 47.8) and other retail sales not through general stores, such as mail-order, door-to-door, vending machines etc. (Group 47.9). The range of goods in this grouping is limited to goods commonly referred to as consumer goods or retail goods. Therefore, goods not normally sold in retail trade, such as cereal grains, ores, industrial equipment and so on. not included in this group

- retail sale of goods such as personal computers, stationery, paint or wood, although these products may not be suitable for personal or domestic use. Traditional processing of goods in trade does not affect the essential characteristics of goods and may include, for example, only their sorting, separating, mixing and packaging.

Checks can serve as protection for both the client and the seller. In the event of conflict situations (detected shortage, discrepancy between the price in the check declared), each of the parties keeps a proof of correctness. And in court cases, which arise at the initiative of customers, a check is the only opportunity for a store to prove its case and maintain its image.

Retail Okvad

Retail sale of merchandise such as personal computers, stationery, paint, or wood, although these products may not be applicable for personal or household use. Traditional processing of goods in trade does not affect the essential characteristics of goods and may include, for example, only their sorting, separating, mixing and packaging.

Resale (sale without conversion) of new and used goods for personal or household use, or use by shops, department stores, stalls, postal companies, door-to-door deliveries, merchants, consumer cooperatives, etc. . Retail trade is classified primarily by type of trade enterprises (retail trade in department stores - groupings from 47.1 to 47.7, retail trade outside stores - groupings from 47.8 to 47.9). Retail trade in stores of a general assortment of goods includes: retail sales of used goods (group 47.79). For retail sales in department stores, a further distinction is made between retail sales in specialized stores (groups 47.2 to 47.7) and retail sales in non-specialized stores (group 47.1). The above groupings are further subdivided according to the range of products sold. Sales other than general stores are subdivided according to the form of trade, such as retail sales in stalls and markets (class 47.8) and other retail sales not through general stores, such as mail order, door-to-door, vending machines, etc. d. (Group 47.9). The range of goods in this grouping is limited to goods commonly referred to as consumer goods or retail goods. Therefore, goods not normally sold in retail trade, such as cereal grains, ores, industrial equipment, etc. not included in this group

OKVED: retail sale of non-food products

- photographic equipment, optical or measuring instruments;

- services of specialists in optics;

- souvenirs, handicrafts, items of a religious nature;

- services for commercial galleries;

- liquid boiler fuel, bottled gas, coal, wood fuel;

- weapons and ammunition;

- numismatic and philatelic goods;

- non-food products that are not included in other groups;

- in commercial galleries.

45 grouping includes activities that are related to the sale, as well as the repair of cars or motorcycles. 46 and 47 include all activities that are related to sales. The main difference between 46 and 47 (wholesale and retail) is based on the predominance of a particular type of buyer in each group.

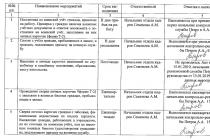

OKVED table for retail trade in 2019

- Classification of organizations, private and individual enterprises and firms of any organizational and legal form by type of their activity.

- Assigning a separate code to each type of activity.

- regulation of this activity.

- Company surveillance.

- Access to the international level.

- Informing higher authorities.

OKVED in this industry allows you to regulate the activities of official organizations of various sizes: specialized and non-specialized stores, kiosks, stalls, tents, as well as home sales, handing over goods in person, Express delivery, delivery services by mail and so on.

Retail trade, except for motor vehicles and motorcycles

On the site Consulting company"Consensus" presented new OKVED codes, which will help you with the registration of LLC and IP. To do this, it is enough to choose what your company will do, for example, “production tobacco products» - and write down the code of this type of economic activity in the application for registration.

- resale (sale without conversion) of new and used goods for personal or household use, or use by shops, department stores, stalls, postal businesses, door-to-door deliveries, merchants, consumer cooperatives, etc. d. Retail trade is classified primarily by type of trade enterprises (retail trade in department stores - groupings from 47.1 to 47.7, retail trade outside stores - groupings from 47.8 to 47.9). Retail trade in stores of a general assortment of goods includes: retail sales of used goods (group 47.79). For retail sales in department stores, a further distinction is made between retail sales in specialized stores (groups 47.2 to 47.7) and retail sales in non-specialized stores (group 47.1). The above groupings are further subdivided according to the range of products sold. Sales other than general stores are subdivided according to the form of trade, such as retail sales in stalls and markets (class 47.8) and other retail sales not through general stores, such as mail order, door-to-door, vending machines, etc. d. (Group 47.9). The range of goods in this grouping is limited to goods commonly referred to as consumer goods or retail goods. Therefore, goods not normally sold in retail trade, such as cereal grains, ores, industrial equipment, etc. not included in this group

52 Retail trade, except for motor vehicles and motorcycles; repair of household and personal items old 47 Retail trade, except for motor vehicles and motorcycles new

[Old OKVED] 52.11 Retail sale in non-specialized stores primarily of food products, including drinks, and tobacco products

[New OKVED] 47.11 Retail sale predominantly of food products, including beverages, and tobacco products in non-specialized stores

[Old OKVED] 52.11.2 Retail sale in non-specialized stores of non-frozen products, including drinks, and tobacco products

[New OKVED] 47.11.2 Retail sale of non-frozen products, including drinks and tobacco products, in non-specialized stores

OKVED codes for retail trade in 2019

Why does the company, in fact, need the OKVED code? Firstly, it is necessary in terms of collecting statistical data. – this makes it easier for Rosstat to know how many organizations in the country are involved in one or another entrepreneurial activity. Secondly, OKVED is necessary for the correct taxation of certain organizations: depending on the type of economic activity, certain taxation systems are used in companies. That is, a notary's office cannot be subject to a single tax on imputed income, and gold mining – be on USN.

Each OKVED code consists of several digital characters, their number varies from two to six. The All-Russian Classifier of Economic Activities uses a hierarchical classification method – that is, from the general – to a private, and sequential encoding method.

OKVED: codification of the sphere of household goods

It is important to pay attention to the fact that choosing the right code when registering a company is of paramount importance. If you made a mistake with the required codification, or indicated it inaccurately, the tax authority will not be able to correct your mistake, and it will cause registration refusal. And this, in turn, will entail additional troubles, material expenses and wasted time.

The All-Russian Classification of Economic Activities (OKVED) is a universal reference book of basic information, which can be obtained using one or another code. OKVED for household goods, like any other area of economic activity, is regulated in detail.

OKVED code 52: Retail trade, except for motor vehicles and motorcycles; repair of household and personal items

— the operation of shops selling general goods, including clothing, furniture, household electrical goods, hardware, beauty products, jewelry, toys, sporting goods, books, newspapers, magazines, etc.

– retail trade in a universal range of goods in stores that, along with the main sale (more than 50% of turnover) food products, including drinks, and tobacco products, they also sell other goods (clothing, furniture, household electrical appliances, hardware, cosmetic products, etc.)

05 Aug 2018 783OKVED wholesale trade in household goods is the sale of products in bulk, in accordance with state qualification standards. Choosing a code is important when registering individual entrepreneur or any other business entity. It also determines the obligation to have a license and affects the way taxes are calculated. At right choice simplifies the process of obtaining the data necessary for work, helps to maintain a high position in the market.

Trade options according to OKVED are divided by area of work and include production technologies. As an additional classifier, the division of specifics into raw materials and materials can act. The classifier includes 21 sections, each of them has its own letter of the English alphabet from A to Q. Activity options are coded with numbers. Their number in the code varies from 2 to 6 pieces. They are divided into classes, subclasses, groups, subgroups and species.

Codes for wholesales

For the wholesale trade in household goods, the main thing is Code 51.15.5 - the work of sellers in the wholesale of household and household goods, such as:

- dishes;

- household goods for the home;

- household products.

Additional ciphers for such products are:

- 51.44.1 - cutlery and metal utensils;

- 51.44.2 - ceramics, glass products (porcelain, earthenware, majolica) and sanitary ware;

- 51.45.2 - soap for toilet and household purposes;

- 46.45 - perfumery and cosmetics;

- 46.75 - chemical products;

- 46.44.2 - Cleaning products.

Complex and retail deliveries

Complex purchases are carried out by distributors or intermediaries who acquire the right to products and distribute them among enterprises and organizations. This legal entities, such as commercial organizations, importers, exporters, offices for the organization of large purchases, which attract agents for implementation. They operate in class 46 group G.

They can create their own trade marks or work with existing ones. At the same time, place orders for stores to receive products and deliver them already according to OKVED for retail sales. They can additionally sort, repack and store large batches.

Note! At the beginning of work, it is important to accurately determine the number by all-Russian classifier economic activity. This will help reduce costs and increase profits.

Retail companies are entities providing items for personal daily use. They are represented by supermarkets, shops, stalls and tents. They also offer delivery to the customer's door.

This type of provision of dishes or detergents is classified under class 47 of group G: distribution in specialized outlets - 47.2 - 47.7, in non-specialized outlets - 47.1.

In Russia, there are many standards by which business is built in the country. For this kind of supply of goods, such as the provision of household and household products, there is OKVED. Working in accordance with it, enterprises provide themselves with a stable income and minimum costs funds for taxes and licenses.