I have been working at the institute since the times of the USSR of developed socialism. As long as there was an adequate CEO at the helm, everything was fine. But then the leadership changed and it started ... The situation became sad to the limit: people are being kicked out, there are no new orders, colleagues are very skeptical, young people are leaving, graduate school has ceased to exist. Throughout history, the institute has been led by at least PhDs. Of course, it is difficult to call Filatov and Glukhikh major scientists, however, they were quite respected people in the Minsredmash, and then in the Civil Code. The current director has problems even with spoken English (!) I suspect that they will write a candidate's and then a doctor's thesis, but who will feel better about this? For many years the institute was stable, people were not laid off, there was a prospect for ITER and other topics, there was a Director who was considered at all levels, one scandal with the BUI from which he emerged victorious is worth something. I'm afraid to introduce a new director in this situation. I will sing a couple of praises to the new administrators of the departmental institute: 1. The guys keep to themselves (maybe this is right), they do not differ in adequacy, with the exception of Kostyukova, I only heard about her positive reviews. 2. Kadrovichka, according to my immediate supervisor, is an inadequate woman, rots everyone in a row, including her subordinates. Her services have the biggest turnover in the institute and this person is appointed to close personnel issues and manage ENGAGEMENT (!) 3. Chief Engineer, came along with the general director, participated in the same meeting with him, the man seemed to me competent and pragmatic, but WHERE IS HE NOW? I don't know. 4. CEO. On the first day of informing, he showed a bunch of graphs, including a graph with revenue and cf. salary, it turned out that for today, both schedules are not being fulfilled. He likes to sing songs about his native Sarov (about how everything is cool and good there) and resembles a big child. 5. They began to destroy the pilot plant, for some reason they rotted and fired Sapozhnikov, the man is a strong production worker, efficient and reasonable. And now the questions: What has the new management done since 2016!?? Where is at least some result of changes in a positive way? Where is the success? Where are the new orders? Oh yes, there is one - the cyclotron complex (with the current composition of the STC responsible for this contract, there are big doubts about the success this project, because The work is very complicated, with a lot of difficult calculations, and the last cyclotron was manufactured and installed by the STC about 10 years ago). It is worth noting that the contract with the Thais is the merit of the director of the center, and not the kids who were taught at the corporate academy. Conclusions: - works are inundated in almost all areas, where they have not yet been inundated - the prospect is clear; - all visible persons are gone; - the new administration on all days of informing only feeds with promises; - Today there is no science left at the institute, the closure of the postgraduate course was the last straw. - many employees of the STC believe that the new administration intends to bring the institute into bankruptcy. Sincerely, Alexander.

Name of organization JOINT STOCK COMPANY "NIIEFA IM. D.V. EFREMOVA" TIN 7817331468 Type code economic activity By OKVED classifier 73.1 - Advertising activity Code according to OKPO 08626377 Form of ownership (according to OKFS) 41 - Mixed Russian property with a share of federal property Legal form (according to OKOPF) 12267 - Non-public joint-stock companies Report type 2 - Full Unit of measurement 384 - Thousand rubles Composition of reporting

Reporting for other yearsZero lines are hidden for ease of reporting.

Balance sheet

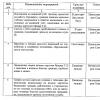

| Name of indicator | Line code | As of December 31, 2015 | As at 31 December 2014 |

| Assets | |||

| I. Outside current assets | |||

| Intangible assets | 1110 | 4 717 | 5 295 |

| fixed assets | 1150 | 2 219 666 | 2 178 976 |

| Deferred tax assets | 1180 | 44 714 | 50 795 |

| Other noncurrent assets | 1190 | 38 161 | 32 402 |

| Total for Section I | 1100 | 2 307 258 | 2 267 468 |

| II. current assets | |||

| Stocks | 1210 | 428 573 | 411 712 |

| Value added tax on acquired valuables | 1220 | 25 494 | 22 603 |

| Accounts receivable | 1230 | 331 069 | 283 250 |

| Cash and cash equivalents | 1250 | 925 067 | 1 068 311 |

| Other current assets | 1260 | 19 366 | 12 409 |

| Total for Section II | 1200 | 1 729 569 | 1 798 285 |

| BALANCE | 1600 | 4 036 827 | 4 065 753 |

| Passive | |||

| III. Capital and reserves | |||

| Authorized capital(share capital, authorized capital, contributions of comrades) | 1310 | 2 659 262 | 2 673 595 |

| Additional capital (without revaluation) | 1350 | 94 433 | 19 100 |

| Reserve capital | 1360 | 157 | 0 |

| 1370 | 218 780 | 220 224 | |

| Total for Section III | 1300 | 2 972 632 | 2 912 919 |

| IV. LONG TERM DUTIES | |||

| Other liabilities | 1450 | 39 805 | 41 883 |

| Total for Section IV | 1400 | 39 805 | 41 883 |

| V. SHORT-TERM LIABILITIES | |||

| Accounts payable | 1520 | 738 173 | 838 432 |

| revenue of the future periods | 1530 | 19 575 | 22 380 |

| Estimated liabilities | 1540 | 266 642 | 250 139 |

| Section V total | 1500 | 1 024 390 | 1 110 951 |

| BALANCE | 1700 | 4 036 827 | 4 065 753 |

Income statement

| Name of indicator | Line code | For 2015 | For 2014 |

| Revenue Revenue is shown net of value added tax and excises. |

2110 | 2 362 803 | 3 551 157 |

| Cost of sales | 2120 | (1 851 941) | (2 878 244) |

| Gross profit (loss) | 2100 | 510 862 | 672 913 |

| Selling expenses | 2210 | (655) | (970) |

| Management expenses | 2220 | (439 498) | (555 514) |

| Profit (loss) from sales | 2200 | 70 709 | 116 429 |

| Interest receivable | 2320 | 12 558 | 12 298 |

| Percentage to be paid | 2330 | (0) | (3 727) |

| Other income | 2340 | 145 411 | 48 158 |

| other expenses | 2350 | (217 465) | (152 865) |

| Profit (loss) before tax | 2300 | 11 213 | 20 293 |

| Current income tax | 2410 | (3 443) | (0) |

| including permanent tax liabilities (assets) | 2421 | 7 094 | -13 289 |

| Change in deferred tax liabilities | 2430 | 628 | -61 528 |

| Change in deferred tax assets | 2450 | -5 265 | -78 876 |

| Other | 2460 | 188 | -188 |

| Net income (loss) | 2400 | 1 689 | 3 133 |

| Cumulative financial result of the period | 2500 | 0 | 0 |

Statement of changes in equity

| 1. Movement of capital | |||||

| Authorized capital | Own shares repurchased from shareholders | Extra capital | Reserve capital | Retained earnings (uncovered loss) | Total |

| Equity as at 31 December 2014 (3200) | |||||

| 2 673 595 | (0) | 19 100 | 0 | 220 224 | 2 912 919 |

| (2015) | |||||

| Capital increase - total: (3310) | |||||

| 211 667 | 0 | 75 333 | 0 | 1 689 | 288 689 |

| including: net profit (3311) |

1 689 | 1 689 | |||

| property revaluation (3312) | 0 | 0 | 0 | ||

| income attributable directly to capital increases (3313) | 0 | 0 | 0 | ||

| additional issue of shares (3314) | |||||

| 150 667 | 0 | 75 333 | 226 000 | ||

| increase face value shares (3315) | |||||

| 0 | 0 | 0 | 0 | ||

| reorganization legal entity (3316) | |||||

| 0 | 0 | 0 | 0 | 0 | 0 |

| Decrease in capital - total: (3320) | |||||

| (226 000) | 0 | (0) | (0) | (2 976) | (228 976) |

| including: loss (3321) |

(0) | (0) | |||

| property revaluation (3322) | (0) | (0) | (0) | ||

| expenses relating directly to depreciation of equity (3323) | (0) | (0) | (0) | ||

| decrease in the par value of shares (3324) | |||||

| (0) | 0 | 0 | 0 | (0) | |

| decrease in the number of shares (3325) | |||||

| (0) | 0 | 0 | 0 | (0) | |

| reorganization of a legal entity (3326) | |||||

| 0 | 0 | 0 | 0 | 0 | (0) |

| dividends (3327) | (2 976) | (2 976) | |||

| Changes in additional capital (3330) | 0 | 0 | 0 | ||

| Changes in reserve capital (3340) | 157 | -157 | |||

| Equity as at 31 December 2015 (3300) | |||||

| 2 659 262 | (0) | 94 433 | 157 | 218 780 | 2 972 632 |

Cash flow statement

| Name of indicator | Line code | For 2015 |

| Cash flows from current operations | ||

| Income - total including: |

4110 | 2 492 066 |

| from the sale of products, goods, works and services | 4111 | 2 431 316 |

| lease payments, license payments, royalties, commissions and other similar payments | 4112 | 1 102 |

| from the resale of financial investments | 4113 | 0 |

| other supply | 4119 | 59 647 |

| Payments - total including: |

4120 | (2 629 582) |

| to suppliers (contractors) for raw materials, materials, works, services | 4121 | (1 235 630) |

| in connection with the remuneration of employees | 4122 | (1 208 387) |

| interest on debt obligations | 4123 | (0) |

| corporate income tax | 4124 | (0) |

| other payments | 4129 | (185 565) |

| Balance cash flows from current operations | 4100 | -137 516 |

| Cash flows from investment operations | ||

| Income - total including: |

4210 | 0 |

| from the sale of non-current assets (except for financial investments) | 4211 | 0 |

| from the sale of shares of other organizations (participatory interests) | 4212 | 0 |

| from the return of loans granted, from the sale of debt valuable papers(claim rights Money to others) | 4213 | 0 |

| dividends, interest on debt financial investments and similar income from equity participation in other organizations | 4214 | 0 |

| other supply | 4219 | 0 |

| Payments - total including: |

4220 | (77 232) |

| in connection with the acquisition, creation, modernization, reconstruction and preparation for the use of non-current assets | 4221 | (77 232) |

| in connection with the acquisition of shares of other organizations (participation interests) | 4222 | (0) |

| in connection with the acquisition of debt securities (the rights to claim funds from other persons), the provision of loans to other persons | 4223 | (0) |

| interest on debt obligations included in the cost of an investment asset | 4224 | (0) |

| other payments | 4229 | (0) |

| Balance of cash flows from investment operations | 4200 | -77 232 |

| Cash flows from financial transactions | ||

| Income - total including: |

4310 | 61 000 | obtaining credits and loans | 4311 | 0 |

| cash deposits of owners (participants) | 4312 | 0 |

| from issuance of shares, increase in participation | 4313 | 61 000 | from the issuance of bonds, bills of exchange and other debt securities, etc. | 4314 | 0 |

| other supply | 4319 | 0 |

| Payments - total including: |

4320 | (2 977) |

| owners (participants) in connection with the redemption of shares (participatory interests) of the organization from them or their withdrawal from the membership | 4321 | (0) |

| for the payment of dividends and other payments for the distribution of profits in favor of the owners (participants) | 4322 | (2 977) |

| in connection with the redemption (redemption) of promissory notes and other debt securities, repayment of credits and loans | 4323 | (0) |

| other payments | 4329 | (0) |

| Balance of cash flows from financial operations | 4300 | 58 023 |

| Balance of cash flows for the reporting period | 4400 | -156 725 |

| Balance of cash and cash equivalents at the beginning of the reporting period | 4450 | 0 |

| Balance of cash and cash equivalents at the end of the reporting period | 4500 | 0 |

| The magnitude of the impact of exchange rate changes foreign exchange in relation to the ruble | 4490 | 13 481 |

The information is generated from a set of open data "Accounting (financial) statements of enterprises and organizations for 2015" Federal Service state statistics (Rosstat)