AMS or the average number of employees is the number of employees of the enterprise on average for any particular period. To determine this value is required for statistical accounting and taxation. According to the law (clause 7, article 5 of the law dated December 30, 2006 No. 268-FZ), each individual entrepreneur and the head of the organization must submit this data to tax service annually. In addition, data on SCH are required when filling out the following forms:

1. N PM "Information on the main indicators of the activity of a small enterprise";

2. P-4 "Information on the number, wages and movement of employees";

3. N MP (micro) "Information on the main performance indicators of a micro-enterprise";

Also data on the average payroll employees are necessary when confirming the rights and benefits when calculating taxes for enterprises that use the labor of people with disabilities.

: in the usual manner, during pregnancy and vacation, after dismissal.

Come up with a company name - what could be easier? But, it's not so simple!

Terms of submission

CSC must be submitted no later than January 20 of the current year. That is, information on the average number of employees for 2013 must be received by the tax service on January 20, 2014. There are exceptions to the deadline for submitting this data, for example, if the company was recently registered, or the company was reorganized. Then the information must be provided no later than the 20th day of the month following the month of the establishment or reorganization of the enterprise. The terms are strictly regulated by clause 3 of Art. 80 tax code RF and clarified by the letters of the Federal Tax Service No. 25-3-05/512 dated 07/09/2007 and No. ChD-6-25/535 dated 07/09/2007.

CSC must be submitted no later than January 20 of the current year. That is, information on the average number of employees for 2013 must be received by the tax service on January 20, 2014. There are exceptions to the deadline for submitting this data, for example, if the company was recently registered, or the company was reorganized. Then the information must be provided no later than the 20th day of the month following the month of the establishment or reorganization of the enterprise. The terms are strictly regulated by clause 3 of Art. 80 tax code RF and clarified by the letters of the Federal Tax Service No. 25-3-05/512 dated 07/09/2007 and No. ChD-6-25/535 dated 07/09/2007.

Calculation formula

The annual average of employees is calculated by summing the average of employees for the months of the reporting year and dividing this amount by 12.

Calculation of TSC of employees for the month is made according to the following formula:

Monthly TMS = ∑Day TMS/K day, where

- "∑SCH per day" - the sum of the average headcount for each calendar day of the month

- "By day" - quantity calendar days this month.

Therefore, to calculate the average headcount for the year, the following formula is obtained:

AMS for a year = (∑ AMS for a month)/12, where

- "∑MSCh per month" - the sum of the average number of employees for all months of the reporting year.

The average headcount for the quarter is calculated as follows:

TSC per sq. = ∑ TSS per month. quarter/3, where

— “∑ TSS for the month. quarter" - the sum of the average headcount for all months of the quarter.

The calculation of the TSC of employees must be carried out by the entrepreneur himself (accountant of the enterprise) independently and then sent to the Federal Tax Service in the form of KND 1110018.

Form (sample)

When calculating, keep in mind that number of employees for a weekend or holiday, the weekday is equal to the working day before it. With several weekends or holidays in a row, the number of each of them will also be equal to the working day before them.

In whole units, the average headcount includes the following workers:

— those who actually showed up for work, including those who could not work due to downtime

- employees who were on business trips, in the event that they are kept wages in the organization

– employees on sick leave (during the entire time of illness before coming to work with a sick leave)

- who have taken walks

- employees on a part-time or part-time basis, also employed part-time. Accounted for each calendar day.

- located on good reason and with the permission of the administration on leave without pay,

employees who took part in various strikes

— who are studying in educational institutions, graduate schools and who are on study leave with the preservation of incomplete and full salaries

- located in additional and annual leave, which were provided in accordance with the legislation of the Russian Federation, labor and collective agreements. Also employees who are on leave with further dismissal

- received time off for work on a holiday or day off

- shift workers

Persons working part-time work time are accounted for in proportion to the time they have worked.

How to calculate?

Their average number is calculated as follows:

a) the number of worked man-days in total is calculated. The number of man-hours in total for the month of the report is divided by the duration of a full working day in a given enterprise (by 7.2 hours, or by 8 hours, or by 4.8 hours). Calculation formula:

To man.days \u003d ∑K man.h / T slave, where

- "T slave" - the time of the working day

— "∑K man-hours" - the number of man-hours in total for the reporting month

- "To man.days" - the total number of man-days worked by the employee

b) the average number of part-time employees for the month of the report is determined in terms of full-time employment. The number of man-days worked is divided by the number of working days in the reporting month according to the calendar. Calculation formula:

SCH incomplete. = To man.days / To workdays, where

- "SCH is incomplete." — average number of part-time employees per month of the report

- "By working days" - the number of working days of the month of the calendar report.

Keep in mind when calculating the FV of part-time employees that:

- Persons who are employed for part-time work at the initiative of management should be included in the calculation of the average number of employees as whole units;

— Employees who, according to the legislation of the Russian Federation, have an incomplete working time, incl. persons with disabilities should be counted as whole units in the AMS.

The average headcount does not include:

- performing work on civil law contracts

— lawyers

- Members of the armed forces performing military service

- owners of the enterprise who do not receive a salary

- members of the cooperative who did not conclude an employment contract

— transferred to work in another enterprise, without saving wages

- persons who are involved in work through special contracts with government organizations

— sent by the enterprise to study in educational institutions with a direct separation from work, receiving a scholarship at the expense of the enterprise

— hired from other enterprises part-time

Example of monthly average number of employees

The monthly TSC of the employees of LLC "Primer" for March 2014 is calculated. The organization has 20 employees, 16 of which have worked for a full month.

The monthly TSC of the employees of LLC "Primer" for March 2014 is calculated. The organization has 20 employees, 16 of which have worked for a full month.

Employee Ivanov P.S. was on sick leave from March 4 to March 11, he is included in the calculation as a whole unit for each day, because employees who did not show up for work due to illness are calculated in the SSC.

Petrov A.P. is an external part-time worker, so it is not included in the SSC.

Sidorova E.V. is on parental leave. This employee is not included in the SSC.

Sergeev I. D. worked the whole month only for 4 hours a day, when determining the AMS, he will be taken into account in proportion to his hours worked.

As a result, the monthly TMR of employees will be 16+1+20/31+4*31/8/31=16+1+0.7+0.5=18.2 people.

fines

The report on the average headcount is submitted to the tax office at the place of residence of the entrepreneur, i.е. at the place of registration of the organization or individual entrepreneur.

The report on the average headcount is submitted to the tax office at the place of residence of the entrepreneur, i.е. at the place of registration of the organization or individual entrepreneur.

For failure to provide information about the SSC, liability is provided in accordance with paragraph 1 of Art. 126 of the Tax Code, and entails a fine of 200 rubles.

Late delivery of information also entails a fine of 300 to 500 rubles.

The calculations themselves using the formulas do not present any particular difficulties, the main thing is to take into account all the nuances in specific cases, of which there are many in the average number.

Average number of employees is the average number of employees for certain period time.

As a rule, the average number of employees is calculated for the month, quarter and year.

The quarterly and annual calculation of the average number of employees is based on the monthly calculation of the average number of employees.

Who is obliged to submit information on the average number of employees to the tax office

The obligation to submit to the tax office at the end of the year information on the average number of employees is established by paragraph 3 of Art. 80 of the Tax Code of the Russian Federation. This report must be submitted by all organizations without exception.

As for entrepreneurs, they submit information only if they hired personnel in the reporting year.

Taxpayers whose average number of employees for the previous calendar year exceeds 100 people are required to submit tax returns (calculations) in tax inspections according to established formats in electronic format.

This procedure also applies to newly created (reorganized) organizations with a number of employees exceeding the specified limit.

In order to fulfill this provision, organizations (individual entrepreneurs who attracted in the specified period employees) must annually, no later than January 20, submit to tax authorities information on the average number of employees for the previous calendar year.

Newly created (reorganized) organizations submit such information no later than the 20th day of the month following the month in which the organization was created (reorganized).

Cases when you should calculate the average number of employees

The average number of employees should be calculated in the following cases.

1. In order not later than January 20 of the current year to submit to the IFTS at the location of the organization information on the average number for the past year.

This must be done annually.

If the organization submits information about the average headcount late, then the IFTS can impose two fines at once:

to an organization or individual entrepreneur- in the amount of 200 rubles;

for its head or chief accountant - in the amount of 300 to 500 rubles.

2. To know if organizations need to take tax reporting in the IFTS in electronic form (clause 3 of article 80 of the Tax Code of the Russian Federation).

3. To fill in the field "Average headcount" in the calculation in the RSV-1 PFR form.

4. To fill in the field "Number of employees" in the calculation in the form 4-FSS.

5. To calculate the amount of income tax (advance payment) paid at the location of a separate subdivision, if the organization uses the average headcount indicator for calculation (clause 2 of article 288 of the Tax Code of the Russian Federation).

The procedure for calculating the average number of employees

The average number of employees for any period (year, quarter, six months, 2 - 11 months) is calculated using the average number of employees for each month included in this period.

1. First you need to determine the payroll in full employed workers organizations for each calendar day of each month.

On working days, it is equal to the number of all employees with whom employment contracts have been concluded, taking into account all employees who did not show up for work due to temporary disability, as well as taking into account all employees on business trips and vacations.

In this case, it is not necessary to include in the calculation:

external part-timers;

employees who are on maternity leave or are on parental leave;

employees who are on unpaid study leave;

part-time workers who work part-time, i.e. work part-time or part-time work week.

The headcount for weekends and non-working holidays is equal to the headcount for the previous working day.

For example, an employee fired on Friday should be taken into account in the calculation of the headcount for the coming days: Saturday and Sunday.

Individuals working only under civil law contracts are not included in the calculation of the headcount.

The average number of employees per month is calculated by summing the number of employees on the payroll for each calendar day of the month, i.e. from the 1st to the 30th or 31st (for February - to the 28th or 29th), including holidays (non-working) and days off, and dividing the amount received by the number of calendar days of the month (28, 29, 30 or 31).

To do this, it is necessary to divide the sum of the average number of employees for the first, second, etc. until the last month of the period by the number of months in the period.

In this case, the result obtained must be rounded up to integer units: a value less than 0.5 is discarded, and 0.5 or more is rounded up to an integer unit.

Still have questions about accounting and taxes? Ask them on the forum "Salary and personnel".

Average number of employees: details for an accountant

- Who has the right to submit documents to the FSS on paper?

The average number of employees for all months of the calendar year is calculated. Determination of the average number of employees per year. The average number of employees for ... a year is determined by summing the average number of employees for all ...

- We consider the indicators of the average and average number of employees

Art. 80 of the Tax Code of the Russian Federation, taxpayers whose average number of employees in the previous calendar year exceeds ... the average number per month, to the average number of employees must be added the average number of external ... institutions are required to provide information on the average number of employees for the previous calendar year in ... the relevant fields are entered indicators on the average number of employees of the institution. When filling in the field "Reliability ...

- Separate subdivisions of UE and income tax

The arithmetic average of the share of the average number of employees (labor costs) ... which of the indicators to use - the average number of employees or the amount of payment costs ... 11 of the Tax Code of the Russian Federation, the average number of employees for tax purposes is calculated similarly to the average number of employees in the order ... number for the previous business day. The average number of employees is calculated on the basis of the payroll ...

- Compliance with labor laws: inspections are streamlined

Labor (M), which depends on the average number of employees employed by legal entity or ... ,5 - with an average number of employees less than 200 people; 0.7 - with an average number of employees from 200 ... to 499 people; 1 - with an average number of employees from 500 ... to 999 people; 1.5 - with an average number of employees over ...

- New categories will be quota in the Republic of Crimea

Jobs as a percentage of the average number of employees) for the employment of persons with disabilities ... employment of persons with disabilities in the amount of 3% of the average number of employees. Note! According to the Order of the Ministry of Labor ... employment of disabled people in accordance with the average number of employees in the following amounts: from 35 ...

- Income tax and VAT for separate divisions

... : by the residual value of depreciable property + the average number of employees of the EP; according to the residual value of the depreciable ... formula: where: A - specific gravity the average number of employees in the unit; F - the average number of ... depreciable property; A - the share of the average number of employees in the unit or the specific ...

- Innovations in conducting scheduled inspections of employers

Labor (M), which depends on the average number of employees employed by a legal entity or ..., 5 - with an average number of employees less than 200 people; 0.7 - with an average number of employees from 200 ... to 499 people; 1 - with an average number of employees from 500 ... to 999 people; 1.5 - with an average number of employees over ...

- The choice of a reduced tariff with the simplified tax system and not only

Insurance premiums at reduced rates); average number of employees for the reporting (calculation) period ..., conditions on the share of income and the average number of employees for the reporting (calculation) period, ... conditions on the share of income and the average number of employees for the period from 1 ... type of activity more than 90 %. The average number of employees of the organization is 30 people. Organization ... conditions on the share of income and the average number of employees for the reporting (billing) period, ...

The formation of an optimal staff is one of the priority tasks both for achieving business goals and for its manageability. Properly calculated number of staff allows you to achieve your goals and ensure compliance with the work and rest schedule of staff, taking into account the absence of some employees from work. In this article we will talk about how to determine the number of sales staff of the store.

The calculation is based on the rationing of labor, taking into account the planned absenteeism of employees at work. For this, the following formula is applied:

W \u003d H x K n,

- W - the required staffing level (excluding technical staff, for example, cleaners and loaders),

- H is the standard number of employees,

- K n - the planned coefficient of absenteeism of employees at work.

Definition of K n

This coefficient is calculated by the formula:

K n \u003d 1 + D n,

- D n - the share of non-working time in the total fund of working time according to production calendar. It is calculated as the sum of the employee's absenteeism hours divided by the total number of working hours in the specified period.

Let's define K n in the period from January to November. The number of non-working days will be 49 (28 days of planned vacations in accordance with the Labor Code of the Russian Federation + 7 days (standard leave without pay) +14 (standard sick leave)) or 392 hours with an 8-hour working week.

The share of non-working hours in the total amount of working time will be:

392 hours: 1,803 hours (according to the production calendar) = 0.22.

Thus, K n in the period January - November is 1 + 0.22 = 1.22.

K n in December is determined similarly. The number of non-working hours will be: 7 days (sick days) x 8 hours \u003d 56. Days \u003d 56 hours: 183 hours (according to the production calendar) \u003d 0.31.

Thus, K n in December = 1 + 0.31 = 1.31.

Calculation of the standard number (N)

The standard number (N) is determined by the formula:

H \u003d V / (F rv x H vyr x K vn),

- V - the planned scope of work in the accepted units of measurement;

- Ф RV - working time fund for the planned period, in hours;

- H vyr - the rate of revenue;

- To vn - the planned coefficient of compliance with the norms, which is defined as the ratio of the planned revenue of the corresponding period in 2009 to the actual revenue of the same period in 2008.

Suppose that stores are divided into 2 categories according to the rate of revenue, depending on the share of the book department in the area and turnover of the store:

Planning the number of personnel based on labor standards allows you to achieve the level of productivity that actually corresponds to the organizational and technical conditions.

Calculation based on population norms

population rate- the established number of employees of a certain professional and qualification composition required to perform specific production, managerial functions or the amount of work in the given organizational and technical conditions.

Despite the obvious ease of application, these norms also have some disadvantages, one of which is their relatively low accuracy. This is explained by the fact that when calculating the headcount norms, the most typical composition and scope of work for this category of personnel are taken into account. If the actual scope of work deviates from the typical, the accuracy of the result obtained decreases. Most often, the number norms are presented in the form of calculated dependencies or normative tables compiled on their basis. So, in the Intersectoral standards for the number of accounting employees, approved by order of the Ministry of Labor and social policy of Ukraine dated September 26, 2003 No. 269, normative tables and calculated dependencies are given for determining the number of accountants in enterprises with the number structural divisions from 3 to 120 and the number of employees from 10 to 20,000 people. The specified norms of the number take into account the preparatory-final time and time for rest and the personal needs of employees.

At enterprises with the number of employees from 5,100 to 10,000 people. and the number of structural units from 25 to 80, the standard number of accountants is determined as follows:

where Chrab - the number of employees of the enterprise (thousand people);

Npodr - number of structural subdivisions;

Kk.p.z - coefficient taking into account the proportion of accounting work that is performed using a computer. Determined by the table.

For each measurement range of the specified parameters, different calculated dependencies are used.

If the enterprise includes 47 structural divisions, which employ 5350 people, and 75% of the work in the accounting department is performed using a computer, then the standard number of accounting employees is:

In this case, the standard number is calculated taking into account typical types of accounting work. If the types of such work at the enterprise differ from the typical ones, the accuracy of the result will decrease. Therefore, the Intersectoral Standards for the Number of Accounting Employees also provide time standards for accounting work, which fully allow taking into account the specifics of each particular enterprise.

Calculation based on norms of time

Norm of time- the amount of working time spent to perform one unit of work by an employee or a group of employees (team) of the appropriate qualification in the given organizational and technical conditions. With sufficient coverage of the rationing of the work performed, the use of time standards gives an accurate and objective result for calculating the number of personnel. An increase in the proportion of work not covered by the regulation introduces a growing error, since such work is usually taken into account by an expert (evaluative) way.

Based on the norms of time, the standard number of personnel is calculated as follows:

where To - total labor costs for the amount of work of the planned period (shift, month, year, etc.), man / hour;

Fr.v - working time fund for the planned period, h;

Total labor costs for the scope of work of the planned period:

where Тp i- time spent on each individual ( i th) type of work, person/hour (if the time norms used do not include time spent on rest and personal needs of employees, then Tp i = T i(1 + Koln / 100), where Koln is the percentage of loss of working time, from 1 to 15%, depending on the category of workers, for recreation and personal needs);

K is a coefficient that takes into account the laboriousness of work that is not covered by rationing or is of a one-time nature. K = 1 + % abnormal works / 100;

Hb n- standard time for this species works, man/h;

O n- the scope of this type of work.

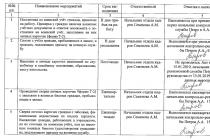

Consider an example of calculating the number of accountants involved in payroll accounting. The types and scope of such work are given in tab. 1. The planned rate of compliance with the norms Kv.n = 100, the coefficient of work not covered by the rationing, K = 1.03, the working time fund for 2004 - 2012 hours. More than 90% of the work is performed on a computer (Kk.p.z = 1.0 ).

![]()

|

Table 1. Types and scope of work on payroll accounting |

|||||

|

Types of jobs |

Unit measurements |

Norm time, person/h |

Scope of work in a year |

labor input, person/h |

|

| Calculation of wages to employees for work performed | 1 position in the statement | 0,15 | 350 x 12 = 4200 | ||

|

Income tax withholding |

350 x 12 = 4200 |

||||

|

Pension fund deductions |

350 x 12 = 4200 |

||||

|

Withholding to the fund social insurance in case of temporary disability |

350 x 12 = 4200 |

||||

|

Unemployment Social Security Deductions |

350 x 12 = 4200 |

||||

|

Deductions on writ of execution |

|||||

|

Withholding union dues |

315 x 12 = 3780 |

||||

| Total | |||||

Thus, the standard number of employees of the accounting department of the enterprise, determined on the basis of the planned scope of work and time standards, is 1.84 people. The headcount of this category of workers with the absenteeism coefficient Kn = 1.10 is:

Calculation based on production rates

Production rate- the established amount of work (number of units of production) that an employee or a group of employees (team) of appropriate qualifications are required to perform (manufacture, transport, etc.) per unit of working time in given organizational and technical conditions. The rate of production is the reciprocal of the rate of time.

The calculation of the number of personnel based on production standards gives a fairly objective and accurate result. This uses the formula:

![]()

Where V- the planned scope of work in the accepted units of measurement;

Fr.v - working time fund for the planned period, hours;

Nvyr - production rate in accepted units of measurement;

Kv.n - planned coefficient for the implementation of standards.

Suppose working programm the enterprise provides for cutting 108,000 blanks per year. The local production rate per worker is 8 billets per hour. The planned rate of compliance with the norms is 1.1. The working time fund for 2004 - 2012. The standard number of workers producing this type of blanks is:

![]()

Calculation based on service rates

Service rate- the number of production facilities (pieces of equipment, jobs, livestock, etc.) that an employee or a group of employees (team) of appropriate qualifications are required to service per unit of time in given organizational and technological conditions.

At its core, the service rate is equivalent to the production rate for the service function. Therefore, service time standards are often developed. For example, for cleaners (service function), both the area of the room to be cleaned (service rate) and the time for cleaning 1 m2 (service time rate) can be set.

The standard number of employees based on service standards is calculated by the formula:

where O i- volume of work performed i-th type;

Ho i- service standards for i-th type of work;

K is a coefficient that takes into account the time for performing auxiliary functions, as well as rest and personal needs of employees.

![]()

Where a1- time to perform auxiliary functions,%;

a2- time for rest and personal needs of employees, %.

When using service time standards, the standard number of employees is determined as follows:

Where T n.o - the norm of service time for the entire complex of work performed for the planned period (year, month, shift, etc.);

Ф - fund of working time of the planned period.

Where T n i- the rate of service time for certain types works;

K is a coefficient that takes into account the time for performing auxiliary functions, as well as rest and personal needs of employees.

![]()

Where ti- the rate of service time per unit of work;

Vi- the amount of work performed for each type;

qi- the average repeatability of work for each type.

Consider an example of calculating the standard number of cleaners cleaning the lobby, corridors and toilets. Maintenance rates and maintenance times for these types of work are given in tab. 2 and are determined on the basis of the Norms of time for cleaning office and cultural premises (2001).

Assume that cleaners daily sweep and mop 1300 m2 of floors in the foyer and corridors of an office building, 250 m2 of floors in stairs and stairwells, and mop 60 m2 of floors in toilets twice per shift in a single shift. At the same time, the norm of time for performing auxiliary functions is 3%, the norm of time for rest and personal needs of employees is 2%.

![]()

When calculating the standard number of personnel based on service standards

When calculating the standard number of personnel based on the norms of service time

![]()

Thus, the standard number of cleaners performing the specified work should be 3.06 people.

When calculating both the standard and staffing levels, results are often obtained that are expressed as fractional numbers, which must be rounded off. In practice, it is customary to operate with staff units of at least 0.25 rates. The calculation results serve as the basis for the adoption of specific management decisions for the formation personnel enterprise and its staffing.

Such a value as the average number of the organization is a fairly important aspect of the organization's report to the tax authorities.

The above indicator for the period we have chosen can be obtained as follows: we find the sum of the average number of employees for all months of the period we have chosen, divided by their total number. So, the average number of employees - how to calculate?

To simplify the calculations, we divide the entire calculus algorithm into four simple steps:

So let's get started: first, we will need to determine the average number of fully employed employees of the organization. To do this, you need to decide who directly relates to those.

In a broad sense, this is the totality of all employees of the organization. This also includes those employees who are at that moment in time, as well as employees who are on business trips.

When making calculations, the following groups of employees are not taken into account:

- located;

- located;

- who are on unpaid study leave;

- part-time employees (namely, those working, subject to agreement directly with their employer, not full-time or not a whole week, except for those employees for whom such reductions are provided for at the legislative level - for example, those who work during harmful conditions labor).

After we have decided on the basis for making calculations, we proceed directly to the calculations - on working days the number is equivalent to the totality of employees of the enterprise with whom there are employment contracts.

for weekends and public holidays the average number is taken as of the last working day preceding the non-working day.

The formula for calculating the average headcount

Consider how to calculate the average number of employees per month.

Consider how to calculate the average number of employees per month.

Let's proceed directly to the calculations themselves, using the formula:

Average number of full-time employees per month = (average number of fully-employed employees on the 1st day of the month + average number of fully-employed employees on the 2nd day of the month + ... + average number of fully-employed employees on nth number month)/number of calendar days in a month, where n is the last day of the given month.

Thus, after receiving the first value for subsequent use in the format of the desired data, we proceed to the second step.

When performing the second step, it is necessary to calculate the average number of part-time employees. To obtain the final value for calculating this value for the period we need, it should be calculated for each month.

Let's use the formula:

The average number of part-time employees per month = the sum of the hours that they worked within one month / (duration of a normal working day (in hours) * number of working days in a month).

When calculating, you should also take into account the working days falling on the period sick leave or leave of absence of any such employee. These days are counted in the number of hours worked on the last working day before the occurrence of one of these events.

Based on the results of the calculations, you can calculate the average number of employees per month. It will be equal to the sum of the average number of full-time employees for the month and the average number of part-time employees for the same month.

Thus, the final formula takes the following form:

The average number of employees for the period = (the average number of employees for the 1st month + the average number of employees for the 2nd month + the average number of employees for nth month)/ number of months in the period,

where n is the last month in order in the selected period.

In all calculations, the results are reduced to integer units by the method of mathematical rounding.

Calculation examples

Now that we have mastered the theoretical material on the calculation, let's try to put our knowledge into practice by considering the following example:

The duration of the working week in the organization is five working days, eight hours a day. Next, select any date, let's say 05/01/2015.

According to existing employment contracts The organization employs 45 people:

- 38 of them are busy during the whole working day;

- three employees perform work as external part-timers;

- four are employed part-time. In May 2015, they worked for the entire month in total 406 hours.

On May 26, 2015, one employee left the organization.

Let's say that the month of May 2015 has 15 working days.

Now, when all the conditions necessary for us to calculate the desired value are stipulated, let's move on to its search:

The average number of employees for May 2015 will look like:

- List number of fully employed employees:

— from May 1 to May 25 (25 days) — 38 people;

— from May 26 to May 31 (6 days) — 37 people. - The average number of fully employed workers in June will be 32.96 people. 25 days * 38 people + 6 days x 37 people) / 31 days = 32.96 people.

- The average number of part-time employees will be 406 hours / (8 hours x 15 days = 3.38 people.

- The average number of all employees for May 2015, taking into account rounding, will be 36 people (32.96 + 3.38).

Ability to analyze and calculate key indicators is an essential quality modern leaders any level. This article will allow you to replenish the baggage of theoretical knowledge intended for practical application, about such an important indicator of the organization's life as the average number of employees.