Conducting activities without monitoring its results, the efficiency of the enterprise is simply unthinkable. Periodically, it is necessary to analyze the data obtained, to identify the profitability of operations and all activities in general, on the basis of this, to draw up reports with conclusions about the prospects for the further functioning of the enterprise.

To assess all activities identified main indicator- , but we will consider it in a narrow specificity, namely, product analysis. Thanks to this calculation, competent compilation is possible, with the help of which it is possible to identify how much profit is attributed per unit of products sold.

The essence and composition of the concept

Profitability is part of the structure economic efficiency, which shows the profitability of the work performed. It helps to calculate how profitable the organization is using its assets.

Exactly profitability of production any product and characterizes the profitability of products. It is the relationship between profit from sales and the cost of producing the product sold.

Exactly profitability of production any product and characterizes the profitability of products. It is the relationship between profit from sales and the cost of producing the product sold.

profitability base production is the efficiency of product sales. And regardless of the type of activity of the company, the ratio of profits and costs does not change. It is the formula that will help calculate the operating activities of the company.

Myself indicator consists from profitability:

- all goods sold;

- sales by PE (net profit);

- generalized data.

Formula and data calculation

This indicator has the abbreviation "ROM" and is calculated as follows:

ROM= (Profit from sales)/(production costs)*100%

As we can see from the formula, we get the result as a percentage. He characterizes Not current situation at the enterprise, and taking into account strategic plans. The numerator and denominator are made up of data for a certain period, they are selected for a couple of months or years, i.e. the analysis is carried out in dynamics.

When calculating, do not overlook three key points:

- price dictatorship;

- increase in the cost of production;

- heterogeneity of produced goods.

Rising prices, even with rising costs, can be controlled, but provided that you are engaged in monopoly activity, or your competitors have low activity, without posing a threat to your demand

If you have not yet registered an organization, then the easiest do it with online services, which will help you generate all the necessary documents for free: If you already have an organization, and you are thinking about how to facilitate and automate accounting and reporting, then the following online services come to the rescue, which will completely replace an accountant in your enterprise and save a lot money and time. All reporting is generated automatically, signed electronic signature and sent automatically online. It is ideal for an individual entrepreneur or LLC on the simplified tax system, UTII, PSN, TS, OSNO.

Everything happens in a few clicks, without queues and stress. Try it and you will be surprised how easy it got!

Calculation options

Using revenue, sales and total costs for production:

ROM = (Profit from sales)/(Full cost) *100%;

Using revenue and cost, consisting of the cost of raw materials and materials, workers, maintenance, depreciation (technological):

ROM = (Profit from sales) / (Technological cost) * 100%;

Using net profit and total cost:

ROM = PV / (Full cost) * 100%;

Using net profit and production cost manufactured product:

ROM = PV / (Manufacturing cost) * 100%;

Let's look at examples

Example 1 The total revenue from the sale of shampoo for the past month is 6 million rubles. The cost of manufactured products is 3.2 million rubles. Determine the profitability of products.

Initially, we will define total profit received last month.

PR \u003d 6 - 3.2 \u003d 2.8 million rubles.

Thus,

ROM = (2,800,000)/(3,200,000)*100%=87.5%

It turns out that profit from each ruble of sold products is equal to 87.5 kopecks. For a product, this is a fairly high performance. After analyzing all this, it is possible to assess the competition of this company in the market. If the indicator starts to decline, then this indicates a drop in demand for the product, or incomplete production efficiency is affected.

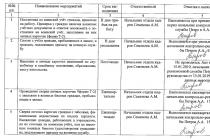

Example 2 The situation is more complicated, the enterprise produces several types of goods .

The conditions are:

Find the profitability for each type, and give feedback on each type of product.

First, let's determine the profitability of the product:

First, let's determine the profitability of the product:

- (46-37)/37*100 = 24,3%;

- (40-32)/32*100 = 25%;

- (31-33)/33*100 = -6,06%.

The first thing that catches your eye is the absolute unprofitability of the 3rd product, it even has a negative profit. Its release must be stopped, because it brings a loss of 1.89 kopecks for every ruble.

Product 1 brings more profit than the second, but it is less profitable. The second product is more profitable (by 0.7%), therefore, it is necessary to concentrate on its release.

Nuances in the calculation of balance sheet items

The formula calculation always has a high percentage of confidence and evaluates the effectiveness of products taking into account many factors, but sometimes the data is affected by fluctuations in tax system, but this is an extreme case.

It is also possible to calculate according to the balance, with certain features.

ROM=((line 050)/(p.20+p.30+p.40)-1)*100%

We got profitability in percent for certain period. But the formula itself may vary, depending on the number of types of manufactured products.

We got profitability in percent for certain period. But the formula itself may vary, depending on the number of types of manufactured products.

Analysis and conclusions based on the results obtained

We have already answered why the indicator is calculated: for a qualitative assessment of the result of the functioning of the enterprise. The head of the company can determine for himself how much profit he receives if he invests one ruble of his funds. If we calculate according to the technological cost, then we reveal the effectiveness of the costs of production of goods.

Result by production cost is always higher than in full, so both indicators must be calculated and taken into account. Undoubtedly, the greater the profitability, the more profitable the products are produced, and this also leads to effective competitiveness.

In order to maintain and improve profitability, follows:

In order to maintain and improve profitability, follows:

- Reduce costs, but not at the expense of quality. Try new techniques and methods of production;

- Increase sales, use new directions in marketing and advertising, open or find new sales markets, increase the species assortment.

Like any activity, increasing the performance requires some costs, but later they will pay for themselves, if properly applied.

For information on what profitability is, what types of it exist and the features of the product profitability indicator, see the following video material:

Product profitability is included in the system of profitability indicators. What is the essence of this indicator, how to calculate it and what it can tell the tax authorities, read in this article.

Why consider profitability?

Each owner of an enterprise, its potential or real investor is interested in obtaining information about how efficiently it functions. Financial analysis helps us evaluate business performance. With it, you can get an idea of the current activities of the company, or you can make a forecast. Also, financial analysis is used before the start, for example, to develop business plans or development strategies. In this context, cost-benefit analysis plays an important role.

Profitability is a relative indicator of profitability. This is not a single indicator, but whole system, a set of indicators. The main ones are the profitability of sales, assets, equity, as well as the profitability of products. We will talk about the latter in this article.

Read about return on equity in the article "We determine the return on equity (formula)" .

Profitability of products - what is it?

Product profitability is the ratio of profit to cost, that is, to the costs of production and sale of products. She supplies stakeholders information about how much profit each ruble spent on production gives, that is, it shows the return on the costs incurred.

How to calculate the profitability of products

Calculate both the profitability of products as a whole for the company, and the profitability certain types products.

The general formula for its calculation looks like this:

Rpr \u003d Pr / Ss × 100,

Rpr - product profitability;

Pr - profit;

SS - cost.

However, taking into account the objectives of the analysis, the profitability of products can be considered:

- by net profit or by profit from sales;

- the full cost of production or only the production cost.

Depending on this, the final calculation formula will also differ.

The formula for the profitability of products according to the balance

To calculate the profitability of products, form 1 of the balance sheet is not required. All the information necessary for the calculation is in the report on financial results(form 2).

For more information about the balance sheet, see the article "Filling out form 1 of the balance sheet (sample)" , and about form 2 - "Filling out form 2 of the balance sheet (sample)" .

Here are the possible calculation formulas.

- The product profitability formula for net profit and full cost is as follows:

Rpr \u003d Line 2400 of form 2 / Sum of lines 2120, 2210 and 2220 of form 2 × 100.

- The profitability of products in terms of net profit and production cost is calculated by the formula:

Rpr \u003d Line 2400 form 2 / Line 2120 form 2 × 100.

- For the profitability of products in terms of profit from sales and total cost, the following formula is used:

Rpr \u003d Line 2200 of form 2 / Sum of lines 2120, 2210 and 2220 of form 2 × 100.

- And for the profitability of products in terms of profit from sales and production cost - the formula:

Rpr \u003d Line 2200 of form 2 / Line 2120 of form 2 × 100.

Return on sales, calculated as the ratio of profit from sales and total cost (see calculation formula No. 3 in this section), on average in the country in 2016, is at the level of 8%. However, it varies greatly across industries. Therefore, you should compare your profitability with the industry average.

Low profitability of products - a beacon for tax authorities

In conclusion, we note that the profitability of products is one of the criteria for assessing the risk of falling into the plan of tax audits, provided for by order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06 / [email protected] The deviation of profitability from the industry average by 10 percent or more is considered critical. This is a kind of signal to the tax authorities to put the organization under control. Industry-average values of product profitability since 2006 are given in Appendix 4 to the order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06 / [email protected] We recommend checking your profitability against these values. View the industry average profitability (download Appendix 4 to the order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06 / [email protected]) can be found on the website of the tax service.

Results

Calculation of the profitability of products is necessary both for assessing the efficiency of production, and for planning interaction with the tax authorities. If the organization's profitability indicators are less than the industry average by 10 percent or more, this means that it falls into the risk zone and can be included in the plan of field tax audits.

Hello! Today we will talk about profitability, what it is and how to calculate it. aimed at making a profit. To assess the correctness of the work and the effectiveness of the applied management methods, you can use some parameters. One of the most optimal and informative is the profitability of the enterprise. For any entrepreneur, understanding this economic indicator is an opportunity to assess the correctness of the expenditure of resources at the enterprise and adjust further actions in all directions.

Why Calculate Profitability

In many cases, the financial profitability of an enterprise becomes key indicator analysis of the activities of a business project, which helps to understand how well the funds invested in it pay off. Correctly calculated indicators for several factors and articles are used by the entrepreneur for, when pricing services or goods, for general analysis at the working stage. They are calculated as a percentage or used in the form of a numerical coefficient: the larger the number, the higher the profitability of the enterprise.

In addition, it is necessary to calculate the profitability ratios of an enterprise in the following production situations:

- For forecast possible profit, which the company will be able to receive in the next period;

- For comparative analysis with competitors in the market;

- To justify large investment investments helping the potential participant in the transaction to determine the projected return on the future project;

- When determining the real market value of the company during pre-sale preparation.

The calculation of indicators is often used when lending, obtaining loans or participating in joint projects, developing new types of products.

Profitability of the enterprise

Discarding scientific terminology, we can designate the concept:

Profitability of the enterprise as one of the main economic indicators, which well characterizes the profitability of the entrepreneur's work. Its calculation will help to understand how profitable the chosen project or direction is.

In the process of production or sales, many resources are used:

- Labor ( wage-earners, personnel);

- Economic;

- Financial;

- Natural.

Their rational and proper operation should bring profit and a steady income. For many enterprises, the analysis of profitability indicators can become an assessment of the effectiveness of work for a certain (control) period of time.

In simple words, the profitability of a business is the ratio between the costs of the production process and the resulting profit. If after a period (quarter or year) a business project has made a profit, then it is called profitable and beneficial for the owner.

To carry out correct calculations and predict indicators in future activities, it is necessary to know and understand the factors that affect profitability to varying degrees. Experts divide them into exogenous and endogenous.

Among the exogenous are:

- Tax policy in the state;

- General sales market conditions;

- Geographic location of the enterprise;

- The level of competition in the market;

- Features of the political situation in the country.

In many situations, the profitability and profitability of an enterprise is affected by its geographical position, proximity to sources of raw materials or customer-consumers. The situation in the stock market and fluctuations in exchange rates have a huge impact.

Endogenous or internal factors of production that have a strong impact on profitability:

- Good working conditions for personnel of any level (which necessarily affects the quality of products positively);

- Efficiency of logistics and marketing policy of the company;

- General financial and managerial policy of management.

Taking into account such subtleties helps an experienced economist to make the level of profitability as true and realistic as possible.

Factor analysis of enterprise profitability

To determine the degree of influence of any factors on the level of profitability of the entire project, economists conduct a special factor analysis. It helps to determine the exact amount of income received under the influence of internal factors, and is expressed in simple formulas:

Profitability \u003d (Profit from sales of products / Cost of production) * 100%

Profitability = ((Product price - Production cost) / Production cost)) * 100%

Usually, when doing this financial analysis use his three-factor or five-factor model. Quantity refers to the number of factors used in the counting process:

- For a three-factor one, the profitability of manufactured products, the indicator of capital intensity and the turnover of fixed assets are taken;

- For the five-factor, it is necessary to take into account the labor intensity and material consumption, depreciation, turnover of all types of capital.

The factor calculation is based on the division of all formulas and indicators into quantitative and qualitative ones, which help to study the development of the company from different angles. It shows a certain relationship: the higher the profit and return on assets from the production assets of the enterprise, the higher its profitability. It shows the manager the relationship between the standards and the results of economic activity.

Types of profitability

In various production areas or types of business, specific indicators of the profitability of the enterprise are used. Economists distinguish three significant groups that are used almost everywhere:

- Profitability of products or services: the ratio of the net profit received from the project (or direction in production) and the costs spent on it is taken as a basis. It can be calculated both for the whole enterprise and for one specific product;

- Profitability of the entire enterprise: this group includes many indicators that help characterize the entire enterprise as a whole. It is used to analyze a working project by potential investors or owners;

- Return on assets: a fairly large group of various indicators that show the entrepreneur the appropriateness and completeness of the use of a particular resource. They allow you to determine the rationality of using loans, your own financial investments or other important assets.

An analysis of the profitability of an enterprise should be carried out not only for internal needs: this is an important stage before large investment projects. It may be required when granting a loan, or it may become the starting point for the consolidation or reduction of production.

A real complete picture of the state of affairs at the enterprise can be obtained by calculating and analyzing several indicators. This will allow you to see the situation from different angles, to understand the reason for the decrease (or increase) in expenses for any items. This may require several coefficients, each of which will reflect a specific resource:

- ROA - return on assets;

- ROM - the level of profitability of products;

- ROS - return on sales;

- ROFA - profitability of fixed assets;

- ROL - personnel profitability;

- ROIC - return on investment in the enterprise;

- ROE - return on equity.

These are just a few of the most common odds. To calculate them, there are enough numbers from open sources - the balance sheet and its appendices, current sales reports. If an estimated profitability estimate for a business is needed for a start-up, the data is taken from marketing analysis market for similar products or services available in general overview competitor reports.

Calculation of the profitability of the enterprise

The largest and most generalized indicator is the level of profitability of the enterprise. For its calculation, only accounting and statistical documentation for a certain period is used. In a more simplified version, the formula for the profitability of an enterprise looks like this:

P=BP/SA*100%

- P is the main profitability of the enterprise;

- BP is an indicator of balance sheet profit. It is equal to the difference between the revenue received and the cost (including organizational and management costs), but before taxes;

- SA - the total cost of all current and non-current assets, production capacity and resources. It is taken from the balance sheet and appendices to it.

For the calculation it will be necessary average annual cost all tangible assets, the depreciation of which is used in the formation of the selling price for services or goods.

If the assessment of the profitability of the enterprise is low, then certain management measures should be taken to improve the situation. It may be necessary to adjust production costs, review management methods or resource efficiency.

How to Calculate Return on Assets

A complete analysis of the profitability of an enterprise is impossible without calculating the efficiency of using various assets. This is the next important stage, which helps to assess how fully all assets are used, to understand their impact on profit. When evaluating this indicator, pay attention to its level. A low level indicates that the capital and other assets are not working enough, and a high level confirms the correct management tactics.

Practically, the return on assets (ROA) means for an economist the amount of money that falls on one unit of assets. In simple words, it shows the financial return of a business project. Calculation for all types of assets must be carried out with regularity. This will help to timely identify an object that does not bring returns or benefits in order to sell it, lease it or modernize it.

In economic sources, the formula for calculating the return on assets looks like this:

- P - profit for the entire analyzed period;

- A - the average value by type of assets for the same time.

This coefficient is one of the three most indicative and informative for the manager. Getting a value less than zero indicates the operation of the enterprise at a loss.

Profitability of fixed assets

When calculating assets, the profitability ratio of fixed assets is separately distinguished. These include various means of labor that are directly or indirectly involved in manufacturing process without changing the original shape. The term of their use must exceed a year, and the amount of depreciation is included in the cost of services or products. These main assets include:

- Any buildings and structures in which workshops, offices, laboratories or warehouses are located;

- Equipment;

- Heavy vehicles and loaders;

- Office and work furniture;

- Cars and passenger transport;

- Expensive tool.

The calculation of the profitability of fixed assets will show managers how effective the economic activity of a business project is and is determined by the formula:

R = (NP / OS) * 100%

- PE - net profit for a certain period;

- OS - the cost of fixed assets.

This economic indicator is very important for commercial manufacturing enterprises. It gives an idea of the share of profit that falls on one ruble of invested fixed assets.

The coefficient directly depends on profitability and should not be less than zero: this means that the company is operating at a loss and is using its fixed assets irrationally.

Profitability of sold products

This indicator is no less important for determining the level of profitability and success of the company. In international economic practice, it is referred to as ROM and is calculated by the formula:

ROM=Net Profit/Cost

The resulting coefficient helps to determine the effectiveness of the sale of manufactured products. In fact, this is the ratio of sales revenue and the cost of its manufacture, packaging and sale. For an economist, the indicator clearly demonstrates how much, in percentage terms, each ruble spent will bring.

More understandable for beginners may be the algorithm for calculating the profitability of products sold:

- The period in which it is necessary to analyze the indicator is determined (from a month to a whole year);

- The total amount of profit from sales is calculated by adding up all income from the sale of services, products or goods;

- Net profit is determined (according to the balance sheet);

- The indicator is calculated according to the above formula.

A good analysis will include a comparison of the profitability of products sold over several periods. This will help determine the decline or increase in the company's income in dynamics. In any case, you can conduct a deeper review of each supplier, product group or range, work out the client base.

Profitability of sales

Margin or return on sales is another essential characteristic when pricing a product or service. It shows how many percent of the total revenue is accounted for by the profit of the enterprise.

There is a formula that helps to calculate this type of indicator:

ROS= (Profit / Revenue) x 100%

As a basis for calculation, can be used different types arrived. The values are specific and vary depending on the product range, the company's line of business and other factors.

Sometimes experts refer to the profitability of sales as the rate of return. This is due to the ability to show the proportion specific gravity profit in total sales revenue. It is also calculated in dynamics in order to track changes over several periods.

IN short term a more interesting picture can be given by the operating margin of sales, which can be easily calculated using the formula:

Operating return on sales = (Profit before tax / Revenue) x 100%

All indicators for calculations in this formula are taken from the Profit and Loss Statement, which is attached to the balance sheet. The new indicator helps the entrepreneur to understand what is the real share of revenue contained in each monetary unit of his revenue after paying all taxes and fees.

Such indicators can be calculated for a small enterprise, one department or an entire industry, depending on the task. The higher the value of this economic coefficient, the better the enterprise works and the more profit its owner receives.

This is one of the most informative indicators that helps determine how profitable a business project is. Without its calculation, it is impossible to draw up a business plan, track costs in dynamics, or evaluate the profitability of the whole enterprise. It can be calculated using the formula:

R=VP/V, Where:

- VP - gross profit (calculated as the difference between the proceeds received from the sale of goods or services and the cost);

- B is the proceeds from the sale.

The formula often uses net profit, which better reflects the state of affairs in the enterprise. The amount can be taken from the application to the balance.

Net profit no longer includes income tax, various commercial and overhead expenses. It includes current operating costs, various penalties and paid loans. To determine it, a calculation is carried out total revenue, which was received from the sale of services or goods (including discounts). All expenses of the enterprise are deducted from it.

It is necessary to carefully choose the time interval depending on the task of financial analysis. To determine the results when internal control calculation of profitability of profit is carried out in dynamics regularly (monthly or quarterly). If the purpose is to obtain an investment or a loan, a longer period is taken for comparison.

Obtaining the profitability ratio gives a lot of information for the management personnel of the enterprise:

- Shows the compliance of real and planned results, helps to evaluate the effectiveness of the business;

- Allows you to conduct a comparative analysis with the results of other competing companies in the market.

If the indicator is low, the entrepreneur needs to think about improving it. This can be achieved by increasing the amount of revenue received. As an option - increase sales, slightly increase prices or optimize costs. You should start with small innovations, observing the dynamics of changes in the coefficient.

Staff profitability

One of the interesting relative indicators is the profitability of personnel. Almost all enterprises, regardless of the form of ownership, have long taken into account the importance effective management labor resources. They affect all areas of production. To do this, it is necessary to monitor the number of personnel, their level of training and skill, and improve the qualifications of individual employees.

You can determine the profitability of personnel by the formula:

- PE - net profit of the enterprise for a certain period of time;

- NS - the number of staff of different levels.

In addition to this formula, experienced economists use more informative ones:

- Calculate the ratio of all staff costs to net profit;

- The personal profitability of one employee, which is determined by dividing the costs associated with him by the share of profit brought to the enterprise budget.

Such a complete and detailed calculation will help determine labor productivity. On its basis, it is possible to carry out a kind of diagnostics of jobs that can be reduced or need to be expanded.

Do not forget that low-quality or old equipment, its downtime or other factors can affect the profitability of personnel. This can reduce performance and give additional costs.

One of the unpleasant, but sometimes necessary methods often leads to a reduction in the number of employees. Economists must calculate the cost-benefit for each type of workforce to highlight the weakest and most vulnerable areas.

For small businesses, regular calculation of this ratio is necessary to adjust and optimize their costs. With a small team, it is easier to carry out calculations, so the result can be more complete and accurate.

Profitability threshold

For many commercial and industrial enterprises, the calculation of the profitability threshold is of great importance. It means the minimum volume of sales (or sales finished products), at which the proceeds received will cover all the costs of production and bringing to the consumer, but without taking into account profits. In fact, the profitability threshold helps the entrepreneur to deduce the number of sales at which the company will operate without loss (but not make a profit).

In many economic sources, this important indicator can be found under the name "breakeven point" or "critical point". It means that the company will receive income only if this threshold is overcome and the coefficient increases. It is necessary to sell goods in a quantity that exceeds the volume obtained by the formula:

- PR - threshold (norm) of profitability;

- PZ - fixed costs for sales and production;

- Kvm - gross margin ratio.

The last indicator is calculated preliminary according to the formula:

Kvm \u003d (V - Zpr) * 100%

- B is the company's revenue;

- Zpr - the sum of all variable costs.

The main factors affecting the profitability threshold ratio:

- The price of the goods for one unit;

- variables and fixed costs at all stages of production and sale of this product (service).

With the slightest fluctuation in the values of these economic factors, the value of the indicator changes up or down. Of particular importance is the analysis of all costs, which economists divide into fixed and variable. The first ones include:

- Depreciation for major facilities and equipment;

- rent;

- All utilities and payments;

- Salaries of employees of the company's management;

- Administrative costs for their maintenance.

They are easier to analyze and control, can be tracked in dynamics. Variable costs become more “unpredictable”:

- Salary of the entire workforce of the enterprise;

- Commissions for servicing accounts, loans or transfers;

- Expenses for the purchase of raw materials and components (especially when exchange rates fluctuate);

- Payment for energy resources spent on production;

- Fare.

If a company wants to remain consistently profitable, its management must control the rate of return, analyze costs in all respects.

Any enterprise seeks to develop and increase capacity, open up new areas of activity. Investment projects also need a detailed analysis, which helps to determine their effectiveness and adjust investments. IN domestic practice More often, several basic calculation methods are used to give an idea of what the profitability of a project is:

- Methodology for calculating the net present value: it helps to determine the net profit from a new project;

- Methodology for calculating the profitability index: necessary to obtain income per unit of costs;

- The method of calculating the marginal efficiency of capital (internal rate of return). It is used to determine the maximum possible level of capital expenditure in new project. The internal rate of return is most often calculated using the formula:

GNR = (net worth current / amount of initial investment current) * 100%

Most often, such calculations are used by economists for certain purposes:

- If necessary, determine the level of costs in the case of project development at the expense of borrowed funds, loans or credits;

- To confirm the profitability and document the benefits of the project.

If there are bank loans, the calculation internal norm profitability will give the maximum allowable interest rate. Its excess in real work will mean that the new enterprise or direction will be unprofitable.

- Methodology for calculating the return on investment;

- A more accurate modified method for calculating the internal rate of return, for the calculation of which the weighted average cost of the advanced capital or investments is taken;

- The accounting rate of return methodology that is used to short term projects. In this case, the profitability will be calculated by the formula:

RP=(PV + depreciation/amount of investment in the project) * 100%

NP - net profit from a new business project.

Full settlement different ways is done not only before the development of a business plan, but also during the operation of the facility. This is a necessary set of formulas that owners and potential investors use when trying to assess the possible benefits.

Ways to increase the profitability of the enterprise

Sometimes analysis yields results that require serious management decisions. To determine how to increase profitability, it is necessary to understand the reasons for its fluctuation. To do this, we study the indicator for the reporting and previous period. Usually taken as the base last year or a quarter in which there was a high and stable revenue. The following is a comparison of the two coefficients in dynamics.

The profitability indicator may be affected by a change in the selling price or cost, an increase in costs or the cost of raw materials from suppliers. Therefore, it is necessary to pay attention to factors such as seasonal fluctuations in the demand of buyers of goods, activity, breakdowns or downtime. Solving the problem of how to increase profitability and, it is necessary to use various methods to increase profits:

- To improve the quality of a product or service, its packaging. This can be achieved by modernizing and re-equipping its production facilities. Perhaps, for the first time, this will require serious investments, but in the future it will more than pay off by saving resources, reducing the amount of raw materials, or at a more affordable price for the consumer. You can consider the option;

- Improve the properties of their products, which will help attract new consumers and become a more competitive company in the market;

- Develop a new active marketing policy for your business project, attract good management staff. Large enterprises often have an entire marketing department dedicated to market analysis, new promotions and finding a profitable niche;

- In various ways to reduce the cost in order to compete with a similar range. This should not be at the expense of the quality of the product!

The manager needs to find a certain balance among all methods in order to achieve a stable positive result and keep the profitability indicators of the enterprise at the proper level.

Not only its management is interested in the efficiency of the enterprise, but also investors (both real and potential) and employees (the more efficient the organization is, the greater the increase in wages the employer can provide). Financial analytics will help to correctly assess the efficiency of the enterprise, which can give an objective idea of the current state of affairs and make a forecast for subsequent periods. The most important place in this process is given to the analysis of various profitability indicators, among which the product profitability formula is considered one of the fundamental ones.

Product profitability is a ratio that shows the ratio of profit to the cost of production and sale (in other words, cost) of products. In other words, such a profitability ratio informs about how much profit one ruble invested in the production process will bring to the enterprise. The indicator can be calculated both for the company as a whole, and for individual areas, and even for types of products.

How to calculate the profitability of products

In general, the formula for calculating the profitability of products sold can be represented as follows:

Rpr \u003d Pr / Ss * 100%,

where Rpr is the product profitability ratio;

Pr - the value of profit from the sale of products;

Cs - the cost of production.

The numerator and denominator contain data for a certain time period (several months or years), which allows for analysis in dynamics.

- Depending on the ultimate goal analysis of the profitability of products, the coefficient can be calculated:

- At full cost of production.

- According to the production cost of products.

- By profit from sales.

- By net profit.

Balance calculation formula

Like any other profitability ratio, this indicator can be calculated based on the balance sheet data. The figures from form 1 are not used, all the necessary information is contained exclusively in form 2 (report on financial results).

Depending on the type of the analyzed parameter, the formulas for calculation may differ slightly:

- The formula for calculating Rpr based on net profit and total cost:

Rpr = Line value 2400 from form 2 / Total value of lines 2120, 2210 and 2220 from form 2 * 100%. - The formula for calculating Rpr by profit from sales and the total cost:

Rpr = Line value 2200 from form 2 / Total value of lines 2120, 2210 and 2220 from form 2 * 100%. - The formula for calculating Rpr based on net profit and production cost:

Rpr = Line value 2400 from form 2 / Line value 2120 from form 2 * 100%. - The formula for calculating Rpr by profit from sales and production cost:

Rpr = Line value 2200 from form 2 / Line value 2120 from form 2 * 100%.

In our country, the value of the indicator at the level of 12% is considered normal.

It is worth mentioning that this figure can vary in a fairly wide range, depending on the industry the company is focused on. For the most honest assessment of effectiveness, the value of the coefficients should be compared with the industry average.

Poor profitability is a reason for inspections

The profitability of products can become one of the criteria on the basis of which tax authorities the schedule for the implementation of inspections is determined. Moreover, the suspicion of the Federal Tax Service can cause both a too low value of the indicator, and too high. A critical deviation from the industry average is 10 percent or more.

What can affect the profitability of the company's products

The value of the coefficient calculated for the organization as a whole is directly dependent on several factors:

- From any changes in the structure of products sold. If in total goods sold the share of their more profitable types increases - the profitability ratio of products increases, otherwise it decreases.

- Change in the average value of selling prices. It has a direct effect on the value of the coefficient.

- Change in the level of cost of goods. It is inversely related to the level of profitability of products. The cost price increases - the value of the indicator decreases, and vice versa.

Rising prices (even under the condition of rising costs) can be controlled, but only if the company is a monopolist in its field, and the nearest competitors have a relatively low business activity and practically do not affect the company's demand indicators.

Calculation of indicators

Example 1

The company produces toothpaste. Over the past month, the total sales revenue amounted to 5,000,000 rubles. Production costs for the same period amounted to 3,300,000 rubles. The task is to evaluate the profitability of products.

First of all, you need to find the total profit for billing period. Pr \u003d 6,000,000 - 3,000,000 \u003d 2,700,000 rubles. Based on this value, you can calculate the profitability ratio:

Rpr \u003d Pr / Ss * 100% \u003d 2,700,000 / 3,300,000 * 100% \u003d 81.8%

The resulting figure shows that each ruble invested by the enterprise in the production of this product brings 81.8 kopecks of net profit, which is a fairly good result.

After conducting a comparative analysis with previous time periods, we can draw some conclusions about the competitiveness of the product on the market. Thus, in the case of a decrease in the indicator, we can talk about a fall consumer demand or lack of production efficiency.

Example 2

The same enterprise in the context of the release of several goods. For example, it will be toothpaste, soap and shampoo. For each of them, the values of revenue and cost of production are known. The task is to evaluate the profitability of each product and conduct a comparative analysis of three types of products.

The profitability of individual types of products can be defined as the ratio:

Rpr1 \u003d Pr1 / Cs1 * 100% \u003d (47 - 38) / 38 * 100% \u003d 23.6%

Rpr2 \u003d Pr2 / Cs2 * 100% \u003d (39 - 31) / 31 * 100% \u003d 25.8%

Rpr3 \u003d Pr3 / Cs3 * 100% \u003d (61 - 66) / 66 * 100% \u003d -7.5%

Immediately catches the eye negative profitability third product. For each ruble invested in its production, there will be 1 ruble 7.5 kopecks of losses. It is worth thinking about stopping its production, or about reducing the cost of production (preferably not at the expense of quality).

The first product brings the company more profit, but its profitability is somewhat lower than that of the second. Literate financial analyst recommends the management of the company to focus on increasing the volume of the second product.

How indicators are analyzed

A specialist who is well versed in economics must know not only how to calculate the profitability of products and what ratio can determine its value. A competent analyst will be able to extract a lot of useful information from the calculated values of indicators. To keep the level of the coefficient at the required level, or to increase its value, there are several ways.

The basis of the profitability of production, in general, is the efficiency of the production and sale of its products. Regardless of the field of activity of the company, profitability is determined by the ratio of the profit received from the sale of the final product to the cost of its release. The formula will help calculate the current state of the company.

How to calculate?

Tracking the current state of the enterprise and monitoring the profitability of its activities is a common practice all over the world.

For successful development For business, it is not enough just to have an intuitive understanding that some project will bring profit, it is also necessary to conduct a mathematical analysis of the objective state of the market with a calculation of the return on the implementation of the project (product) and its payback period.

The current level of product profitability is calculated on the basis of real data, which are reflected every month in the accounting documentation of the enterprise, as well as quarterly reports.

The calculation of profitability is of interest to a wide range of people:

- business owners who evaluate the correctness of the "set course";

- creditors who monitor the economic situation at the enterprise.

The profitability of an enterprise is considered as an absolute value, so it can be easily represented as Money(in the accounting report).

Applying relative profitability indicators (ratios of absolute values, which are expressed as a percentage of each other), it is necessary to give some explanations. Relative indicators are not so demonstrative.

The profitability ratio of products (in its general form) shows how many units of profit a businessman will receive from a unit of production costs.

The profitability ratio is written as a fraction, where the numerator is the profit that is earned in the process of selling the goods, and the denominator is the total costs related to both commercial promotion and the technological production cycle.

The calculated coefficient must be multiplied by 100. Thus, the proportion shows the ratio of profit to the total cost (total production costs).

It is important to understand that a single calculation of the profitability of products is not able to reflect the real state of the enterprise. When conducting a comprehensive analysis, the following points should be considered:

- the difference between the actual and planned profitability of products sold;

- comparison of the data obtained in the course of profitability calculations with competing firms for similar products;

- analysis of the rating of the company's products over the past few years.

There are two main concepts in the search for the profitability of an enterprise's products.

There are two main concepts in the search for the profitability of an enterprise's products.

Very often, profitability is calculated only for a unit of a product, then the costs of its release and the profit received from the sale are distinguished from the general structure.

This concept is mainly used by analysts to make forecasts. The second concept of calculating profitability is to analyze the global situation. A study of the total amounts for the reporting period is being carried out.

The profitability of the production of goods is always considered as a percentage. This makes it possible to simplify the further application of calculated indicators for conducting a comprehensive analysis of the enterprise in the long term.

Profitability of products sold (ROM - from the English Return on Margin) - an indicator that shows the effectiveness of product sales in the form of a ratio between income and costs for the production of goods and its sale.

Business with minimum investment really open. Here you will find information about proven ideas for men and women. profitability in practice.

Profitability formula for products sold

In order to calculate the profitability indicator from the sale of a certain product, the profit from sales or net income received is applied.

In order to calculate the profitability indicator from the sale of a certain product, the profit from sales or net income received is applied.

Two can also be used different kind cost - full (including the costs of commerce) and production (costs of production).

When calculating the profitability of products, the following formulas are used:

- Profitability on the total profit from sales and full cost = PR / TS * 100%, where PR is the total profit; TS - total costs for release;

- Profitability based on profit from sales and cost of direct (production) costs \u003d PR / TS prod. , where PR is the total profit; TC product - total production costs;

- Profitability of products based on net profit and full cost of prime cost = NP / TS, where NP is net profit (total profit minus taxes and other payments); TC - total cost of production;

- The profitability of products, which was calculated based on net profit and the cost of production of goods = NP / TS prod. , where PE - net profit; TC product - total production costs.

Sales profit is taken from the income statement (value in line 050). Also, profit can be calculated using the following formula: PR=TR-TS, where PR is profit from sales; TR - sales proceeds; TC - the cost of production (full). Revenue can be viewed in the income statement in line 010. The full cost can be easily calculated using the proposed formula: TS = line 020 + line 030 + line 040, where line 020, 030 and 040, respectively, are the costs of release, commerce and administration.

Net profit (NP), as a rule, is taken from the income statement (line 190 value).

Net profit (NP), as a rule, is taken from the income statement (line 190 value).

Other expenses and income are those costs that are not directly related to production costs.

The profitability of products, as mentioned earlier, can be calculated both for a separate commodity item and for a whole group of products.

Product profitability is traditionally calculated as a percentage. The information obtained during the calculations is not of momentary interest, however, it is used to draw up an enterprise strategy for the near future.

When calculating the profitability of products, you should not lose sight of some important details, namely:

- Factors influencing the profitability forecast of an enterprise (dictation of sales numbers).

- The cost of goods is not always reduced. Especially if we are talking about knowledge-intensive areas where modernization is necessary. Replacing equipment at the initial stage will cost a pretty penny.

- Preference (with a heterogeneous list of goods) must be given to those whose profitability is the highest.

The standard profitability of products, as a rule, is calculated in dynamics, by sampling over several months or years.

As a result, users of information receive an illustrated picture of the effectiveness of management in the enterprise.

The formula for calculating the profitability of products shows a reliable result, however, the correctness of the calculations is more influenced by the taxation system that operates in the country.

Calculation examples

To understand the process of calculating the profitability indicator, consider a few simple examples from life.

Let's say the total revenue received from the sale of goods of an enterprise for the production of baby diapers for the past month amounted to 500 million rubles. Cost of goods sold (including expenses for commerce and administrative staff) - 265 million rubles. Determine the profitability of the products that the company produces.

First, let's find the profit from the sale of goods for the past month.

First, let's find the profit from the sale of goods for the past month.

To do this, we subtract the total cost from the total revenue: 500-265 = 235 million rubles.

We will find the profitability of products using the calculation formula: PR / TS * 100, where PR is the profit from sales, TS is the total cost of production.

Let's substitute the values: 235/265*100%=88.68%. The profitability of product sales shows how much profit the company receives from each ruble of products sold. In our case, the profit is 88.68 kopecks. This is a fairly high return on the product. Analyzing the indicator of profitability of products, it is possible to assess the competitiveness of the company in the market for the promotion of new products. If the profitability of a product falls, this indicates a decrease in demand for the company's products or low production efficiency at the plant.

The profitability indicator can also be calculated for several products that form a certain product group at the same time.

Let's consider the second example.

The company produces three types of products with an average profitability of 26%. The sales proceeds and cost for each product are presented in table 1. It is necessary to find the profitability for each product and give recommendations to the company regarding the further production of products.

To calculate the profitability of products, we use the formula from the first example.

Profitability of commercial products. Formula: "A" \u003d 9/27 * 100% \u003d 33.3%;

Profitability of product "B" = 8/22*100%=36.36%;

Profitability of product "B" = -1.89%.

If we analyze the absolute value, then the product "A" brings more profit than "B". However, in reality, "B" is more profitable by 3 kopecks (3.06%). Thus, the company needs to focus on the release of product "B". Concerning products "B", it should be said that this product unprofitable, i.e. brings a loss. Accordingly, the release of product "B" must be stopped immediately. The loss for each ruble of expenses is 1.89 kopecks.

Related video