Any credit institution accepts payment orders. Thanks to these documents, you can accurately, quickly, and most importantly, correctly make a payment - transfer, withdrawal of funds, etc. The payment order includes a very important detail -...

Read moreVAT

How to calculate VAT from the amount?

The VAT calculator is the simplest and instant way to calculate the amount of tax payable. If you do not know how to correctly calculate VAT, use our service. A novice entrepreneur or an inexperienced accountant does not need to delve into...

Read more

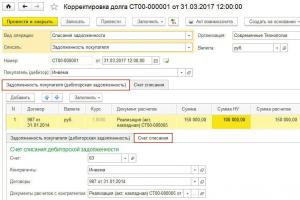

How to write off bad receivables

BUKH.1S experts spoke about the procedure for writing off bad debts using reserves, as well as debts not covered by reserves. Accounts receivable is the sum of all debts due to the organization from other legal and...

Read more

How to calculate VAT using formulas: Visual and useful examples of calculation

One of the most famous payments that every entrepreneur encounters is. Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how to solve...

Read more

How to calculate VAT: 18% of the amount

Many citizens involved in the sale of goods/services have to face a similar question. In particular, the problem is relevant for newcomers to this environment who cannot afford to pay for an accountant’s work. How to calculate VAT 18% of the amount and...

Read more

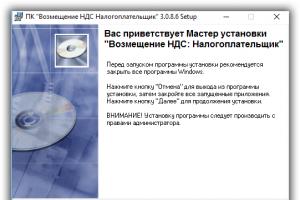

VAT Refund Program: Taxpayer

When the amount of input VAT subject to deduction is greater than the amount of calculated VAT tax that must be paid to the budget, the difference between them can be reimbursed to the taxpayer. VAT refund to the taxpayer is regulated by Article 176...

Read more

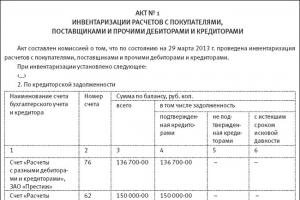

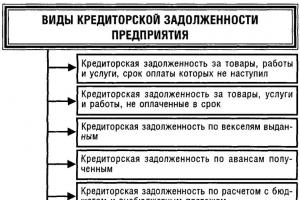

Write-off of accounts payable with expired statute of limitations

In the course of the activities of each company, there are always settlements with suppliers, credit institutions, the Federal Tax Service and its own personnel. The formed debt to counterparties is called accounts payable and allows for the time specified in...

Read more

How to fill out a payment order

The settlement document discussed in this article contains an order (written) from the owner of a specific account to the bank in which it is opened regarding the transfer of funds to another account (their recipient). Deadlines within which payment is due...

Read more

Documents that will help you write off accounts payable

votes: 23 Samples of documents with which you can write off accounts payable without causing unnecessary claims from tax authorities. Overdue accounts payable for which the statute of limitations has passed...

Read more

Zero VAT return for individual entrepreneurs

At the legislative level, tax inspectorates require individual entrepreneurs to submit reports on their income within specific deadlines. However, some companies registered as individual entrepreneurs may temporarily lack...

Read more

How to calculate VAT: calculation formula, examples

In our country, the sale of goods, works or services in most cases must be accompanied by the payment of value added tax. This procedure is declared by Art. 168 of the Tax Code of our country. Standard added tax rate...

Read more

Write-off of overdue accounts payable

The issue of debt repayment today is quite relevant and is widely discussed in legal circles. In particular, one of the most discussed is the issue of the possibility of writing off debt on...

Read more

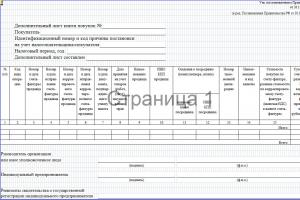

Preparation of an additional sheet of the purchase book when calculating VAT

Each buyer is responsible for accounting for his own transactions, as tax legislation obliges him to do so. The purchase book is a special type of reporting that reflects all transactions performed to provide or receive...

Read more

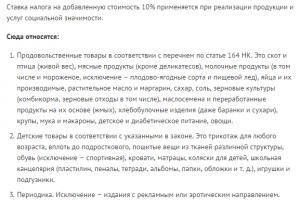

The “5 percent” rule for VAT: an example of calculation, when it applies

If an organization simultaneously carries out transactions that are taxed and not subject to VAT, it is obliged to carry out separate accounting for tax amounts. This is provided for in Art. 170 Tax Code of the Russian Federation. Collection amounts for taxable transactions are accepted for deduction. In a different situation...

Read more

How to deduct VAT from the amount?

Or VAT, was first used in France. The famous French economist M. Lauret used this phrase back in 1954. Four years later, this type of tax became mandatory for all citizens of this country. In addition, he gradually began to enter...

Read more

How to enter a customs declaration for imports based on receipt of Import VAT in 1s 8

Automatic selection and filling of customs declaration for 1C: Enterprise Accounting 8, edition 3.0 platform 8.2, 8.3 Why is this processing needed? As you know, in the standard solution "1C: Enterprise Accounting 8, edition 3.0" accounting of goods in the context of customs declaration...

Read more