When studying the theory and practice of entrepreneurship, the category “object of entrepreneurial activity” is important, because it is with the object that the entrepreneurial idea is most often associated (although it can be aimed at organizing the production process or managing it, searching for new, non-traditional methods or markets, etc.). .d.). The object of entrepreneurial activity is a product, product, service, i.e. something that can satisfy someone's need for something and that is offered on the market for purchase, use and consumption.

Separate integrity, which is characterized by such indicators as quantity, price, appearance, etc., is called a commodity unit. The professional approach of an entrepreneur to his activities implies, first of all, attention to quality, consumer properties, price, appearance, product packaging, etc., and only then - to the number of trade units.

To characterize entrepreneurship as an economic category, the central problem is the establishment of its subjects and objects. The subjects of entrepreneurship can be, first of all, private individuals (organizers of sole proprietorship, family, as well as more large-scale production). The activities of such entrepreneurs are carried out both on the basis of their own labor and with the involvement of hired workers. Entrepreneurial activity can also be carried out by a group of persons related to each other contractual relations and economic interest. The subjects of collective entrepreneurship are joint-stock companies, rental collectives, cooperatives, etc. In some cases, the state represented by its relevant bodies is also referred to as business entities. Thus, in a market economy, there are 3 forms of entrepreneurial activity: state, collective, private, each of which finds its "niche" in the economic system.

The relations between all subjects of the entrepreneurial process are of a commodity nature, but since the selfish economic interest is always expressed through the form of money (it is cheaper to buy, it is more expensive to sell), since the relations between the subjects take on the character of commodity-money relations.

The object of entrepreneurship is the implementation of the most efficient combination of factors of production in order to maximize income. New all kinds of ways to combine economic resources, according to J. Schumpeter, are the main business of an entrepreneur and distinguish him from an ordinary business executive. Entrepreneurs combine resources to produce a new good unknown to consumers; discovery of new production methods (technologies) and commercial use of existing goods; development of a new sales market, development of a new source of raw materials; carrying out reorganization in the industry to create their own monopoly or undermine someone else's.

For entrepreneurship as a method of managing the economy, the main condition is the autonomy and independence of economic entities, the presence of a certain set of freedoms and rights for them - to choose the type of entrepreneurial activity, to form a production program, to choose sources of financing, access to resources, to sell products, establish on it prices, disposal of profits, etc.. The independence of the entrepreneur should be understood in the sense that there is no governing body over him, indicating what to produce, how much to spend, to whom and at what price to sell, etc. But the entrepreneur is always dependent on the market, on the dynamics of supply and demand, on the price level, i.e. from the existing system of commodity-money relations.

The second condition for entrepreneurship is responsibility for the decisions made, their consequences and the risk associated with it. Risk is always associated with uncertainty and unpredictability. Even the most careful calculation and forecast cannot eliminate the unpredictability factor, it is a constant companion of entrepreneurial activity.

The third sign of entrepreneurship is the focus on achieving commercial success, the desire to increase profits. But such an attitude is not self-sufficient in modern business. The activities of many business structures go beyond purely economic tasks, they take part in solving social problems society, donate their funds to the development of culture, education, health, environmental protection, etc.

Entrepreneurship as a special type of economic thinking is characterized by a set of original views and approaches to decision-making that are implemented in practical activities. The personality of the entrepreneur plays a central role here. Entrepreneurship is not an occupation, but a mindset and a property of nature. Being an entrepreneur means not doing what others do. You need to have a special imagination, the gift of foresight, constantly resist the pressure of routine. You have to be able to find something new and use its possibilities. You need to be able to take risks, overcome, overcome fear and act not depending on the ongoing processes - to determine these processes yourself.

The entrepreneur in his activity is driven by the will to win, the desire to fight, the special creative nature of his work.

As for the intellect of an entrepreneur, according to J. Schumpeter, he is very limited and selective. It is aimed at a very narrow range of phenomena that the entrepreneur studies thoroughly. The limited horizon does not allow the entrepreneur to compare many different options for achieving his goal and indulge in long hesitation.

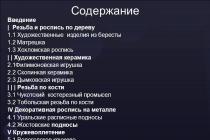

Lecture #5

1. Individuals as business entities. 1

2. Legal entities as subjects of commercial activity. 3

3. Ways to create and liquidate commercial structures. 6

4. Objects of entrepreneurial activity. 8

1. Individuals as business entities.

Most of the citizens - individuals involved in commercial transactions. But not all of them can be recognized as business entities. A significant part of citizens participate in trade operations as consumers who purchase goods and services for personal needs. Consumers are not professional participants in commodity circulation. In trade turnover, they are recognized as a weak, unprotected party. In relation to them, the general principles of commercial relations, such as work for the purpose of making a profit, and others, are not applicable. The subjects of PD include only those participants in economic relations for whom the production and sale of goods and services are a source of income. Can be distinguished several groups of individuals professionally engaged in PD.

These include, first of all, all FLs that have received the status individual entrepreneur. Article 23 of the Civil Code of the Russian Federation connects the possibility of performing PD with the registration of an individual entrepreneur as an individual entrepreneur. Lack of registration entails liability, including criminal liability (Article 171 of the Criminal Code of the Russian Federation). Bringing to responsibility for illegal entrepreneurship, however, does not exempt from liability under civil contracts that are concluded by the individual entrepreneur, who carries out PD without state registration. A citizen who actually carries out entrepreneurial activities “is not entitled to refer, in relation to transactions concluded by him, to the fact that he is not an entrepreneur,” Article 23 points out. The rules of the Civil Code of the Russian Federation and other regulations that regulate the activities of legal entities, apply to entrepreneurial activities of citizens, unless otherwise directly follows from the law, other legal act or the essence of the legal relationship.

The second group of FL, carrying out PD does not need state registration as an individual entrepreneur. An exception is currently made for such activities as private security and detective activities and the activities of private notaries. These persons have the right to work on the basis of a license or certificate provided for by the Fundamentals of Legislation on Notaries and the Federal Law on private security and detective activities.

The third group is formed by officials of organizations who are legal representatives of legal entities. They act on behalf of the organization and their actions on its behalf are identified with the actions of the organization. A feature of the legal status of legal entities is that PEs, through their actions, acquire rights and obligations not for themselves, but for the organization. Article 53 of the Civil Code of the Russian Federation stipulates the duty of officials to act in good faith and reasonably in the interests of the headed organization. At the request of the founders of legal entities, they are obliged to compensate for losses caused to the legal entity by unlawful actions. However, the amount of personal responsibility of officials is determined by the founders themselves in the memorandum of association, charter, contract with the head. In some cases, their personal liability is established by law. An example is the Code of Administrative Offenses, which establishes the administrative responsibility of both legal entities and officials for violation of various types of legislation, Article 199 of the Criminal Code of the Russian Federation establishes the responsibility of officials for non-payment of taxes by an organization on a large scale, etc.

Rights and obligations for the organization during trading activities acquire not only officials, but also ordinary wage-earners directly performing trading operations and making other transactions. They form fourth group FL, involved in trading transactions. These include salespeople, cashiers, freight forwarders, sales and supply department employees who are authorized to enter into contracts on behalf of the organization. Sellers and cashiers carry out trading operations either in accordance with an employment contract, or by order of the head. The powers of employees of the commercial departments of the enterprise must be confirmed by a power of attorney certified by the signature of the head and the seal of the enterprise. Their actions as a whole, as well as the actions of officials, are recognized as the actions of the organization. But in some cases, personal liability for violations is also established. This responsibility may be established by internal acts of the enterprise or by law. For example, article 7 of the Federal Law on the use of cash registers establishes the personal responsibility of the seller for the failure to issue a cash receipt, while the absence or malfunction of the cash register is considered as a violation of the organization.

Fifth group FL - professional businessmen, form sales representatives. Unlike employees they act on behalf of the organization not on the basis of an employment contract, but on the basis of a civil contract (order, commission, agency, etc.). Their powers and scope of responsibility are determined by the contract. With regard to commercial representatives, the Civil Code of the Russian Federation does not establish mandatory registration as an individual entrepreneur. But article 184 states that they are obliged to "execute the instructions given to them with the diligence of an ordinary entrepreneur." This indicates that activities under commercial representation agreements are recognized as entrepreneurial, and, therefore, require state registration. In a number of cases to resellers even more stringent requirements are imposed than for independent individual entrepreneurs. Brokers and dealers on stock exchanges must not only register, but also obtain licenses and certificates, without which their activities are considered illegal.

All PEs who are professionally involved in PD must have the appropriate legal personality, i.e. they must be capable and possess legal capacity necessary for the respective commercial activity. Questions capacity merchants are resolved in a civil procedure, which is the subject of articles 26 to 30 of the Civil Code of the Russian Federation. In accordance with the provisions of Articles 175-177, transactions made by incapacitated citizens are recognized as invalid in accordance with the established procedure.

concept legal capacity merchants, however, differs from general civil legal capacity. In general, the ability to have rights and obligations arises in a person from birth. But if an individual intends to engage in commerce, then he needs to acquire the right to do so in the appropriate manner. Legal capacity of an individual as a merchant arises from the moment of state registration, obtaining a license or certificate of the right to engage in relevant activities, from the moment an agreement or contract is concluded, an order is issued, etc. In this case, the rules similar to those established for legal entities apply. At the same time, the legal capacity of natural persons - merchants can be both general and special. General legal capacity allows them to acquire all the rights and obligations of legal entities carrying out CD. Special legal capacity associated with obtaining permission to carry out certain types of activities, which accordingly imposes on them additional responsibilities and restrictions. Another difference between commercial legal capacity and general civil legal capacity is that a citizen cannot be deprived of civil legal capacity. It only ends with his death. But with regard to the right to engage in PD, a ban may be imposed for a certain period. The basis for the ban may be a court decision (under articles 169, 170, 184, 199, 200 of the Criminal Code of the Russian Federation, it is possible to impose a ban on certain types of activities). A ban has been established on the classes of CA for officials (Article 9 of the Federal Law on competition and Article 11 of the Federal Law on the basics public service) and for deputies (Article 6 of the Federal Law on the status of a deputy). In addition, a citizen can voluntarily, under an agreement, waive his right to engage in commercial activities in general or in a specific area (Dovgan).

All individuals(Article 24 of the Civil Code of the Russian Federation) are liable for their obligations with all their property, with the exception of property that cannot be foreclosed. In accordance with Article 368 of the Code of Civil Procedure, the recovery of a citizen's obligations is levied on the citizen's personal property, and if his own property is not enough, then the recovery is levied on a share in the common shared property or joint property of the spouses, as well as on his share in the common property of a peasant (farm) economy ( Article 378 Code of Civil Procedure). If the property of a citizen is insufficient to cover his debts, his share in the joint capital of the partnership can be attracted (Article 80 of the Civil Code of the Russian Federation). Foreclosure is not applied to the property of a citizen if it is possible to pay off the debt at the expense of his income - wages, other earnings, pensions or scholarships. This is possible if the amount of the penalty does not exceed 20-50% of the monthly income (Article 383 of the Code of Civil Procedure). In order to ensure the interests of a citizen and his dependents, the execution of his obligations cannot be levied on property necessary for existence - food, clothing, household utensils, livestock, poultry (their number is determined in Appendix 1 to the Code of Civil Procedure). present order valid for all PD participants.

In relation to individual entrepreneurs, however, special measures of property liability are also provided. An individual entrepreneur may be declared bankrupt. The grounds and procedure for declaring bankrupt are determined in Article 25 of the Civil Code of the Russian Federation and in the Law of the Russian Federation of 08.01.98. "On the insolvency (bankruptcy) of an enterprise"

2. Legal entities as subjects of commercial activity

legal entity an organization is recognized that owns, manages or manages separate property and is liable for its obligations with this property, acquires and exercises property and non-property rights on its own behalf, bears obligations, and is a plaintiff and defendant in court. Legal entities must have an independent balance sheet or estimate. The term organization in legal theory is used to denote a certain organizational unity, i.e., the sustainability of education, which is reflected in the constituent documents of legal entities (although not all organizations can be considered as legal entities). Signs organizations as a legal entity are:

- the presence of separate property in ownership, economic management or operational management;

- the ability to meet its obligations with this property;

- the ability to acquire rights;

- ability to carry out duties;

- the ability to be a plaintiff and defendant in court;

- the presence of an independent balance sheet or estimate.

Legal entities in the Civil Code of the Russian Federation are initially divided into commercial and non-profit organizations. Recognized as commercial in accordance with the provisions of Article 50 of the Civil Code of the Russian Federation "organizations pursuing profit as the main goal of their activities." Commercial organizations include: business partnerships and companies, production cooperatives, state and municipal unitary enterprises.

Partnerships built on the principles of contractual association of property and entrepreneurial efforts (Art. 66-86 of the Civil Code of the Russian Federation). As a general rule, members of a partnership bear complete liability for the partnership's obligations. This means that any property of a participant in the partnership may be involved in the performance of the obligation of the partnership. An exception is the property of citizens, which cannot be levied. The partnership may be complete. In this case, all its participants bear full, joint and several liability for its debts. The partnership may be limited(on faith). In this case, it includes participants who are liable only within the framework of their contribution (limited liability).

Business companies built on the principles limited liability participants. They are liable for the obligations of the company only within the authorized capital. Moreover, the share of each in the authorized capital is strictly defined. Business entities include: LLC, open and closed joint stock company, ALC, as well as dependent and subsidiaries. Features of the legal status in articles 87-94 of the Civil Code of the Russian Federation and in the Federal Law of 11.07.98. About LLC. ALCs are LLCs that establish additional liability of one or more participants for the obligations of the company, indicating the amount of liability. The procedure for accepting and exercising responsibility is defined in Article 95 of the Civil Code of the Russian Federation. Features of the legal status of JSCs are defined in articles 96-104 of the Civil Code of the Russian Federation and in the Federal Law of December 26, 1995. About AO.

Features of the legal status subsidiaries are defined in Article 105 of the Civil Code of the Russian Federation, which establishes that a company is a subsidiary if another company or partnership has the ability to decisively influence the decisions made by this company. This possibility may be related either to the predominant participation, or to the contract or other circumstances. In such cases, the parent organization bears subsidiary liability for the obligations of the subsidiary, the latter is also liable in the established cases for the debts of the parent company. Society is recognized dependent if the parent company owns more than 20% of voting shares (Article 106 of the Civil Code of the Russian Federation). Such companies are recognized as affiliated persons and information about them is published in the open press. The procedure for determining affiliates is established by Article 21 of the Law of the Russian Federation dated March 22, 1991. (as amended on May 6, 1998) “On competition and restriction of monopolistic activity on commodity markets».

Production cooperatives built on the union of property and labor participation. Features of their legal status are regulated in articles 107-112 of the Civil Code of the Russian Federation, as well as the Federal Law of May 8, 1996. “On production cooperatives”, as well as the Federal Law of December 8, 1995 “On agricultural cooperation”.

State and municipal unitary enterprises are not endowed with the right of ownership of the property used by them in the course of their activities. The property is state or municipal property. The appointed heads of enterprises carry out the functions of possession, disposal and use of property on the basis of the right of economic management or the right of operational management. The features of these organizational and legal forms of enterprises are defined in articles 112-115 of the Civil Code of the Russian Federation. They are also defined in the charters of enterprises approved by the state and local authorities that create these enterprises.

Organizations that do not set the goal of their activities to make a profit and do not distribute profits among the participants are classified by the Civil Code of the Russian Federation as non-commercial. In accordance with paragraph 3 of Article 50 of the Civil Code of the Russian Federation, “non-profit organizations have the right to carry out entrepreneurial activities”, but only insofar as “it serves to achieve the goals for which they were created and corresponding to these goals.” In cases where non-profit organizations carry out a CA, they are subject to all the rules relating to commercial organizations, except for cases expressly established by law. Distinctive feature non-profit organizations are usually prohibition of distribution of income (profit) between participants. An exception is made only for consumer cooperatives.

The legal status of non-profit organizations is regulated in § 5 of Chapter 4 of the Civil Code of the Russian Federation, as well as in the Federal Law of 12.01.96. "About non-commercial organizations". Special laws have been adopted for certain types of commercial organizations. The Civil Code of the Russian Federation defines several types of non-profit organizations:

Article 116 defines the provision consumer cooperatives. Consumer cooperatives in Russia have a long history and have always been actively involved in commercial and industrial activities. Their legal status is regulated in detail in the Federal Law of 01.01.2001. “On consumer cooperation (consumer societies, their unions) in the Russian Federation”, Federal Law of December 8, 1995 “On agricultural cooperation”, Federal Law of August 7, 2001 “On credit consumer cooperatives of citizens”, etc.

Article 117 defines the legal status public and religious organizations, giving them the right to carry out entrepreneurial activities if there is a corresponding provision in the charter of the organization. In more detail, their activities are regulated in the Federal Law of 01.01.2001. "On freedom of conscience and religious associations", Federal Law of 19.05.95. "On public associations", dated 11.08.95. "On charitable activities and charities»; "On trade unions, their rights and guarantees of their activities" dated 01.01.2001. "About political parties". Separate laws establish restrictions on the right to carry out commercial activities by certain commercial organizations. Political parties are prohibited from carrying out commercial activities. Therefore, they are not subjects of commercial law.

Articles 118, 119 define the legal status funds. There are many funds in the Russian Federation. But most of them are not funds in the sense that the Civil Code of the Russian Federation puts into this concept. They are mostly government or municipal institutions, since they are formed at the expense of budgetary sources.

In the law of the Russian Federation of 12.01.96. About non-commercial organizations 8.07.1999 amendments have been made, where the possibility of creating non-profit organizations in the form of a state corporation is determined. They can only be created by the Russian Federation and do not have membership. The procedure for their activities is determined by the Federal Law. An example is the Federal Law on insurance of deposits of individuals or in banks, in accordance with which state corporation"Deposit Insurance Agency" - ARKO.

The next large group of non-profit organizations are institutions. They can be created on the basis of any form of ownership, that is, they can belong to both the state and private individuals. But the main share of the institution is formed by budgetary institutions created by the state and municipalities. Legal status budget institutions regulated by the Budget Code of the Russian Federation. Legal status individual institutions may be regulated by the Federal Law (On Education) and by-laws (PP of the Russian Federation, approving the provisions on higher, secondary, general educational institutions). The right to carry out entrepreneurial activity is determined by the owner of the institution, who bears subsidiary liability for the obligations of the institution.

Commercial and non-profit organizations can create unions and associations. In accordance with paragraph 1 of Article 121 of the Civil Code of the Russian Federation, associations and unions cannot carry out entrepreneurial activities. If such an obligation is imposed on them, then they must be transformed into economic companies.

Associations of legal entities with commercial purposes may be formed. But the basis for creating such an association can be the formation holding based on participation in the capital of one (possibly specially created) economic company in other (subsidiaries, dependent) companies. The basis can be partnership agreement(agreement about joint activities).

When distinguishing between commercial and non-commercial organizations, it is the organizational- legal form legal entities, and not the content of the statutory documents. So, commodity exchanges are not created for the purpose of making a profit, they are not entitled to carry out commercial transactions on their own behalf, but in the event that a profit arises, they distribute it among the members of the exchange. Therefore, commodity exchanges should be recognized as commercial organizations. Consumer cooperatives are recognized as non-profit organizations. Nevertheless, they traditionally carry out the purchase of goods from the population, their processing and sale, that is, their functions directly include the implementation of trade and commercial activities, although profit is not their goal.

3. Ways to create and liquidate commercial structures

In accordance with the rules of Article 51 of the Civil Code of the Russian Federation, a legal entity is considered created from the moment of state registration. But some activities can be carried out only from the moment of obtaining the appropriate license. In this regard, it is possible to highlight three ways to create legal entities.

The central place belongs regulatory way of creating organizations, which for small businesses is supposed to be transformed into notifying. Its essence lies in the fact that the organization is created on the initiative of individuals, voluntarily, in their interests. They themselves determine the goals and objectives of the organization. But they must register its creation. At the same time, registration is of an accounting nature, and not of a permissive one. No one has the right to prevent the creation and registration of legal entities, if their statutory provisions do not contradict the requirements of the law.

The second way is command. It is typical for legal entities created by order of the state or local governments. When creating institutions by private individuals, the administrative method is also used. In this case, the basis for registration is not the decision of the founders of the organization, but the order of the owner of the property. But the organization is considered created only from the moment of registration.

The third way is permissive. It is used in cases where the constituent documents of the organization set the task of carrying out activities requiring a license. In this case, the organization usually acquires the status of a legal entity through registration, but acquires the right to engage in these types of activities only from the moment it receives a license. Prior to obtaining a license, an organization may acquire any rights and obligations not related to the implementation of licensed activities. It can participate in litigation as a plaintiff if it is wrongfully denied a license, carry out those activities that do not require a license and are compatible with the license requirements for the chosen type of activity. In established cases, the procedure for state registration and licensing may be changed. An example is the state registration and licensing of the activities of credit institutions.

From the moment of registration, a legal entity may have civil rights, corresponding to the objectives of the activity provided for in its constituent documents, and to bear the obligations associated with this activity. This means that the organization becomes legally capable.

Legal capacity can be general and special. As a general rule, commercial organizations may have civil rights and bear civil obligations necessary to carry out any types of activities that are not prohibited by law from the moment of state registration. Therefore, state registration guarantees the acquisition of the general legal capacity of a commercial organization. There are a few exceptions.

Firstly, state and municipal enterprises are always limited in their rights to dispose of property. Therefore, from the moment of state registration, they acquire special legal capacity.

Secondly, non-profit organizations always have special legal capacity, since they limit their right to carry out commercial activities by statutory documents.

Thirdly, commercial organizations can provide in the constituent documents for certain restrictions on their rights and obligations. In this case, from the moment of registration, they acquire not general, but special legal capacity.

If the constituent documents of the organization do not exclude the possibility for it to engage in licensed activities or directly provide for this, the legal entity must obtain a license for the relevant activity. Prior to obtaining a license, the organization has general legal capacity and the right to carry out any types of activities, except for licensed ones. From the moment of obtaining a license, the organization has special legal capacity, since it must comply with license requirements.

An organization may acquire special legal capacity after registration if it enters into an agreement with others in which it voluntarily assumes certain restrictions on the conduct of business. For example, the conclusion of an exclusive supply agreement deprives the supplier of the right to supply goods to other buyers.

In all cases, except for the creation of a unitary enterprise, the issue of acquiring special legal capacity, i.e., accepting restrictions, is decided by the entrepreneur on a voluntary basis. If he does not want restrictions, he can engage in other activities. However, the state may abuse its right to determine the types of activities to be licensed, leaving no opportunity for entrepreneurs to freely exercise their civil rights and obligations. This situation indicates the bureaucratization of the economy.

A feature of the implementation of the legal capacity of legal entities is that the rights and obligations for them are acquired by an individual who, in accordance with the constituent documents, head the management bodies of the organization.

Termination of legal capacity is associated with the termination of state registration of legal entities. Termination of state registration can be carried out voluntarily. The basis for this may be: the decision of the founders or the general meeting, the expiration of the contract, the achievement of the statutory goals or the goals of the contract. Forced termination of state registration carried out primarily by court order. For example, a certificate of state registration of a credit institution is canceled if it does not pay the specified central bank account of 100% of the authorized capital declared in the founding documents. The methods of forced termination of registration should also include decisions of the antimonopoly authorities on the division or separation of economic entities, which they can take in accordance with the Federal Law on Competition. But if the organization does not agree, such a decision can be challenged in court or AMOs must go to court in order to enforce their decision. Therefore, the basis for termination of registration will still be a court decision. If the economic entity agrees with the decision of the AMO, it carries out the reorganization procedure voluntarily.

From point of view ways to terminate activities organizations, allocate complete liquidation and reorganization. Complete liquidation means the destruction, destruction or sale of property. Reorganization is carried out in the form of separation, separation, merger, accession or transformation (change in legal form).

Termination of state registration does not always coincide with the termination of the organization's activities in time. An organization can be completely liquidated as a property object as a result of a natural disaster or emergency. It can be eliminated in a planned manner (harmful production). In this case, the termination of registration only states the fact of liquidation. In the event of bankruptcy, termination of registration effectively reflects the inability of the organization to operate profitably. At the same time, the enterprise as a property complex may continue to exist until the complete sale of the property by the liquidation commission. In progress reorganization the property complex of enterprises is not liquidated, only re-registration takes place. Some faces disappear, others appear. Consequently, the moment of termination of registration of a liquidated person and the moment of its liquidation coincide in time.

4. Objects of entrepreneurial activity

Objects of entrepreneurial activity are products manufactured, work performed or services rendered , that is, what can satisfy someone's need and what is offered on the market for purchase, use and consumption. Economic science considers entrepreneurship as an element market economy, as an activity to create socially useful products, works or services for sale for money, i.e. as goods.

1. A product is a product of labor, i.e., a person’s physical or mental efforts must be spent on its production. (Water in the river is not a commodity, but pumping it to the consumer through a water pipe is a commodity).

2. Only a product of labor intended for exchange or sale becomes a commodity. (For example, strawberries grown in a country house become a commodity only when they are exchanged for another commodity or sold).

3. A product has two properties: use value or utility and value, which is reflected in the market turnover by the price.

In such broad concept goods include not only things, but also the results of work, as well as services. In practice, the concept of goods is applied in the narrow sense. It does not include works and services. They are considered as independent objects of PD. Therefore, expressions such as "realization of goods, works, services" are used. In addition, in trade and statistics, it is customary to refer only a certain group of things to goods. It is not customary to call real estate objects, land, enterprises as goods property complexes, although they can be objects of sale, and, consequently, objects of PD. In a narrow sense, for the purposes of PD, only movable tangible and intangible assets are usually called goods.

TO material assets include things acquired for their physical, chemical or biological useful properties, i.e. useful due to their material nature. TO intangible It is customary to refer to assets as things whose usefulness is determined not by their material nature, but by the information that is embedded in them by nature or by man. Information can be intellectual (databases on disks or floppy disks, inventions, utility models and industrial designs, TK, elite seeds and thoroughbred animals) or emotional (video films, audio recordings, paintings, books) and must have value.

Goods in the narrow sense are often identified with the concept products, however, products are things produced in the enterprise, but not intended for sale. For example, milk may be produced for sale or for processing, as well as for feeding calves. In the first case, it is a commodity, and in the second, a manufactured product is a raw material for the production of another product.

The product in the PD is examined and considered from various angles.

From positions production, its organization of paramount importance is the type of entrepreneurial activity, that is, the type of created good. For an entrepreneur, the technology of production of the corresponding product, work or service is important. It defines the types of purchased equipment and raw materials, requirements for labor force, premises, structure of production. The defining moments in this area are the professional data of the entrepreneur or his employees, their knowledge and experience, the ability to follow scientific achievements and apply them in practice.

From positions consumer A commodity is a product of labor that a potential consumer is interested in owning. That is, the product must have a use value - the ability to satisfy human needs. A commodity may have a high, low, limited or individual use value. Low - due to some certain reasons, little interested people possess the goods. (For example, a coffee drink - purchase units or if there is no coffee, soy milk). high – to meet the corresponding needs of most people (bread). Limited - A product is produced for a specific group of consumers. (For example, a wheelchair, stockbook). Individual - the goods are produced taking into account the individual wishes of customers (For example, Rolls - Royce, server,)

Marketers are engaged in determining, and sometimes even forming, the level of significance of a product, its promotion from producer to consumer. If the entrepreneur does not contact them, then he himself must do marketing, even if he does not suspect it. Of course, having the right knowledge helps.

From point of view marketing There is the following classification of goods:

1.By purpose - consumer (expression of personal will, families) and production purposes (the collective, the administration participate in the development of the decision).

1.1.Consumer can be classified in two ways:

A) according to the nature of consumption :

- short-term use (food, soap, newspaper). The volume of consumption depends on the packaging.

– durable use (shoes, refrigerator). Acquired rarely, sometimes 1 time in a lifetime;

– works and services (watch repair).

B) by consumer behavior :

– daily demand(stationery)

– careful selection (electrical appliances)

– prestigious (car)

1.2.Production:

- equipment

- parts and semi-finished products

2. By the nature of the appearance on the market in terms of novelty

New goods have several gradations depending on the nature of novelty. (New in relation to what?) In the US, a product is considered new if it appears every 4 years. We have a product that has no analogues in world production by 80%. Distinguish:

- pioneer products - designed to meet the non-traditional consumer demand that arises due to new needs. Absolute novelty is rare. According to experts, in the entire history of mankind there were only 150-400 such absolutely new products. (From the point of view of Kondratiev, Schumpeter - 1885 - a car, 1960 - a tape recorder, 1975 - a personal computer). All the rest were compositions at the junction of commodity properties and qualities of pioneer goods (video recorder).

– technical modernization leads to the appearance of goods market novelty. They arise as a result of the activities of research institutes to improve pioneer products. It is based on inventions (black and white - color photos, tapes - disks, video cassettes, Cell Phones). These products meet existing needs by increasing quality parameters.

– modifications existing product, i.e. some technical changes, improvement corporate identity, design, service quality improvement, brand renewal.

In the consumer market, 1-3% of buyers are willing to pay any money for absolute novelty. If the firm, due to the success of the developer, has become a legal monopolist, then it can receive monopoly rent - the excess income included in the price, which guarantees its reimbursement of R&D costs.

rocket and space complexes,

communication systems,

poisons and drugs,

ethanol,

uranium and other fissile materials, etc.

The fact that these objects are withdrawn from circulation does not mean that the rules of compensation do not apply when they are transferred into ownership. But the rules for their circulation are usually strictly regulated by the state, and violation of these rules entails liability, including criminal liability.

2) A wider range of goods are things limited in circulation. They apply to general principles market exchange, but their sale and sometimes purchase require special permits. Restricted items include:

- goods, the sale of which requires a license (scrap ferrous and non-ferrous metals, alcoholic products, purchase and sale of hunting and sporting weapons and ammunition, oil);

– excisable goods (fuels and lubricants, jewelry, cars, tobacco and alcohol products);

- objects of exclusive rights, the implementation of which requires the permission of the copyright holder (books, audio and video recordings);

- goods for which mandatory order certification.

- objects subject to mandatory state registration: real estate, vehicles.

3) All other things have free circulation. As a general rule, things have free circulation if their circulation is not limited, or if they are not withdrawn from free circulation.

From point of view identification goods in trade turnover, various means of individualization of goods are used. These include: the use of commodity classifiers and labeling of goods. Commodity classifiers are binding and equal to laws (standards). They are officially approved lists of goods and services indicating the code, number, which is affixed to the commodity documents in established cases. In Russia there are several types of classifiers.

OKP (OKPU) - All-Russian classifier products and services approved by Gosstandart. It is used in all shipping documents and is used for the purpose of uniform application of tax laws.

MKTU - International classifier of goods and services for the registration of TK. It is compiled by Rospatent authorities in agreement with the countries that are parties to the Paris Convention.

TN VED - Commodity nomenclature of foreign economic activity. Applies only when filling out customs documents. approved by the State Customs Committee.

To assign goods to a particular class, product directories are often used, which are developed by Gosstandart and scientific institutions. They provide more detailed description goods and recommendations on their assignment to one or another class of the corresponding classifier. You can also use the information about the product that provides buyers and trade organizations manufacturer. This information may be provided in the form of text and by special markings. Marking serves both as a means of providing information about the product and as an independent means of individualizing goods in trade (TK, barcodes).

Business entities are individuals and legal entities that carry out independent activities associated with a certain risk in order to make a profit. All of them are entrepreneurs and enter into complex economic relations with other subjects: the state, consumers, employees. In this case, "entrepreneurs" should be considered both individual and collective entrepreneurs, i.e. entrepreneurial organizations.

IN modern meaning an entrepreneur is a person who carries out entrepreneurial activities, the right to which is enshrined in Art. 34 of the Constitution of the Russian Federation.

The subjects of entrepreneurial activity can be: citizens of Russia, foreign citizens, stateless persons and associations of citizens.

In accordance with the current legislation, entrepreneurs have rights and obligations. The rights of entrepreneurs, as a rule, are regulated by the legislation and customs of business turnover.

In accordance with Art. 5 of the Civil Code of the Russian Federation, a customary business practice is a rule of conduct that has developed and is widely used in any area of business activity, not provided for by law, regardless of whether it is recorded in any document.

Entrepreneurs as taxpayers have the following rights (Article 21 of the Tax Code of the Russian Federation):

Receive from the tax authorities at the place of registration free information on applicable taxes and fees, legislation on taxes and fees;

Written explanations on the application of legislation on taxes and fees;

Use tax benefits if there are grounds and in the manner prescribed by the legislation on taxes and fees;

Receive a deferment, installment plan, tax credit or investment tax credit in the prescribed manner;

For the timely offset or refund of amounts of overpaid or overcharged taxes;

Require officials of tax authorities to comply with the legislation on taxes and fees;

Do not comply with illegal acts and requirements of tax authorities and their officials that do not comply with tax legislation;

Appeal in accordance with the established procedure against decisions of tax authorities and actions (inaction) of their officials;

Require tax secrecy;

Demand, in accordance with the established procedure, compensation in full for losses caused by illegal decisions of tax authorities or illegal actions (inaction) of their officials.

In accordance with the Civil Code of the Russian Federation, civil rights and obligations of entrepreneurs arise in the event of:

Conclusion of contracts and other transactions provided for by law, as well as when concluding contracts and other transactions, although not provided for by law, but not contrary to it;

Signing acts by state bodies and local governments, which are provided by law as the emergence of civil rights and obligations;

Judgment establishing civil rights and obligations;

Acquisition of property on grounds permitted by law;

Creation of works of science, literature, art, inventions and other results of intellectual activity;

Causing harm to another person;

Unjust enrichment;

Other actions of citizens and legal entities;

Events with which the law or other legal act connects the onset of civil law consequences.

The implementation of entrepreneurial activity is the realization of the most important right of its participants - the right of ownership to own property, which allows the owners-owners to determine the content and directions of use of their property, including the right to sell. The right of ownership involves the possession, use and disposal of one's own property.

Individuals as individual entrepreneurs, along with the above rights, have the following rights:

To be participants in general partnerships and general partners in limited partnerships;

Be executive bodies (sole) joint-stock company(according to the concluded agreement with JSC);

To be an arbitration manager (internal, external, competitive) in accordance with the established procedure;

Act on the organized securities market as a broker;

Engage in audit activities.

An individual is a citizen who is engaged in entrepreneurial activities without forming a legal entity from the moment of state registration as an individual entrepreneur.

In accordance with Art. 80 of the Constitution of the Russian Federation, a citizen of the Russian Federation can independently exercise his rights and obligations in full only from the age of 18. Consequently, from a legal point of view, legal capacity to engage in entrepreneurial activity is acquired by individuals who have reached 18 years of age by the time of state registration of their business.

Thus, an individual who has reached the age of 18 has the right to engage in entrepreneurial activities in the manner prescribed by law alone, without accepting the status of a legal entity, or to create legal entities. But for the lesson certain types entrepreneurial activity, a citizen must have a secondary or higher education and certain professional skills, ie. experience gained over a period of time. For class certain types activity, a citizen must have a document confirming the required level of physical health.

In accordance with civil law, certain categories of capable citizens do not have the right to engage in entrepreneurial activities. These include: officials of state authorities and state administration, military personnel, employees of power ministries and services, employees of tax authorities and other categories of citizens.

In accordance with Art. 9 of Federal Law No. 9481 “On Competition and Restriction of Monopolistic Activities in Commodity Markets”, officials of public authorities and state administration are prohibited from:

Engage in self-employment activities;

Own an enterprise;

To vote independently or through a representative by means of their shares, deposits, shares, shares when making decisions by the general meeting of an economic entity;

To hold positions in the management bodies of an economic entity.

In accordance with the Civil Code of the Russian Federation, legal capacity may be limited for citizens registered in connection with the use of drugs and alcohol.

Thus, capable persons may engage in individual entrepreneurial activities in accordance with the procedure established by law, without creating a legal entity, and also for this purpose establish legal entities independently or with other citizens and legal entities.

In order to engage in entrepreneurial activity without forming a legal entity, a citizen must, in accordance with the established procedure, undergo state registration and obtain a certificate of an individual entrepreneur.

The certificate of state registration of an entrepreneur is the main document confirming his rights and obligations, presented at the request of officials of tax and other authorized bodies executive power. State registration data are included in the unified State Register individual entrepreneurs (EGRIP).

A legal entity is an enterprise (organization, institution) that acts as a single independent bearer of civil rights that correspond to the objectives of the activity provided for in the constituent documents, and bears the obligations associated with this activity.

In accordance with Art. 48 of the Civil Code of the Russian Federation, a legal entity is an organization that:

Has separate property in ownership, economic management or operational management and is liable for its obligations with this property;

May acquire and exercise property and personal non-property rights on its own behalf;

Has responsibilities;

Acts as a plaintiff and defendant in court;

Has an independent balance or estimate.

Legal entities in respect of which their founders do not have property rights include public and religious organizations, charitable and other foundations, associations of legal entities (associations and unions).

A legal entity is subject to state registration in the manner prescribed by law. State registration data are included in the Unified State Register of Legal Entities (EGRLE), open to the public.

A legal entity has legal capacity that arises at the time of its creation and terminates at the time of making an entry on its exclusion from the unified state register of legal entities.

A legal entity may engage in certain types of activities, the list of which is determined by law, only on the basis of a special permit (license). The right of a legal entity to carry out activities for which it is necessary to obtain a license arises from the moment such a license is obtained or within the period specified in it and terminates upon its expiration, unless otherwise provided by law or other legal acts (Article 49 of the Civil Code of the Russian Federation).

A legal entity must have a name containing an indication of the nature of its activities and its organizational and legal form. Depending on the organizational and legal form, legal entities act on the basis of the charter, or the constituent agreement and the charter, or only the constituent agreement.

The location of a legal entity is determined by the place of its state registration, which is carried out at the location of its permanent executive body, and in the absence of such, another body or person acting on behalf of the legal entity. The name and location of a legal entity must be indicated in its founding documents.

In accordance with Art. 50 of the Civil Code of the Russian Federation legal entities are divided into two types: commercial and non-commercial organizations.

A commercial organization is an organization whose main goal is to make a profit from its activities. In accordance with the procedure established by law and constituent documents, a commercial organization distributes net profit among the founders (participants).

Commercial organizations, with the exception of unitary enterprises, may have civil rights and obligations necessary to carry out any type of activity not prohibited by law.

In accordance with the law, all commercial organizations (except for state-owned enterprises) can be considered entrepreneurial. Commercial organizations can be created in the form of economic partnerships and companies, production cooperatives, state and municipal unitary enterprises.

A legal entity that is a commercial organization must have a company name, subject to registration of which receives the exclusive right to use it.

A non-profit is an organization that does not aim to make a profit and, accordingly, does not distribute the profit received among the participants (founders). Non-profit organizations can carry out entrepreneurial activities only insofar as it serves the achievement of the goals for which they were created, and corresponding to these goals.

Legal entities that are non-profit organizations may be created in the form of consumer cooperatives, public or religious organizations (associations), institutions, autonomous non-profit organizations, social, charitable and other funds, associations and unions, as well as in other forms provided by law.

Non-profit organizations are created:

To achieve social, charitable, cultural, educational, scientific and management goals;

Protection of the health of citizens;

Development of physical culture and sports;

Satisfaction of spiritual and other non-material needs of citizens;

Protection of the rights, legitimate interests of citizens and organizations;

Resolution of disputes and conflicts;

Providing legal assistance;

Achievement of public goods, etc.

Legal organizations can create branches and representative offices that are not legal entities. They are endowed with property by the legal entity that created them and act on the basis of the provisions approved by it.

Branch is separate subdivision a legal entity located outside its location and performing all or part of its functions, including the functions of a representative office.

A representative office is a separate subdivision of a legal entity located outside its location, representing the interests of the legal entity and protecting them.

Heads of branches and representative offices are appointed by a legal entity and act on the basis of its power of attorney. Representative offices and branches must be indicated in the constituent documents of the legal entity that created them.

Objects of entrepreneurial activity

The objects of entrepreneurial activity are everything that can be profitable: property, goods (services), money and securities, information and results of intellectual activity, which include works of science, literature, art, databases, industrial designs, production secrets (know- hau), etc.

Money and securities. Money is a specific commodity that is the universal equivalent of the value of other goods or services. By its very nature, money is generic, fungible, and divisible.

A security is a document certifying, in compliance with the established form and mandatory details, property rights, the exercise or transfer of which is possible only upon its presentation (Article 142 of the Civil Code of the Russian Federation). Securities include: a government bond, a bill of exchange, a check, a deposit and savings certificate, a bank savings book to bearer, a bill of lading, a share, etc.

Information. Represents information about persons, objects, facts, events, phenomena and processes, regardless of the form of their presentation. Documented information (document) is information recorded on a material carrier with details that allow it to be identified.

Results of intellectual activity The list of results of intellectual activity and means of individualization equated to them, which are provided with legal protection. In accordance with Art. 1225 of the Civil Code of the Russian Federation list intellectual property includes 16 titles.

Let us consider in more detail the main objects of entrepreneurial activity - goods and services.

A product is a product of activity (including works, services) intended for sale, exchange or other introduction into circulation. According to expert estimates, there are more than a million items on the market.

Goods must have a designation, grade, generic characteristic and trademark:

A designation is a set of identification elements (design, symbol, name, etc.) that ensure product recognition;

A grade is a designation of the quality of a product using a combination of letters or numbers;

A generic attribute is the designation of a product through its genus and type;

A trademark is any word (image, sound, shape or color) or combination thereof used to distinguish goods and services. this seller from other goods and services.

There are many different classifications of goods. Nevertheless, several generalized classification criteria can be distinguished - these are materiality, period of use and target value goods.

So, depending on the materiality, the actual goods and services are distinguished.

Services are actions aimed directly at the consumer and bringing him a useful result and satisfaction.

Services in the world account for 50% of the volume of consumer goods, 15% of durable goods and 35% of non-durable goods.

The salient features of the services are:

Low degree of tangibility. This property makes it difficult to demonstrate the merits of the services offered. It is impossible to evaluate the advantages that the consumer receives before the acquisition;

quality variability. Services depend mainly on the people who provide them, and people are more variable than goods;

Impossibility of storage. If the service is not used at the time of its provision, then it immediately becomes useless;

Simultaneity of production and consumption. Unlike goods that are produced, sold and then consumed, services are most often sold and then simultaneously produced and consumed.

There is a wide variety of service classifications:

2) in relation to property;

4) in relation to intangible assets.

Depending on the period of use, goods of long-term use (furniture, refrigerators, cars, clothes) and short-term use (food, cosmetics, detergents, etc.) are distinguished.

Depending on the purpose of the application, goods are divided into consumer and industrial.

Industrial goods include:

Capital property - goods partially present (through depreciation) in the finished product. These are structures (buildings, assembly lines, main equipment, etc.); auxiliary equipment(tools, lift trucks, forklifts, etc.) and office equipment (computers, fax machines, desks, chairs, etc.). Equipment of this type does not become part of finished product, it simply contributes to the process of production;

Raw materials and materials - raw materials, semi-finished products, basic and auxiliary materials, spare parts, production stocks necessary for the daily functioning of the enterprise;

Business services are intangible products that are purchased by businesses for production and operational processes.

The following groups can be distinguished:

– maintenance and repair services (painting, equipment repair, security, cleaning, etc.);

— business consulting services (management and legal and financial consulting, services advertising agencies, insurance companies, audit services, etc.);

- services related to the rental of goods (services for the rental and rental of equipment and vehicles).

Convenience goods:

Basic goods (bread, milk, household items, etc.);

Goods impulsive buying(ice cream, mineral water, etc.);

Emergency supplies (drugs, plastic bags etc.);

Preselection Products:

Similar products of the same quality but different prices;

Dissimilar products differing in quality and price.

There are two aspects of a product (service):

1) use value;

2) the value of the socially necessary labor embodied in the commodity.

Use value is the usefulness of a commodity, the ability to satisfy specific human needs. When choosing a product as an object of business, consumer properties should be taken into account.

In the economic literature there is no single definition of the concept of "entrepreneur".

The emergence of this concept is associated with the name of the English scientist Richard Cantillon (1680-1734), who believed that an entrepreneur is a person acting under risk.

Your contribution to conceptual apparatus well-known English economists Adam Smith (1723-1790), David Riccardo (1772-1823), Alan Marshal (1842-1924), Friedrich Hayek (1899-1992), French economist Jean Baptiste Say (1767-1832), American economists Joseph Schumpeter (1883-1950), Peter Drucker (1909-2005), Paul Samuelson (1915-2009) and others.

So, A. Smith considered an entrepreneur as an owner who takes economic risks for the sake of realizing his commercial idea and making a profit. D. Riccardo, whose opinion was also supported by the German scientist Karl Marx (1818-1883), saw the entrepreneur as an ordinary capitalist. J.B. Say defined an entrepreneur as a person who organizes other people within a production unit and combines the factors of production.

The modern view of the entrepreneur is presented by the American economist P. Samuelson, according to whom the entrepreneur is a courageous person with original thinking, who achieves the successful implementation of new ideas.

In turn, a number of Russian scientists believe that entrepreneurs are business entities, whose function is precisely the implementation of new combinations and which function as its active element.

Another simple definition: an entrepreneur is the owner of an enterprise, a person engaged in any economic activity that brings him income.

The current stage of economic development requires the entrepreneur not only to carry out "any economic activity”, and move to innovative entrepreneurship. In this regard, the entrepreneur is characterized as a person for whom creativity and innovation are a habit, as a result of which, based on the opportunities he has noticed, he creates and delivers something new and valuable to the consumer.

Russia's transition to market economic conditions in the second half of the 80s. 20th century brought with it freedom of enterprise.

After the release of a number of laws: "On the individual labor activity”, “On Enterprises and Entrepreneurial Activities”, the Decree of the Council of Ministers of the USSR “On Measures for the Creation and Development of Small Enterprises” and others, an entrepreneurial class began to actively form in Russia.

The entrepreneurial class in Russia was formed by:

Ordinary citizens who own funds opened a case under their own responsibility;

Officials of the administrative and economic elite (former party workers) who supervised in Soviet times industrial enterprises and those who had economic experience, who, due to their position, were able to organize an enterprise with minimal risk to themselves;

Former "tsekhoviks" (representatives of the shadow business), who were previously engaged in illegal business and had extensive business experience;

Trade and service workers with commercial experience;

Heads of privatized retailers, services, transport, construction industry;

. "shuttle traders" - entrepreneurs, most of them representing small traders. The bulk of people came into business because of the difficult economic situation that developed in the country in the 1990s. 20th century The activity of such entrepreneurs is associated with constant moving from the place of purchase of goods to the place of their sale and back.

According to experts, two generations of entrepreneurs can be distinguished in Russia - those who started a business at the beginning of perestroika, and a new generation, which in the 1990s. finished school. The first generation retained in many respects psychological and ideological ties with the intelligentsia environment that gave birth to them. The second generation, already from school, figured out quotes, stock prices, exchange rates against the ruble, were aggressive in the market and did not experience intellectual complexes.

In the economic literature, there are quite a lot of types of entrepreneurs, the generalization of which made it possible to group them taking into account the following classification features:

Depending on the purpose of creating a business, all entrepreneurs can be divided into two types:

1) "adventurers" focused only on profit, on personal enrichment;

2) "capitalists" who above all value the cause itself.

Depending on the nature of the activity, two types of entrepreneurs are distinguished:

1) “chess players” are entrepreneurs who build their business gradually, relying on their knowledge and experience. They focus on long-term prospects with moderate risk;

2) "poker players" - entrepreneurs who build their business on the basis of risky situations. Their life expectancy in business is much shorter than that of "chess players".

Depending on the conditions and content of entrepreneurial activity:

Owner or co-owner of the enterprise;

An economic tenant who ensures the process of production of goods or the provision of services on leased means of production;

Entrepreneur-manager (specialist in the field of enterprise management), who in the future may become a co-owner of the business.

Based on motivation:

Entrepreneurs who are positively motivated to develop the economy and their own material well-being;

Craftsmen who organized a business based on the results of their work;

. "involuntarily entrepreneurs" - people who lost their place in their former place of activity and remained without work;

False entrepreneurs are asocial organizations of scammers.

Depending on the features of entering the business:

. "innovator" - entrepreneurs who start their business with an original idea or invention;

. "artisan" - entrepreneurs who start their own business, having studied it from the basics, working in a certain specialty at an enterprise;

. "Cunning" - entrepreneurs who, before starting their own business, receive a higher or secondary specialized education and are hired for a managerial position, for work in a small firm related to his future business;

. "manager" - this type of entrepreneur starts or acquires his own business after receiving the appropriate education and career as a manager in a large enterprise;

. "son or daughter" - a type of entrepreneurs who enter the business, having received a firm by inheritance from their parents.

Depending on the psychological properties:

. "my boyfriend" - an emotionally stable, kind, sympathetic person who easily comes into contact with others, adapts to difficult situations, has a high level of intelligence, is able to think logically, and is motivated to achieve success;

. "Superman" - courageous in social and emotional terms, people who are able to quickly respond to changes in the environment, having an average or below average level of intelligence. They easily and quickly find contact with others, strive for leadership. The lack of intelligence is more than compensated for by calmness, equanimity, self-confidence, the ability to keep the situation under control;

. "lone wolf" - characterized by self-absorption, isolation, closeness, unwillingness to enter into any social contacts. They do not seek to impress others and are not distinguished by sensitivity and insight in everything that concerns interpersonal relationships. These people do not tolerate leadership over themselves and do not seek to lead themselves. They are motivated to achieve success, but want to achieve it on their own;

. "formal leader" - these are people with high level self-control, sharing generally accepted norms and rules, inclined to take responsibility for making decisions, effective in activities that require constancy, perseverance and perseverance. Representatives of this type demand unquestioning fulfillment of their orders, love hardworking people and are not inclined to indulge someone's weaknesses or delve into other people's problems.

Example. The image of an entrepreneur is described in dozens of works of world and Russian literature. The characters of D. London and O. Balzac, T. Dreiser, E. Zola, A. Hayley, A. Chekhov, I. Shmelev and others clearly testify to the strength and originality of the character of an entrepreneur.

In the novel "Lady's Happiness" E. Zola captivatingly, vividly and accurately describes the story of the businessman Octave Mouret, who created a thriving department store in the center of Paris. Thoughtful organization, the latest trading technologies and psychological calculation allow him to attract crowds of customers to his store. The novel describes the competitive struggle of stores and how main character surpasses its competitors by boldly taking commercial risks, showing initiative, invention and ingenuity. Sales promotion and merchandising techniques used by O. Mure to attract customers are relevant in our time.

The protagonist of T. Dreiser's trilogy "The Financier", "Titan", "Stoic" - Frank Cowperwood is not only a successful businessman and the owner of a huge fortune. He has initiative, energy, the ability to take risks, withstand the blows of fate and steadily - against all odds! - move towards the goal - gaining wealth and power. The trilogy describes the path of a businessman, starting from his youth and ending with the death of the hero. Frank Cowperwood began to show a penchant for business from childhood, and he made his first commercial transaction at the age of 14, when, having bought a batch of Castile soap at an auction for $ 32, he then resold it to a grocer for $ 62. “Frank from a young age knew how to make money . He collected subscriptions to a juvenile magazine, worked as a salesman for a new type of ice skate, and once even enticed the local boys to band together and buy a batch of straw hats for the summer at wholesale prices. About how to put together a capital frugality, Frank did not even think. Almost from childhood, he was imbued with the conviction that it is much more pleasant to spend money without counting, and that he will achieve this opportunity one way or another.

The generalized image of an entrepreneur is endowed with:

A special view of things, and the main role is played not so much by the intellect as by the will and the ability to single out certain moments of reality and see them in a real light;

The ability to go it alone, without being afraid of the associated uncertainties and possible resistance;

Its impact on other people, which is defined by the concepts of "have everything", "have authority", "be able to force to obey."

The Russian historian P.V. Bezobrazov (1859-1918) defined the traits that entrepreneurs of the past should have possessed - this is a sense of proportion, practical calculation, self-control, sobriety of character, willpower.

Modern Russian entrepreneurs should have the following positive personal qualities: professionalism, initiative, energy, creativity, responsibility, communication skills, willingness to take risks, dynamism and mobility, good organizational skills, business acumen, the ability to make decisions correctly, a penchant for leadership, etc.

But representatives of small business formulated a portrait of a modern entrepreneur as "a competent person with a clear head, business acumen, capable of self-irony and with endless vitality."

According to researchers, among the personal qualities an entrepreneur first of all needs:

The intuition and flair required to discover new non-standard paths;

Energy and will to abandon the established order, to overcome the strong inertia of economic and social processes.

Experts also note the negative aspects of the character of entrepreneurs. So, for example, entrepreneurs are promiscuous in the means to achieve the goal, they are partly characterized by a tendency to cheat, and making money by any means is unacceptable. Quite a lot of resolute, energetic organizers who know how to work are employed in business, but not all of them are professionals. In his activities, an entrepreneur must be guided, first of all, by the norms of the law, universal norms of morality, and religious principles.

According to the psychologist S. M. Belozerov, who studied individual characteristics entrepreneurs, their activities are realized by 30%, carried out at the level of guesswork by 70%. Most entrepreneurs are just a "support group", ie. they are just playing business.

According to most researchers, the image of a modern Russian entrepreneur is, as a rule, a man (about 75% of them), the average age is 33-46 years old, he has a family and one or two children. More than 80% of entrepreneurs have higher education.

Of all the above qualities of an entrepreneur, the most priority ones can be distinguished. As practice shows, they influence the fate of a person, guiding him life path into business. This is a desire to take risks, readiness for any changes in the market, a penchant for innovation.

Entrepreneurial activity without forming a legal entity

Entrepreneurial activity without formation of a legal entity is carried out by individual entrepreneurs.

In accordance with the Civil Code of the Russian Federation, any citizen can carry out entrepreneurial activities without forming a legal entity by registering as an individual entrepreneur, or create legal entities independently or jointly with other citizens and legal entities.

According to the English professor A. Hosking, an individual entrepreneur is a person who conducts business at his own expense, personally manages the business and is personally responsible for providing the necessary funds, independently makes decisions. His remuneration is the profit made as a result of entrepreneurial activity and the feeling of satisfaction that he experiences from engaging in free enterprise. But along with this, he must assume the entire risk of losses in the event of bankruptcy of his enterprise.

According to Russian legislation, individual entrepreneurs can be:

Citizens (individuals) of the Russian Federation who are not limited in their legal capacity in accordance with the procedure established by federal law:

- adult, capable citizens of the Russian Federation;

- minor citizens of the Russian Federation (with the consent of parents, guardians; married; when a court or guardianship authority decides on legal capacity);

Citizens (individuals) of foreign states and stateless persons in accordance with the requirements established by law.

Collective forms of activity of individual entrepreneurs are:

General partnership and limited partnership created by concluding an agreement on joint activities between registered individual entrepreneurs;

Production cooperative.

An individual entrepreneur carries out entrepreneurial activities on his own behalf and at his own risk.

It should be noted that the activities of an individual entrepreneur are regulated by the same provisions of the Civil Code of the Russian Federation and the Tax Code of the Russian Federation that apply to legal entities.

Thus, the activities of an individual entrepreneur are equated to the activities of legal entities that are commercial organizations.

Individual entrepreneurs carry out various types of activities not prohibited by law. However, individual entrepreneurs can engage in certain types of activities, the list of which is determined by law, only on the basis of a special permit (license). In addition, there are activities that require additional permission and approval from the supervisory authorities (sanitary and epidemiological service, Ministry of Emergency Situations, etc.). For example, retail trade in Moscow requires permission from the district council.

Activities prohibited for an individual entrepreneur include the production of alcohol, wholesale and retail alcohol; production of weapons and essential parts of firearms; production medicines and etc.

According to Rosstat, there were actually 2,653.3 thousand individual entrepreneurs in the Russian Federation.