In 2018 reporting non-profit organizations must be submitted in a timely manner to a number of state authorities: the Federal Tax Service, the Ministry of Justice, off-budget funds, Rosstat. Last year, a number of changes were legislatively approved in the procedure for granting reporting documentation, some innovations have also affected NGOs. Founders non-profit associations must provide reports that display information about the activities of the subject, its managers, use financial resources. The article will consider in detail which reports of non-profit organizations for 2018 need to be prepared.

Non-Profit Organizations

From the name, we can conclude that making a profit is not the main purpose of the functioning of these institutions. A legal entity has its own bank account, seal, charter, and its leaders are required to draw up reports. Such entities are created for the implementation of cultural, religious, charitable, social, political activities.

Despite the fact that the founders of funds do not receive profit as a result of their operation, they are required to regularly submit accounting, tax and statistical reports. A feature of an autonomous non-profit organization is that it is created on the basis of voluntary contributions by individuals or legal entities and subsequently they do not have rights to the property of this entity. The activities and procedure for compiling reports of autonomous non-profit organizations are regulated by federal legislative acts.

Composition of NPO reporting documentation in 2018

tax reporting (VAT declarations, profit and real estate declarations);

financial statements non-profit partnerships(served once a year); if the organization does not commercial activity, it can generate reports in a simplified manner;

reports to the statistics of non-profit organizations (fill in form No. 1-NCO); if the statistical authorities require other information, the founders of NCOs are obliged to provide them;

payments to extra-budgetary funds (data on personalized accounting, on the amount of payments transferred to the FSS and PFR);

specialized reports of non-profit organizations (submitted to the authorities that keep records of such entities).

Accounting statements and deadlines for their submission

In 2018, financial statements must be submitted to the regulatory authorities by March 31. NPOs working on the simplified tax system and socially oriented organizations can prepare accounting documentation according to a simplified type, and all other non-profit entities form a balance sheet according to a generally accepted model. Compound financial statements in 2018 for non-profit associations will be as follows:

Balance sheet. If the institution is not operating commercial basis, then the section "Capital and reserves" must be replaced with "Target financing". In boo. reporting, it is necessary to indicate information about the sources of asset formation.

Report on intended use resources. It should display the following information: the balance of funds at the beginning of the reporting period, the amount of financial resources used (payment wages, costs of events, etc.), the amount of money received.

An explanatory note can be attached to the annual reporting for 2018 of a non-profit organization, in which the main indicators will be deciphered in any form. One copy of the reporting is submitted to the tax office, and the second to the statistical authorities. Financial statements in 2018 are provided in the following cases:

if during the year the NPO received income from the implementation of activities;

if in the report on the use of funds, data on the income received and the results of the activities of the institution are not fully disclosed;

2018 financial statements are often needed when interested people cannot assess the financial condition of NGOs.

Reporting to the Federal Tax Service

The composition of reporting in 2018 for non-profit institutions depends on the tax regime in which they operate. If you do not submit reports to those approved by the Government, then the founders of NPOs will have to pay large fines. Organizations working for general mode, are required to prepare in 2018 tax reporting of non-profit entities:

declarations: for VAT (quarterly, until the 25th day of a new month), for property tax (until March 30), for income tax (until March 28);

Reports to the Ministry of Justice

NPO leaders need to prepare a report of non-profit organizations to the Ministry of Justice in 2018 by April 15. The procedure for compiling and submitting reports to territorial bodies The Ministry of Justice is regulated by the Law on Non-Commercial Activities. You can transfer the documentation in various ways: send it by mail (be sure to attach an inventory of the contents of the package), bring it in person, post it on the website of the department. The composition of the reporting of non-profit organizations in 2018 is determined by the type of activity of the NPO, the following information should be disclosed in the documents:

about the location of the subject;

about charitable programs;

on the amount of financial resources received;

about the expense Money;

information about leaders.

Features of reporting by various types of NCOs

All NCOs, regardless of their fundamental goals, are required to post on the website of the Ministry of Justice a report on the activities of a non-profit organization in 2018 and on the use of its property. What reports do non-profit organizations need to submit in 2018? More on this later:

Public associations are required to provide data on the property received and how it was used, the actual address of the subject, information about the leaders.

Trade unions submit information about the name of the subject, the actual location of the NPO, information about the founders.

Charity organisations and foundations provide information on economic activities, managers, composition of charitable events, violations identified as a result of a tax audit and measures to eliminate them, statistical reporting.

Religious organizations provide form No. OP0001, information on the continuation of future activities, a special application.

Cossack societies submit documentation similar to that provided by religious organizations. They are also required to provide information on the number of members of the company.

Non-profit associations bear the same responsibility for committed offenses as other entities. Therefore, their founders are interested in competently organizing accounting and reporting and avoiding problems with regulatory authorities. Finabi specialists have extensive experience in providing accounting services, we will be able to analyze the financial statements of non-profit organizations in 2018 and help you draw up reporting documentation in accordance with applicable regulations. Entrust your worries to us!

Our organization is called ASSOCIATION "ASSOCIATION OF BUILDERS", taxation USN-6%. Tell me to which State bodies you need to submit and what reports on our organization, except for the TAX INSPECTION, FSS, PFR !!!

Non-profit organizations must submit accounting reports to a statistical agency. Also, some NGOs must submit reports to the Ministry of Justice of Russia. The procedure for submitting reports to the Ministry of Justice is contained in the materials of the Glavbukh System. There is no special reporting for the SRO.

Rationale

From book

Manual for an accountant of a non-profit organization

What reporting to submit to non-profit organizations

Non-profit organizations are not exempt from reporting. What reports and where to send, we will tell further.

Financial statements. All NPOs should submit accounting reports. It must be sent to the tax office and statistics agency no later than March 31 of the year following the reporting year (subparagraph 1, clause 1, article 2 of the Federal Law of December 6, 2011 No. 402-FZ "On Accounting", hereinafter - Law No. 402- FZ). Only religious organizations are exempted from submitting accounting records to the IFTS, which for the reporting year did not have an obligation to pay taxes or fees (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation). With regard to the establishment of statistics, no exemptions are provided for a religious organization. Therefore, reporting must be submitted (Article 18 of Law No. 402-FZ).

As part of the financial statements, prepare:

- balance sheet;

- report on the intended use of funds.

You can fill out the forms using both regular forms and simplified forms. Ordinary ones are approved by appendices No. and, and simplified ones - by appendix No. 5 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n (hereinafter - order No. 66n). You cannot use simplified forms only for those NPOs that, by law, are not entitled to keep accounting in a simplified form. Such NPOs are listed in paragraph 5 of Article 6 of Law No. 402-FZ. These are organizations whose accounting is subject to mandatory audit, housing and housing cooperatives, political parties, etc. If you are one of these organizations, fill out accounting statements on regular forms.

Absolutely all NCOs are required to submit a balance sheet and a report on the intended use of funds as part of their annual reporting.

If your NPO leads entrepreneurial activity and received substantial income from the business, then, in addition to the marked forms, you will also have to submit a report on financial results. You decide how much income is significant. And the level of materiality (5, 10, 20% of all receipts) is written in your accounting policy for accounting purposes (clause 1, article 13 of Law No. 402-FZ, clause and PBU 4/99 “Accounting statements of an organization”). The form of the income statement is also approved by Order No. 66n. You can use both the regular report form (Appendix No. 1) and the simplified one (Appendix No. 5) - if your company is not prohibited from keeping accounting in a simplified form.

If you are running a business and earning substantial income from it, you will need to fill out a statement of financial results.

Other appendices to the reporting are not required. If you decide to decipher some important information in them, then fill out the applications. You can use both text and tabular form.

Simplification Declaration. Fill out the declaration in the form approved by the order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/99@. And hand it over to the tax office no later than March 31 of the next year (subclause 1, clause 1, article 346.23 of the Tax Code of the Russian Federation). Please note: the declaration is submitted to the IFTS only at the end of the year. Based on the results of the reporting periods, it is not necessary to submit it to the tax office.

In the declaration on the simplified tax system, in addition to the main sections 1.1-2.2, fill out section 3. This is a section special for NCOs - a report on the intended use of property. Reflect there the funds that you received as part of charitable activities, targeted income and targeted funding. And show how the money was spent: for the intended purpose or not.

Information about average headcount . Submit reports for the previous year, no later than January 20 of the current year. The information form was approved by order of the Federal Tax Service of Russia dated March 29, 2007 No. MM-3-25 / 174.

Reports to funds - PFR and FSS. You need to make payments to the funds for your employees. So you will report on the payments made by him and the contributions accrued from them. Send reports based on the results of reporting and tax periods. Reporting periods are I quarter, half a year, 9 months. The tax period is a year (part 9 of article 15 of the Federal Law of July 24, 2009 No. 212-FZ, hereinafter - Law No. 212-FZ).

Submit the calculation to the FSS in the form 4-FSS, approved by order of the FSS of the Russian Federation of February 26, 2015 No. 59. Delivery deadlines:

- no later than the 20th day of the month following the reporting (tax) period - for paper settlement;

- no later than the 25th day of the month following the reporting (tax) period, - for an electronic report ().

Submit the calculation to the Pension Fund in accordance with the RSV-1 PFR form, approved by the Resolution of the Board of the Pension Fund of the Russian Federation dated January 16, 2014 No. 2p. Delivery deadlines:

- no later than the 15th day of the second month following the reporting (tax) period - for a report on paper;

- no later than the 20th day of the second month following the reporting (tax) period, - for settlement in in electronic format(signature 2, part 9, article 15 of Law No. 212-FZ).

In addition, every month you need to submit to the FIU a monthly report in the form of SZV-M for employees. Deadline - no later than the 10th day of the month following the reporting one. The report form was approved by the Resolution of the Board of the Pension Fund of the Russian Federation dated February 1, 2016 No. 83p.

Income tax reporting. You need to hand it over to report on the income paid to your employees. And about the personal income tax withheld from them. The reporting includes the calculation of 6-NDFL and the certificate 2-NDFL.

The calculation form 6-NDFL was approved by order of the Federal Tax Service of Russia dated 10/14/2015 No. ММВ-7-11/450@. Send the report to the tax office no later than the last day of the month following the reporting period (quarter, six months, 9 months). And for the year - no later than April 1 (paragraph 3, clause 2, article 230 of the Tax Code of the Russian Federation).

The certificate form 2-NDFL was approved by order of the Federal Tax Service of Russia dated 10/30/2015 No. ММВ-7-11/485@. Send a tax return only at the end of the year. Deadline - no later than April 1 of the year following the reporting year (paragraph 1, clause 2, article 230 of the Tax Code of the Russian Federation). This is the general deadline for submitting a certificate in which you reflect the tax on income paid, it is filled out with feature 1. In addition, if you did not withhold personal income tax during the year, then send another 2-NDFL certificate with feature 2 to the tax office to report on outstanding amounts. Deadline - no later than March 1 of the next year (clause 1 of article 226 of the Tax Code of the Russian Federation).

From the directory

Reporting of non-profit organizations (NCOs) to the Ministry of Justice of Russia

| What to take | Who rents | Reporting period and due date | Base | |||

| Report on the activities of a non-profit organization and on the personal composition of its governing bodies (f. ON0001), approved | ||||||

| Report on the expenditure of funds by a non-profit organization and on the use of other property, including those received from international and foreign organizations, foreign citizens and stateless persons (f. ON0002), approved by order of the Ministry of Justice of Russia dated March 29, 2010 No. 72 |

All NPOs (except for budgetary and state-owned institutions) that have: - there are participants (members) - foreign citizens and (or) organizations, stateless persons; – during the year there were receipts of money and property from foreign sources; – during the year, the receipt of money and property amounted to more than 3 million rubles. |

Charitable organizations - in time for the submission of annual financial statements to the tax office. |

||||

| Statement of compliance with the requirements of Article 32 of the Law of January 12, 1996 No. 7-FZ and information on the continuation of activities (arbitrary form) |

NCOs (except for budgetary and state-owned institutions), which have: - there are no participants (members) - foreign citizens and (or) organizations, stateless persons; – during the year there were no receipts of money and property from foreign sources; – during the year, the receipt of money and property amounted to no more than 3 million rubles. |

There is no statutory deadline. |

Clauses 4.1 and 4.2 of Art. 1, Law of January 12, 1996 No. 7-FZ | |||

| Report on the amount of funds and other property received by public associations from international and foreign organizations, foreign citizens and stateless persons, on the purposes of their spending or use and on their actual spending or use (f. ON0003), approved by order of the Ministry of Justice of Russia dated March 29 2010 No. 72 | Public associations |

Charitable organizations - in time for the submission of annual financial statements to the tax office. |

||||

| Report on the activities of a religious organization, on the personal composition of its governing bodies, on the expenditure of funds and on the use of other property, including those received from international and foreign organizations, foreign citizens and stateless persons (form OR0001), approved by order of the Ministry of Justice of Russia dated March 29, 2010 No. 72 | Religious organizations | |||||

| , approved by order of the Ministry of Justice of Russia dated March 29, 2010 No. 72 |

Not later than the last day of the month following the reporting quarter |

|||||

| Report structural unit foreign non-profit non-governmental organization on the actual expenditure or use of funds and other property, as well as on the expenditure of funds provided to individuals and legal entities the specified funds and on the use of other property provided to them (f. SP0002), approved, approved by order of the Ministry of Justice of Russia dated March 29, 2010 No. 72 | Structural divisions of a foreign non-profit non-governmental organization |

If you do not meet this deadline, then no later than one month before the start of the program. If it is decided to change the program - no later than 10 working days from the date of such a decision |

Order of the Ministry of Justice of Russia dated March 29, 2010 No. 72 - information on the activities of a non-profit organization, on the personal composition of its governing bodies |

Half a year. Not later than the 15th day of the month following the reporting semester |

||

| – information on the purposes of spending money and using other property, including those received from foreign sources, on the actual spending and use of money and other property received from foreign sources |

Not later than the 15th day of the month following the reporting quarter |

|||||

| – audit report on the results of the audit of the annual accounting (financial) statements |

- Download forms

Today on the territory Russian Federation not only commercial activities, but also non-commercial ones can be conducted.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

It is necessary to register such institutions with various state regulatory authorities.

At the same time, it should be remembered that there are many different features associated with the activities of this kind of enterprises, also called NPOs.

First of all, responsible persons will need to remember the importance of reporting on the activities of non-profit organizations.

What you need to know

The activities of non-profit organizations arouse no less close interest in various kinds of regulatory bodies than commercial ones.

The main reason for this is the presence of a large number of various, indulgences on the part of the state for all kinds of NGOs.

That is why it will be necessary to familiarize yourself in advance with all the main points related to the activities and reporting of such enterprises. Exists a large number of all kinds of features.

The most important issues to consider in without fail, today it will be possible to attribute:

- basic concepts;

- deadline for submission of documents;

- legal base.

Consideration of the issues outlined above will make it possible to form reports in an appropriate way and avoid the most common mistakes.

Basic concepts

First of all, the head of a non-profit organization, as well as its accountant, and other responsible persons should familiarize themselves with the current legislative norms.

Only absence various violations legal documents will help to avoid a large number of various errors and other difficulties.

But for a correct interpretation of the main provisions, it will be necessary to familiarize yourself with the various terms used in the NAP.

To the most important concepts related to normative documents governing the work of NPOs include the following:

- "non-profit organization";

- "annual reporting";

- "statistical reporting";

- "disbursement notices";

- "structural units";

- "founders";

- "public associations".

At the moment, first of all, it will be necessary to familiarize yourself with the concept of “non-profit organization”. Also, in relation to this kind of structures, it will be possible to use the abbreviation NPO.

This type of institution refers to various kinds of enterprises, the main purpose of which is not commercial, but other activities.

At the same time, it is not planned to receive any profit, there is no such thing. It is important to remember that the format of the activities of an enterprise of this type must fully comply with the facts.

Otherwise, quite serious problems can arise - up to compulsory.

"Annual reporting" - a set of various kinds of documents that reflect information about all income received as a result of conducting certain activities.

Most often, such documents are various kinds of declarations. " Statistical reporting"- a set of various kinds of reports that are compiled by enterprises according to previously established forms of documents.

This type of reporting will be provided to Rosstat. “Notice of spending funds” is a special document, the format of which is established at the legislative level.

Compulsorily formed by non-profit enterprises. Is one of the most important documents reporting.

"Structural divisions" - branches non-profit enterprises which are located separately from the main enterprise.

A similar status is assigned if equipped workplace for more than 2 months.

An important feature of such units is that they must have a separate balance sheet, as well as provide reporting separately from the main organization.

There are also other points related to the formation of reporting structural units.

"Founders" - any natural or legal person who is the founder, owner and leader of the organization. It should be remembered that there can be several such founders at the same time.

It is the founders who have the right to make various kinds of important decisions regarding the conduct of the activities of a non-profit enterprise.

The board of founders also appoints executive agency who has the right to represent the interests of NGOs.

"Public associations" is one of the varieties of non-profit enterprise, which is created on the basis of the common interests of ordinary citizens.

At the same time, the reporting of such an NPO should be formed in accordance with all legislative norms in force with respect to such enterprises.

There are a large number of different nuances associated with this kind of activity. There are also various other types of non-profit enterprises.

Deadline for submission of documents

It is very important not to miss the deadline for submitting the relevant reporting documentation. First of all, this concerns various kinds of state off-budget funds.

The following deadlines are currently set:

An important feature of the type of organization under consideration is that there is a need to report to the regional tax authorities.

Reporting is not limited to the delivery of documents to state funds, as well as various kinds of statistical institutions. This moment is established at the legislative level.

Legal framework

At the moment, the fundamental document regulating the activities of such organizations, as well as on the basis of which reporting is formed, is

It includes the following main sections:

There are also some specialized legal documents that regulate the reporting of NCOs.

Today, such legal documents include the following:

Particular attention will need to be paid to the timing and format of the provision of various kinds of reporting.

Since the presence of errors, various kinds of shortcomings and incorrect presentation of information can cause a large number of various difficulties.

NPO tax reporting forms

At the moment, the format of tax reporting of a non-profit organization is established by law. All Required documents must be transferred directly to the place of permanent registration.

The very procedure for creating an NPO differs little from the formation of other organizations. There are differences only in the list of documents provided.

The same goes for reporting. It will be necessary to draw up a fairly extensive list of documents.

The most significant issues that will need to be considered in advance will include the following:

- delivery list;

- if zero reporting;

- responsibility for violations.

Checklist

At the moment, the list of documents for reporting is quite extensive. It includes a large number of various documents.

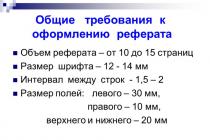

First of all, it is necessary to deal with the formation of financial statements. This moment installed

According to the data legal document You will need to submit reports of the following type, which include:

- standard ;

- attachments to the above documents - if for some reason it is necessary in a particular case.

The composition of financial statements is established only by federal law.

All documents required in this case must be submitted to the relevant authorities no later than 3 months after the end of the reporting period.

Scroll tax documents for reporting depends on the applicable tax regime.

Enterprises that work on a common basis will need to pass:

- tax reporting in the form of various kinds;

- a form of legal ownership, after registration of which it is necessary to submit declarations not only to the tax authorities, but also to other regulatory authorities. Read our article about what reporting NPOs are required to submit and within what time frame.

Tax reports

Depending on the chosen taxation system, a non-profit organization is obliged to submit the required reporting to the IFTS at the place of registration. The most complex is the overall system. In this case, the taxpayer is obliged to submit to the IFTS authorities an income tax return for each quarter (Article 285 of the Tax Code of the Russian Federation).

If the enterprise did not conduct commercial activities and did not have an object for tax calculation, then the report is submitted after the year before April 15 of the next year in a simplified form. Moreover, targeted financing is not taken into account as income when determining the tax base.

VAT reporting is one of the forms submitted by a taxpayer who uses the OSNO (Article 143 of the Tax Code of the Russian Federation) to conduct his activities. The declaration is also submitted for each quarter. You do not need to fill out the entire form, it is enough to determine the areas of activity in which the enterprise carried out its work. But you can pay the tax monthly until the 20th day of the next month, dividing the calculated amount for the quarter into 3 parts.

If the company is listed vehicle, then his duty is to submit a transport tax declaration (Article 357 of the Tax Code of the Russian Federation). The reporting period for submitting the form is considered to be a year - therefore, the declaration is submitted before February 20 of the next year.

Art. 398 of the Tax Code of the Russian Federation obliges enterprises to annually submit reports on land tax to the IFTS no later than 01.02 of the next year.

If the organization acts as a tax agent for income tax, then it is necessary to submit Form 2-NDFL for each employee to the IFTS authorities before 01.04 of the next year. Since 2016, tax reporting for this category of enterprises has been replenished with another form - 6-NDFL, which enterprises submit to the tax office on a quarterly basis, no later than the last day of the month following the reporting one. annual form for rent until 01.04 next year.

If the company is registered as an employer, do not forget about reporting to the FSS and PFR funds, which is submitted quarterly. In the FSS - until the 20th day of the month following the reporting month on paper and until the 25th day - if you submit the form in electronic form. In the FIU, reporting is submitted in the RSV form by the 20th day of the second month following the reporting period. In addition, organizations are required to submit the SZVM form to the PFR authorities every month before the 10th.

Features of the formation of tax reporting of an organization located on, is that the company does not pay, and, therefore, does not file income tax, property, VAT returns. However, the obligation to report to the FSS and the FIU remains.

But in this case, the company annually reports to the IFTS, submitting before March 31 of the next year.

Specific reporting forms

A non-profit organization, in addition to tax reporting, is obliged to submit to the IFTS bodies not only tax, but also accounting reports before March 31 of the next year. Financial statements include the following forms:

- Organizational balance sheet.

- Statement of financial results with all available attachments.

- Targeted funding report.

- Cash flow statement.

- Explanatory note with application.

In addition to these reports, non-profit organizations are required to provide information containing the following information:

- Enterprise activity.

- Deficiencies identified during inspections.

- Charitable programs and their results.

Reporting form to statistical authorities public organizations is presented quarterly in the form of a balance sheet and income statement and cash flow information. It is also important that the annual financial statements non-profit enterprises is subject to mandatory publication in the media.

In addition to the above supervisory authorities, NCOs submit the listed forms of financial statements. Delivery times are adjustable. tax authorities and at least once a year.

Despite the fact that an NPO does not always conduct, it must submit reports in full, otherwise penalties may be imposed on the organization.

- Reporting of non-profit organizations (NCOs) to the Ministry of Justice of Russia

You can clarify the reporting on the official website of the department - http://minjust.ru/ru/nko/otchetnost

|

What to take |

Who rents |

Reporting period and due date |

Base |

|

Report on the activities of a non-profit organization and on the personal composition of its governing bodies (f. ON0001), approved by order of the Ministry of Justice of Russia dated March 29, 2010 No. 72 |

|||

|

Report on the expenditure of funds by a non-profit organization and on the use of other property, including those received from international and foreign organizations, foreign citizens and stateless persons (f. ON0002), approved by order of the Ministry of Justice of Russia dated March 29, 2010 No. 72 |

All NPOs (except for budgetary and state-owned institutions) that have: - there are participants (members) - foreign citizens and (or) organizations, stateless persons; – during the year there were receipts of money and property from foreign sources; – during the year, the receipt of money and property amounted to more than 3 million rubles. |

Charitable organizations - in time for the submission of annual financial statements to the tax office. |

|

|

Statement of compliance with the requirements of paragraph 3.1 of Article 32 of the Law of January 12, 1996 No. 7-FZ and information on the continuation of activities (arbitrary form) |

NCOs (except for budgetary and state-owned institutions), which have: - there are no participants (members) - foreign citizens and (or) organizations, stateless persons; – during the year there were no receipts of money and property from foreign sources; – during the year, the receipt of money and property amounted to no more than 3 million rubles. |

There is no statutory deadline. Focus on the general deadlines for submitting reports |

|

|

Report on the amount received public associations from international and foreign organizations, foreign citizens and stateless persons of funds and other property, on the purposes of their spending or use and on their actual spending or use (f. ON0003), approved by order of the Ministry of Justice of Russia dated March 29, 2010 No. 72 |

Public associations |

Charitable organizations - in time for the submission of annual financial statements to the tax office. |

|

|

Report on the activities of a religious organization, on the personal composition of its governing bodies, on the expenditure of funds and on the use of other property, including those received from international and foreign organizations, foreign citizens and stateless persons (form OR0001), approved by order of the Ministry of Justice of Russia dated March 29, 2010 No. 72 |

Religious organizations |

||

|

Report of a structural unit of a foreign non-profit non-governmental organization on the amount of funds and other property received by this structural unit, their intended distribution, as well as on the purposes of their spending or use (form SP0001), approved by order of the Ministry of Justice of Russia dated March 29, 2010 No. 72 |

Not later than the last day of the month following the reporting quarter |

||

|

Report of the structural unit of a foreign non-profit non-governmental organization on the actual expenditure or use of funds and other property, as well as on the expenditure of the specified funds provided to individuals and legal entities and on the use of other property provided to them (form SP0002), approved by order of the Ministry of Justice of Russia dated March 29 2010 No. 72 |

Structural divisions of a foreign non-profit non-governmental organization |

||

|

Report of a structural subdivision of a foreign non-profit non-governmental organization on programs intended for implementation on the territory of the Russian Federation (form SP0003), approved by order of the Ministry of Justice of Russia dated March 29, 2010 No. 72 |

Structural divisions of a foreign non-profit non-governmental organization |

If you do not meet this deadline, then no later than one month before the start of the program. If it is decided to change the program - no later than 10 working days from the date of such a decision |

|

|

Audit report from Russian auditors |

Structural divisions of a foreign non-profit non-governmental organization |

||

|

Report of a non-profit organization acting as a foreign agent (f. OIA001), approved by order of the Ministry of Justice of Russia dated April 16, 2013 No. 50 The report includes: |

NCOs Acting as Foreign Agents |

||

|

– information about the activities of a non-profit organization, about the personal composition of its governing bodies |

Half a year. Not later than the 15th day of the month following the reporting semester |

||

|

– information on the purposes of spending money and using other property, including those received from foreign sources, on the actual spending and use of money and other property received from foreign sources |

Not later than the 15th day of the month following the reporting quarter |

||

|

– audit report on the results of the audit of the annual accounting (financial) statements |

2) Reports can be submitted to the Ministry of Justice of Russia (its territorial body) directly, in the form postal item with a description of the attachment or by posting on information resources of the Ministry of Justice of Russia on the Internet, intended for posting reports and messages, access to which is carried out through the official website of the Ministry of Justice of Russia (http://unro.minjust.ru/) and the official websites of its territorial bodies on the Internet, in the manner prescribed by the Order of the Ministry of Justice of Russia dated 07.10.2010 N 252 (clause 3 of article 32 of Law N 7-FZ, subparagraph "a" clause 2 of the Decree of the Government of the Russian Federation of 15.04.2006 N 212 "On measures to implement certain provisions federal laws regulating the activities of non-profit organizations”, clause 2 of the Procedure for posting on the Internet reports on activities and messages on the continuation of the activities of non-profit organizations, approved by Order of the Ministry of Justice of Russia N 252 (hereinafter referred to as the Procedure), clauses 3, 4 methodological recommendations on filling out and submitting to the Ministry of Justice of the Russian Federation and its territorial bodies forms of documents containing reports on the activities of non-profit organizations approved by Order of the Ministry of Justice of Russia dated March 17, 2011 N 81).

3) Reporting in Moscow is submitted to the Main Directorate of the Ministry of Justice of Russia for Moscow, this is the official website of the department http://to77.minjust.ru

And this is a link to the Department for Nonprofit Organizations -http://to77.minjust.ru/about/otdel02

4) There is no requirement in the legislation to draw up an act, the parties have the right not to do this. Also, the parties have the right to agree on the obligation to draw up an act and its periodicity.

The form of the act is not established by law. You can develop it yourself together with the counterparty. This conclusion follows from paragraph 4 of Art. 421Civil Code of the Russian Federation.

If you agreed on the form of the act on the provision of services as an annex to the contract, use it. In this case, you can avoid disputes about the form in which the act should be drawn up.

If the contract does not contain requirements for the form of the act, either party has the right to draw it up in a form convenient for it. As a rule, the act is drawn up by the contractor and offered to the customer for signing.

The Civil Code of the Russian Federation does not contain requirements for the content of the act on the provision of services.

The act is used for accounting purposes, therefore, indicate the details required for primary accounting documents (part 2 of article 9 of the Accounting Law):

- Title of the document. The legislation does not mandatory requirement to the title of the act. You can call it an act on the provision of services, an act of acceptance and transfer of services rendered, an act on services rendered;

- the date of its compilation;

- name or full name customer and contractor;

- type and scope of services. We recommend that you specify them in detail. If the act does not allow determining either the type of services, or their volume, or their cost, the court may not accept the act as evidence of the fact of the provision of services (Resolution of the FAS of the East Siberian District of 04.24.2012 N A33-7310 / 2011);

- the period in which the contractor provided the services;

- the price of services, including the amount of VAT, if necessary;

- positions and personal signatures of the heads of the contractor and the customer or persons authorized by them. If the act is signed by a person acting on the basis of a power of attorney, indicate its details in the act.

Put on the act the seals of the parties, if any.

- contract details paid provision services.

Without them, the court may recognize the act as unrelated to the contract and not accept the act as proof of the provision of services (part 1 of article 67 of the Arbitration Procedure Code of the Russian Federation, article 59 of the Code of Civil Procedure of the Russian Federation). If the contractor and the customer have entered into several similar contracts and the act will not refer to a specific contract, it will be difficult for the court under certain circumstances to determine which of them the act refers to (Resolution Arbitration Court of the North Caucasian District dated 08/10/2015 N F08-4898 / 2015).

However, if there is only one agreement between the parties, the absence of a reference to it in the acts will not affect the resolution of the dispute (Resolution of the Arbitration Court of the North-Western District of December 16, 2015 N A26-1252 / 2015);

- information about identified deficiencies in services.

If during the acceptance process the customer has any complaints about the quality of services, he needs to indicate the corresponding shortcomings in the act. Without this, it will be difficult for him to refer to shortcomings in the future (clauses 2, 3 of article 720 of the Civil Code of the Russian Federation, article 783 of the Civil Code of the Russian Federation).

If there is no column in the form of the act for information about the identified deficiencies, we recommend that the customer, instead of signing the act, put a mark on it “services were not accepted due to the discovery of deficiencies”. State the information about the shortcomings in a separate document and send it to the contractor.

We do not advise the customer to leave the act without a note on why it was not signed, otherwise, in the event of a dispute, the contractor may claim that there was an unmotivated refusal to sign the act of providing services. In this case, the services will need to be paid for (clause 1 of article 781 of the Civil Code of the Russian Federation);

- information about the transfer to the customer of the result of the actions of the contractor, if the parties have agreed on the provision of a certain result, for example, draft contracts, statements, complaints, an assessment report, services rendered.

5) In the accounting of the executing organization, receipts related to the provision of services are income from ordinary activities (clause 5 of the Accounting Regulation "Income of the organization" PBU 9/99, approved by Order of the Ministry of Finance of Russia dated 06.05.1999 N 32n). Conditions for the recognition of revenue (income from the provision of services) are established by clause 12 of PBU 9/99. In this case, the entity should recognize income in accordance with the payment schedule. If individual pays educational services monthly, then you must reflect the revenue in the accounting monthly.