Variable costs are the company's expenses spent on the production or sale of goods and services, the amount of which varies depending on the volume of production. This indicator is used to calculate the possibility of reducing the costs of the enterprise.

The main purpose of calculating variable costs

Any economic indicator serves a single goal - to increase the profitability of the enterprise. Variable costs are no exception. They allow you to analyze the company's activities and develop a strategy to increase profitability. Accordingly, this indicator is absent in the balance sheet, since it is needed not for accounting, but for management accounting.

Important! A clear distinction should be made between fixed and variable costs. The first are those whose amount does not change for a long time. For example, office rent, tuition fees, retraining of employees of the enterprise and other fixed costs.

The main types of variable costs

First of all, variable costs are divided into two main subgroups:

- Direct- these are expenses that are directly related to the cost of goods (services). For example, the cost of materials, wages, etc.

- Indirect- these are expenses related to the cost of a group of goods (services). For example, general factory, general warehouse and other types of general costs that affect the cost of all goods or their individual groups.

Some businessmen believe that variable costs are proportional to the volume of production. However, this is not always the case. According to the volume of production, variable costs are divided into three types:

- Progressive. This is a type of cost in which costs increase faster than the growth in sales or production of goods.

- Regressive. With this type of cost, the costs lag behind the pace of production or sales.

- Proportional. This is precisely the case when the increase in costs is directly proportional to the increase in production volumes.

Consider an example of changing variable costs by volume of production:

You can also distinguish the type of costs by interconnection with the production process:

- Production costs are costs that are directly related to the goods produced. For example, raw materials, consumables, energy, wages, etc.

- Non-production costs are costs that are not directly related to the production of products. For example, transportation, storage, commission payments to dealers and other types of indirect costs.

Accordingly, variable costs include:

- Piecework bonus payments to employees (bonuses, commissions, percentages of sales, etc.);

- travel and other related payments;

- costs of storage, transportation and warehousing of goods;

- outsourcing and other types of services used to service production;

- taxes for the manufacture and / or sale of goods and services;

- payment for fuel, energy, water and other utility bills;

- the cost of purchasing raw materials and Supplies for the production of products.

Detailed instructions for calculating variable costs

To calculate costs, you need to determine the material costs for the production of products. This is done on the basis of the following documents:

- reports on the write-off of raw materials, consumables and other materials for the production of goods;

- acts of work performed on the main and auxiliary production processes;

- reports of outsourcing companies involved in the production of products;

- returns for waste materials.

Important! Into the amount material costs data are included only for the first three items from this list. The last point (on the return of waste) is deducted from the amount of costs.

Then you need to determine the amount of costs for paying the variable part of salaries to employees of the enterprise. This includes premiums, interest, commissions, allowances, payments to the Social Insurance Fund and other types of additional payments.

Based on the data on actual consumption and prices set in the region of production, the amount of costs for utility costs and fuel is determined.

After that, the sum of the costs for packaging, storage and delivery of products is calculated. This can be done on the basis of internal documents of the company or reports of third parties responsible for these stages of work.

After all this, the amount of tax costs is determined on the basis of declarations or accounting reports of the company.

Important! Please note that reducing the variable costs of taxes, fees and other obligatory payments is possible only if appropriate changes are made to federal or regional legislative acts. However, in the calculation they must be taken into account without fail.

Formula for calculating variable costs

The easiest way to calculate variable costs is to simply add up all the costs and then divide by the volume of goods produced during the analyzed period of time. The calculation formula is:

PI \u003d (VI¹ + VI² + VI∞) ÷ OP, Where:

- PI - variable costs;

- VI - type of costs (fuel, taxes, bonuses, etc.);

- OP is the volume of production.

Variable Cost Example

In 2017, Romashka LLC spent on the production and sale of products:

- 350 thousand rubles for the purchase of materials;

- 150 thousand rubles for packaging and storage of goods;

- 450 thousand rubles to pay taxes;

- 750 thousand rubles for piecework bonus payments to employees.

Accordingly, the total amount of variable costs amounted to 1.7 million rubles. (350 thousand rubles + 150 thousand rubles + 450 thousand rubles + 750 thousand rubles). The volume of production amounted to 500 thousand units of goods. Accordingly, the variable costs per unit of production amounted to:

RUB 1.7 million ÷ 500 thousand units = 3 rubles 40 kop.

The manual is presented on the website in an abbreviated version. IN this option tests are not given, only selected tasks and high-quality tasks are given, theoretical materials are cut by 30% -50%. I use the full version of the manual in the classroom with my students. The content contained in this manual is copyrighted. Attempts to copy and use it without indicating links to the author will be prosecuted in accordance with the legislation of the Russian Federation and the policy of search engines (see the provisions on the copyright policy of Yandex and Google).

10.11 Types of costs

When we considered the periods of production of the firm, we said that in the short run the firm may not change all the applied factors of production, while in long term all factors are variable.

It is these differences in the ability to change the volume of resources with a change in the volume of production that led economists to break down all types of costs into two categories:

- fixed costs;

- variable costs.

fixed costs(FC, fixed cost) - these are those costs that cannot be changed in the short run, and therefore they remain the same with small changes in the volume of production of goods or services. Fixed costs include, for example, rent for premises, costs associated with the maintenance of equipment, repayment of previously received loans, as well as various administrative and other overhead costs. Let's say build new plant for oil refining within a month is impossible. So if next month oil company plans to produce 5% more gasoline, this is possible only at the existing production facilities and with the existing equipment. In this case, a 5% increase in output will not lead to an increase in the cost of equipment maintenance and maintenance of production facilities. These costs will remain constant. Only the amounts of wages paid, as well as the costs of materials and electricity (variable costs) will change.

Schedule fixed costs is a horizontal line

Average fixed costs (AFC, average fixed cost) are fixed costs per unit of output.

variable costs(VC, variable cost) are those costs that can be changed in the short term, and therefore they grow (decrease) with any increase (decrease) in production volumes. This category includes costs for materials, energy, components, wages.

Variable costs show such dynamics from the volume of production: up to a certain point they increase at a killing pace, then they begin to increase at an increasing pace.

The variable cost schedule looks like this:

Average variable cost (AVC) is the variable cost per unit of output.

The standard Average Variable Cost Chart looks like a parabola.

The sum of fixed costs and variable costs is total cost (TC, total cost)

TC=VC+FC

Medium total costs(AC, average cost) is the total cost per unit of output.

Also, average total costs are equal to the sum of average fixed and average variables.

AC = AFC + AVC

AC graph looks like a parabola

A special place in economic analysis occupy marginal cost. Marginal cost is important because economic decisions usually involve marginal analysis of available alternatives.

Marginal cost (MC) is the incremental cost of producing an additional unit of output.

Since fixed costs do not affect the increment in total costs, marginal cost is also an increment in variable costs when an additional unit of output is produced.

As we have already said, formulas with a derivative in economic tasks are used when smooth functions are given, from which it is possible to calculate derivatives. When we are given separate points (discrete case), then we should use formulas with ratios of increments.

The marginal cost graph is also a parabola.

Let's plot the marginal cost graph together with the graphs of average variables and average total costs:

In the above graph, you can see that AC always exceeds AVC because AC = AVC + AFC, but the distance between them gets smaller as Q increases (because AFC is a monotonically decreasing function).

You can also see on the chart that the MC chart crosses the AVC and AC charts at their lows. To substantiate why this is so, it suffices to recall the relationship between average and marginal values already familiar to us (from the “Products” section): when the marginal value is below the average, then the average value decreases with an increase in volume. When the limit value is higher than the average value, the average value increases as the volume increases. Thus, when the limit value crosses the mean value from the bottom up, the mean value reaches a minimum.

Now let's try to correlate the graphs of the general, average, and limit values:

These graphs show the following patterns.

The manual is presented on the website in an abbreviated version. In this version, tests are not given, only selected tasks and high-quality tasks are given, theoretical materials are cut by 30% -50%. I use the full version of the manual in the classroom with my students. The content contained in this manual is copyrighted. Attempts to copy and use it without indicating links to the author will be prosecuted in accordance with the legislation of the Russian Federation and the policy of search engines (see the provisions on the copyright policy of Yandex and Google).

10.11 Types of costs

When we considered the periods of production of a firm, we talked about the fact that in the short run the firm may not change all the factors of production used, while in the long run all factors are variable.

It is these differences in the ability to change the volume of resources with a change in the volume of production that led economists to break down all types of costs into two categories:

- fixed costs;

- variable costs.

fixed costs(FC, fixed cost) - these are those costs that cannot be changed in the short run, and therefore they remain the same with small changes in the volume of production of goods or services. Fixed costs include, for example, rent for premises, costs associated with the maintenance of equipment, repayment of previously received loans, as well as various administrative and other overhead costs. For example, it is impossible to build a new oil refinery within a month. Therefore, if an oil company plans to produce 5% more gasoline next month, then this is possible only at existing production facilities and with existing equipment. In this case, a 5% increase in output will not lead to an increase in the cost of equipment maintenance and maintenance of production facilities. These costs will remain constant. Only the amounts of wages paid, as well as the costs of materials and electricity (variable costs) will change.

The fixed cost schedule is a horizontal straight line.

Average fixed costs (AFC, average fixed cost) are fixed costs per unit of output.

variable costs(VC, variable cost) are those costs that can be changed in the short term, and therefore they grow (decrease) with any increase (decrease) in production volumes. This category includes costs for materials, energy, components, wages.

Variable costs show such dynamics from the volume of production: up to a certain point they increase at a killing pace, then they begin to increase at an increasing pace.

The variable cost schedule looks like this:

Average variable cost (AVC) is the variable cost per unit of output.

The standard Average Variable Cost Chart looks like a parabola.

The sum of fixed costs and variable costs is total cost (TC, total cost)

TC=VC+FC

Average total cost (AC, average cost) is the total cost per unit of output.

Also, average total costs are equal to the sum of average fixed and average variables.

Costs. Production cost formulas

AC = AFC + AVC

AC graph looks like a parabola

A special place in economic analysis is occupied by marginal costs. Marginal cost is important because economic decisions usually involve marginal analysis of available alternatives.

Marginal cost (MC) is the incremental cost of producing an additional unit of output.

![]()

Since fixed costs do not affect the increment in total costs, marginal cost is also an increment in variable costs when an additional unit of output is produced.

![]()

As we have already said, formulas with a derivative in economic problems are used when smooth functions are given, from which it is possible to calculate derivatives. When we are given separate points (discrete case), then we should use formulas with ratios of increments.

The marginal cost graph is also a parabola.

Let's plot the marginal cost graph together with the graphs of average variables and average total costs:

In the above graph, you can see that AC always exceeds AVC because AC = AVC + AFC, but the distance between them gets smaller as Q increases (because AFC is a monotonically decreasing function).

You can also see on the chart that the MC chart crosses the AVC and AC charts at their lows. To substantiate why this is so, it suffices to recall the relationship between average and marginal values already familiar to us (from the “Products” section): when the marginal value is below the average, then the average value decreases with an increase in volume. When the limit value is higher than the average value, the average value increases as the volume increases. Thus, when the limit value crosses the mean value from the bottom up, the mean value reaches a minimum.

Now let's try to correlate the graphs of the general, average, and limit values:

These graphs show the following patterns:

Accurate calculation of variable costs based on financial statements

Natalya Belorusova,

Leading Economist, LLC PVP "Contact"

CFO

№10 (98) October 2010

During the analysis of his financial statements financiers of PVP "Contact" found a way to more accurately calculate the variable costs of a trading company. All it took was the official balance sheet and income statement.

The production and development enterprise "Kontakt" specializes in the supply of medical and dental equipment.

Calculation of production costs

Branches of the enterprise operate in four cities of the Siberian region.

Despite the fact that the company "Contact" was founded almost 20 years ago, in 1992, a full-fledged financial service created only three years ago. Now this service includes not only accounting, but also the planning and economic department. The main reason for the creation of such a financial unit was the increase in the scale of the business and, as a result, the need to monitor its financial condition.

One of the primary tasks of the financiers was the calculation and analysis of indicators such as marginal income, break-even point, as well as determining the achievable business growth rates*. Interestingly, the company has no management accounting was not done. Therefore, only accounting data had to be used. In particular, limit yourself to the balance sheet and income statement. Due to the lack of information, a number of problems arose in the company related to the calculation of the previously mentioned indicators. As it turned out, due to the peculiarities of accounting, it is impossible to clearly distinguish between fixed and variable costs of the company. Now about everything in order and in detail - how the company solved the listed problems.

The specifics of accounting for the costs of transportation of goods

Since the main activity of PVP "Contact" is wholesale, variable costs include the cost of goods and transportation and procurement costs, with the correct assessment of which certain difficulties arose. The fact is that these costs could be both attributed to the cost of goods, and included in selling expenses.

Table 1. A fragment of the income statement for the month (accounting and management accounting), rub.

Table 2. Deviations financial indicators when using accounting and management (adjusted) data

In the first case, the delivery of goods is highlighted in a separate line in the bill of lading. In accordance with accounting policy companies fare are immediately charged to the cost of goods (account 41 “Goods”) and automatically become part of the cost of goods (line 021 “Including goods” in the income statement).

But transportation costs can also be presented as a separate act. For example, if the delivery was not provided by the supplier of the goods, but by some third-party carrier. Such costs are accumulated on account 44 "Sales costs" and then written off to the expenses of the period in proportion to the volume of goods sold.

Consequently, the cost of goods reflected in Form No. 2 (profit and loss statement) includes only part of the transportation costs.

Company information

LLC Production and Innovation Enterprise "Kontakt" was founded in 1992 in Krasnoyarsk. The main activity of the enterprise is wholesale trade in medical equipment, dental equipment, orthopedic products, pharmaceutical and medical supplies. PVP is one of the largest representatives of the Chirana-Dental, Chirana-Medical, EKOM factories, as well as the dealer of Bien-Air, NTI, Medin, etc. The staff is 150 people, the trade turnover is more than 500 million rubles a year. The company has four trading branches. The first is in Abakan (Republic of Khakassia), the second is in Irkutsk (Irkutsk region), the third and fourth are in Achinsk and Lesosibirsk (Krasnoyarsk Territory). Average headcount The company's employees are about 150 people.

Technique for determining variable costs

To allocate the amount of variable transportation costs, which, due to certain accounting nuances, fell into the composition of commercial expenses, the following formula was used at the Kontakt production and development enterprise:

Write-off of transport costs = Balance of transport costs at the end of the period: Balance of goods at the end of the period x Write-off of goods,

Where Balance of transportation costs at the end of the period- this is the debit balance on account 44 "Sale Expenses", which in the case of PVP "Contact" is reflected in the balance sheet (p. 213). In some organizations, the balance of account 44 may be reflected in the line “Other inventories and expenses” (p. 217);

—Balance of goods at the end of the period is the string " Finished products and goods for resale” of the balance sheet (p. 214). In the case of trading companies, as a rule, only goods for resale are reflected in it;

—Write-off of goods for the period reflected in the line "Cost of goods sold" (line 021) in the income statement.

Perhaps, it is worth warning right away that it is not possible to accurately distinguish the costs of transporting goods from the composition of commercial expenses, having only annual or quarterly financial statements. And the company "Contact" had to make sure of this on own experience. The fact is that the error in the calculations turns out to be too significant. This is especially pronounced in situations where during the year specific gravity transport costs as part of the cost varies significantly.

Therefore, in such cases it will be more correct to use the data of the monthly interim financial statements. That is exactly what they did in the PVP "Contact".

By the way, with this approach, it will not be difficult to determine the amount of adjustments for the entire year. To do this, it is quite enough to sum up the previously calculated monthly write-offs of transport costs.

After the write-offs (adjustments) of transportation costs are determined to obtain the correct figures in the income statement, the adjustments are included in the cost of goods sold. And at the same time, they should be excluded from commercial expenses. Example

Example

For a trading company, according to the balance sheet, the balance of transportation costs at the end of the month was 1,342 rubles, the balance of goods at the end of the period was 106,965 rubles, and the cost of goods sold, appearing in the income statement, was 31,506 rubles.

Accordingly, the amount of the adjustment for transportation costs will be 395 rubles. (1342: 106965 x 31506). The income statement before and after the adjustment is presented in table 1 on page 41. Significant changes are visible to the naked eye. The deviation in terms of gross profit reaches almost 6 percent, according to contribution margin- more than 9 percent and in terms of financial strength - 8 percent.

What did the fixes affect?

Differences in financial indicators of accounting and management accounting (before and after adjustments) reached 9 percent. And this despite the fact that often even less significant deviations can give more serious errors in the calculation of indicators that are significant for the management of the company.

In conclusion, it should be said that the methodology for determining variable costs and calculating basic financial indicators used in the PVP "Contact" may well be adopted in other trading companies. Provided that their variable costs include mainly the cost of the product and the cost of transporting it. This will allow management to operate with more accurate data in their work.

Marginal Cost Formula

The concept of marginal cost

The marginal cost formula is calculated as the ratio of the increase in total cost to the increase in the quantity of goods.

How to calculate costs?

Also, the marginal cost formula is determined by the ratio of the increase in variable costs (the change in the sum of total costs is equal to the change in the variable costs of each additional unit) to the increase in the quantity of goods.

Types of costs

Each company, in its quest to maximize profits, bears the cost of acquiring production factors, while striving to achieve the level of production of a given volume of products with the lowest costs.

The enterprise cannot influence the price of resources, but knowing the dependence of the volume of production on the number of variable costs, the costs are calculated.

In accordance with the organization, expenses are classified into groups:

- Individual expenses for a specific company,

- Public Expenditures - Output Costs a certain kind products carried by the entire economy,

- opportunity cost,

- Production costs, etc.

Also, costs are classified into 2 groups:

- Fixed costs include the investment of funds in order to ensure stable production. This type the cost is constant and does not depend on the production volume;

- Variable costs include costs that are subject to easy adjustment, without causing damage to the activities of the enterprise (they change in accordance with production volumes).

Marginal Cost Formula

Marginal cost is the change in the total cost of the enterprise in the process of producing each additional unit of goods.

The formula for marginal cost is as follows:

MS = TC / Q

Here, TC is the increase (change) in total costs;

Q - increase (change) in the volume of output of goods.

To calculate the increase in total costs, the following formula is used:

TC = TC2 - TC1

To calculate the change in output, the following equation is used:

Q = Q2 - Q1

Substituting these equalities into the marginal cost formula, we obtain the following formula:

MS \u003d (TC2 - TC1) / (Q2 - Q1)

Here Q1, T1 are the initial amount of output and the corresponding amount of costs,

Q2 and TC2 are the new quantity of output and the corresponding cost.

The meaning of marginal cost

The calculation of the marginal cost makes it possible to determine the degree of benefit of producing each additional unit of goods.

Marginal cost is an important economic tool that guides strategy industrial development. The level of marginal cost makes it possible to show the volume of production at which the company needs to stop to get the maximum amount of profit.

In the case of an increase in production and sales, the costs of the enterprise change as follows:

- Uniform change says that marginal cost is constant, equal to variable cost per unit of output;

- The accelerated change reflects an increase in marginal cost with an increase in output;

- Slow change shows a decrease in the firm's marginal cost if its costs of purchased raw materials decrease with an increase in output.

Examples of problem solving

Analysis of indicators of tax costs and tax burden

The problem of optimizing the tax burden for our economy is one of the most urgent. If the tax system does not stimulate the development of business, and especially in the sphere of production, then the expected economic recovery will not happen. In this regard, it should be noted the positivity of the changes made to the domestic tax system by the new Tax Code. However, concrete results can be assessed after a few years. An assessment of the current tax burden on an enterprise is given on the example of one of manufacturing enterprises Orenburg region.

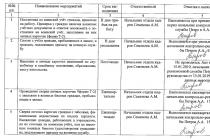

Table 1 - Structure calculation tax costs

| Indicators | Base year | Reporting year | ||

| Amount (million rubles) | Oud. weight % | Amount (million rubles) | Oud. weight % | |

| Taxes reimbursed through the price of products (indirect taxes) – total: incl. VAT, etc. | 41,1 34,9 | 40,2 35,6 | ||

| Taxes reimbursed through prime cost, total: including: - Land tax - Tax on road users - Unified social tax, etc. | 5,5 6,5 4,2 | 32,9 3,4 4,4 2,9 | 5,5 8,0 4,4 | 33,9 3,2 4,6 2,5 |

| Taxes attributable to financial results– total: including: – Property tax, etc. | 4,1 4,1 | 4,1 3,4 | ||

| Taxes refundable on account net profit– total: including: – Income tax – Payments for excess emissions of pollutants in environment etc. | 21,9 17,1 4,8 | 21,8 17,2 4,6 | ||

| Total tax costs |

The calculations in table 11.1 showed that most of the taxes - more than 40% - are indirect taxes. The latter include mainly VAT. The second place in the composition of tax costs is occupied by taxes attributable to production costs, which make up about 33%. The share of taxes attributable to the net profit of the enterprise is also significant - more than 20%.

The role of various groups of tax costs depends on the specifics of production, industry and other factors, but overall picture their structure is typical for most of them, which is confirmed by the results of our study.

Outstripping growth in sales revenue, profit and financial resources(balance currency) in comparison with the growth of tax costs contributed to the reduction of the tax burden on gross profit, financial resources and sales, both in terms of general and particular indicators (Table 11.2).

Table 11.2 - Data for calculating the tax burden on the enterprise

However, the increase in the mass of tax costs significantly weakened the positive trends, and in terms of net profit and the number of employees showed an increase in the tax pressure (Table 11. 3).

The insufficient size of the net profit of the enterprise is the reason that more than 80% of its amount goes into tax payments. The growth in sales volumes contributed to the fact that the tax burden on income decreased, however, it exceeds 50% of the amount of income and sales proceeds, which reduces the interest of entrepreneurs in business development.

Table 11.3 - Calculation of the tax burden on the enterprise

| Indicators | Base year | Reporting year | Adjusted rate | Deviation | ||

| general | including at the expense | |||||

| amounts of taxes (tax costs) | sources of tax refunds or enterprise resources | |||||

| Indicators of the total tax burden on the enterprise in % in relation to the indicators of: a) income b) sales c) financial resources d) profit before tax e) per 1 employee f) net profit | +1 -2 -8 -25 +8 +22 | +8 +8 +10 +35 +10 +63 | -7 -10 -18 -60 -2 | |||

| Partial indicators of the tax burden by sources of covering tax costs (%): a) sales b) cost c) profit before tax d) net profit | -2 +1 -1 +4 | +2 +5 +1 +13 | -4 -4 -2 -9 |

Therefore, constant research is needed to assess the tax burden on the basis of reporting data. changes in tax legislation significantly change the tax burden on the enterprise.

Changes made to the tax legislation in 2002 were aimed at reducing the income tax rate to 24% from 35% in 2001. However, as the calculations in Table 11.3 show, this did not significantly reduce the overall tax burden. So, in relation to income, the load increased by 1%, and to net profit by 22%. These changes are due to the fact that the growth rate of tax costs outpaced the growth rate of income and net profit. The high increase in tax costs, including income tax, is due to the rigidity tax system in terms of penalties and fines for violation of tax laws, as well as an increase in the number of costs not taken into account when forming the taxable base for income tax. In this regard, the company's profit generated in accordance with the Accounting Regulations is significantly lower than the profit generated for tax purposes in accordance with the requirements of Chapter 25 of the Tax Code "Corporate Income Tax".

The decrease in the tax burden at the enterprise under study took place in terms of the load on the balance sheet total amount of the enterprise's financial resources, sales revenue, profit before tax. main reason This decrease is due to the fact that the growth rates of tax costs lagged behind the growth rates of the listed indicators. Consequently, expanding the volume of activities and increasing investment in the business potentially reduces the tax burden. Factor analysis it is confirmed by the importance of these findings: due to the growth of income, the tax burden decreased by 7 points, revenue - by 10, financial resources - by 18, and profit before tax - by 60.

Private indicators of the tax burden had ambiguous changes. The increase in taxes attributable to prime cost is due to the increase in taxable bases: revenue, wages, and others. A significant decrease in net profit as a result of the payment of penalties to the budget for violation of tax laws led to the fact that the withdrawal of net income increased from 80 to 84%. Thus, in practice, a reduction in tax rates does not always lead to a reduction in the tax burden.

Task number 71. Cost calculation

A study of the reasons for the growth of violations of tax laws at individual enterprises showed that they can be caused by frequent changes, inconsistency with other regulations, insufficient competence of employees of the accounting department of the enterprise. This requires increased control by the administrative apparatus over the timeliness of budget settlements, as well as the involvement of auditors in order to correct errors in accounting in a timely manner.

Along with this, at the level of legislators, the simplification of the tax system is required. Practice has shown that the new tax code until this problem is solved. On the contrary, experts note a significant complication of tax legislation and the strengthening of its fiscal function.

10. The concept and classification of costs.

Costs of production - the cost of purchasing economic resources consumed in the process of issuing certain goods.

Any production of goods and services, as you know, is associated with the use of labor, capital and natural resources, which are factors of production, the cost of which is determined by production costs.

Due to the limited resources, the problem arises of how best to use them from all the rejected alternatives.

Opportunity costs are the costs of issuing goods, determined by the cost of the best lost opportunity to use production resources, ensuring maximum profit. The opportunity cost of a business is called economic cost. These costs must be distinguished from accounting costs.

Accounting costs differ from economic costs in that they do not include the cost of factors of production owned by firm owners. Accounting costs are less than economic costs by the amount of implicit earnings of the entrepreneur, his wife, implicit land rent and implicit interest on equity the owner of the firm. In other words, accounting costs are equal to economic costs minus all implicit costs.

Variants of classification of production costs are diverse. Let's start by distinguishing between explicit and implicit costs.

Explicit costs are opportunity costs that take the form of cash payments to owners of production resources and semi-finished products. They are determined by the amount of expenses of the company to pay for the purchased resources (raw materials, materials, fuel, work force and so on.).

Implicit (opportunity) costs are the opportunity costs of using resources that are owned by the firm and take the form of lost income from the use of resources owned by the firm. They are determined by the cost of resources owned by the firm.

The classification of production costs can be carried out taking into account the mobility of production factors. There are fixed, variable and general costs.

Fixed costs (FC) - costs, the value of which in the short period does not change depending on changes in the volume of production. These are sometimes referred to as "overhead costs" or "sunk costs". Fixed costs include the costs of maintaining production buildings, purchasing equipment, rent payments, interest payments on debts, salaries of management personnel, etc. All these costs must be financed even when the company does not produce anything.

Variable costs (VC) - costs, the value of which varies depending on changes in the volume of production. If production is not produced, then they are equal to zero. Variable costs include the cost of purchasing raw materials, fuel, energy, transport services, salaries of workers and employees, etc. In supermarkets, the payment for the services of supervisors is included in variable costs, since managers can adjust the volume of these services to the number of customers.

Total costs (TC) - the total costs of the company, equal to the sum of its fixed and variable costs, are determined by the formula:

Total costs increase as the volume of production increases.

The costs per unit of goods produced are in the form of average fixed costs, average variable costs, and average total costs.

Average fixed cost (AFC) is the total fixed cost per unit of output. They are determined by dividing fixed costs (FC) by the corresponding quantity (volume) of output:

Since total fixed costs do not change, when divided by an increasing volume of production, average fixed costs will fall as the quantity of output increases, since a fixed amount of costs is distributed over more and more units of production. Conversely, if output decreases, average fixed costs will increase.

Average Variable Cost (AVC) is the total variable cost per unit of output. They are determined by dividing the variable costs by the corresponding amount of output:

Average variable costs first fall, reaching their minimum, then begin to rise.

Average (total) costs (ATS) are the total costs of production per unit of output. They are defined in two ways:

a) by dividing the sum of total costs by the quantity of goods produced:

b) by summing average fixed costs and average variable costs:

ATC = AFC + AVC.

Initially, the average (total) cost is high because the output is small and the fixed costs are high. As the volume of production increases, average (total) costs decrease and reach a minimum, and then begin to rise.

Marginal cost (MC) is the cost associated with producing an additional unit of output.

Marginal cost is equal to the change in total costs divided by the change in the volume of output, that is, they reflect the change in costs depending on the amount of output. Since fixed costs do not change, fixed marginal costs are always zero, i.e. MFC = 0.

How to calculate variable costs (examples, formula)

Therefore, marginal cost is always marginal variable cost, i.e. MVC = MC. It follows from this that increasing returns to variable factors reduce marginal costs, while falling returns, on the contrary, increase them.

Marginal cost shows the amount of costs that the firm will incur if the production of the last unit of output increases, or the money that it saves if production decreases by this unit. If the incremental cost of producing each additional unit of output is less than the average cost of the units already produced, the production of that next unit will lower the average total cost. If the cost of the next additional unit is higher than the average cost, its production will increase the average total cost. The foregoing refers to a short period.

In practice Russian enterprises and in statistics, the concept of "cost" is used, which is understood as the monetary expression of the current costs of production and sales of products. Costs included in the cost price include materials, overheads, wage, depreciation, etc. There are the following types of cost: basic - the cost of the past period; individual - the amount of costs for the manufacture of a particular type of product; transportation - the cost of transporting goods (products); of sold products, current - assessment of sold products at the restored cost; technological - the amount of costs for the organization technological process production of products and provision of services; actual - based on the data of actual costs for all cost items for a given period.

G.C. Vechkanov, G.R. Bechkanova

Other related materials Production costs

Microeconomics…

Not a single production, even the most modern, can do without costs. In this case, costs are those used in production. different kinds resources (raw materials, energy, labor, etc.) that have a cost form. At the same time, there is still no single concept of this economic category. For the purposes of the analysis, there are several bases for classifying costs. For example, in the case of the accounting approach, costs are the actual costs of various production resources for the production of products at the cost of their purchase by the enterprise and form the cost of production.

Regarding the volume of output in the short run of the firm's activity, fixed, variable, general, average and marginal costs can be distinguished.

Posted on www.site

A feature of fixed costs (FC) is that their value does not depend on the volume of production: for example, a firm must pay interest on a loan received, regardless of whether it produces products or not. A feature of variable costs (VC) is the dependence of their total value on the volume of production - the larger the volume of output, the more the company spends, for example, raw materials. The sum of constants and variable costs forms the total (or gross) costs of the firm, i.e. TC = FC + VC.

Not only data on the total value of one or another type of cost are important, but also their volume per unit of production, for which average costs are calculated: general (gross), fixed and variable. The volume of output at which the value of the average gross cost is the smallest is the optimal (most profitable) volume of production for the company in terms of costs.

Also, the firm needs to control its marginal cost (MC), which shows what costs the firm will incur if it produces one more unit (or, accordingly, the amount of savings in reducing output per unit). Marginal cost MC is the additional cost required to produce an additional unit of output. The value of marginal cost is not affected by the amount of fixed costs, it depends on changes in variable costs.

The variety of ways to make a profit for enterprises in any industry of production and sale of services, on the one hand, creates unlimited possibilities for the development of a particular business, on the other hand, each type of activity has a certain threshold of efficiency, which is determined by break-even.

In turn, the amount of revenue that guarantees a profit directly depends on the total costs of production and sale of products.

What it is?

The total expenses of the enterprise for the purpose of analyzing the break-even activity are usually divided into two main categories:

- - costs, the amount of which directly depends on the volume of production and sale of services (depending on the chosen direction of the company's operation), i.e., in fact, are directly proportional to any fluctuations in the volume of core activities carried out;

- fixed - these are costs, the amount of which does not change in the medium term (a year or more) and does not depend on the volume of the company's core activities, i.e. they will exist even if the activity is suspended or terminated.

Having considered fixed costs on the example of an enterprise, it is easier to understand their essence and interdependence with the volume of core activities.

So, they include the following items of expenditure:

- depreciation charges on fixed assets of the company;

- rent, tax payments to the budget, contributions to off-budget funds;

- bank expenses for servicing current accounts, loans of the organization;

- wage fund for administrative and managerial personnel;

- other general business expenses necessary to ensure the normal functioning of the enterprise.

Thus, the essence of the fixed costs of any organization is reduced to their functional necessity for the implementation of activities. They can and most often change over time, but the reason for this is external factors (changes in the tax burden, adjustment of bank service conditions, renegotiation of contracts with service organizations, change of tariffs for public utilities and so on.).

Thus, the essence of the fixed costs of any organization is reduced to their functional necessity for the implementation of activities. They can and most often change over time, but the reason for this is external factors (changes in the tax burden, adjustment of bank service conditions, renegotiation of contracts with service organizations, change of tariffs for public utilities and so on.).

Internal factors affecting the change in fixed costs are significant change corporate policy, personnel remuneration system, a significant change in the volume or direction of the company's activities (not just a change in volume, but a radical transition to a new level).

Under the influence of all these factors, there is a change in fixed costs, usually they are characterized by sharp fluctuations in the amount of expenses.

For the purposes of accounting and analysis, the expenses of an enterprise are usually divided into fixed and variable, using the following methods:

- Based on experience and knowledge, through managerial decision expenses are assigned to a certain category. This method good when the company is just starting its activities and there are simply no other ways to allocate costs. Characterized high level subjectivity and needs to be reviewed in the long term.

- Based on the data of the analytical work carried out on the search, evaluation and differentiation of all expenses by categories based on their behavior under the influence of the factor of changes in the volume of core activities. It is the most acceptable, since this method is more objective.

For information on which of the expenses to which group you need to determine, see the following video:

How to calculate them?

Fixed costs are calculated using the formula:

POSTz \u003d W salary + W rent + W banking services + Depreciation + Taxes + General Household, Where:

- POSTz - fixed costs;

- W salary - the cost of salaries of administrative and managerial personnel;

- R rent - rental expenses;

- 3 banking services - banking services;

- General economic expenses - other general economic expenses.

To find the indicator of average fixed costs per unit of output, it is necessary to apply the following formula:

SrPOSTz \u003d POSTz / Q, Where:

- Q - the volume of output (its quantity).

The analysis of these indicators must be carried out in dynamics, evaluating the retrospective of values at different time intervals, including with joint analysis and other economic indicators. This will allow you to see the relationship of processes specific to the enterprise, which means you can get a cost management tool in the future.

economic sense

Fixed cost analysis, performed both on an operational basis and for the purpose of strategic planning, allows you to assess the ability of the enterprise to improve the efficiency of its activities. This is the key economic sense this category.

Fixed cost analysis, performed both on an operational basis and for the purpose of strategic planning, allows you to assess the ability of the enterprise to improve the efficiency of its activities. This is the key economic sense this category.

The simplest and affordable way analysis of the effectiveness of the company's activity is an assessment of the break-even point indicator, including in dynamics. For calculations, data on the amount of fixed costs, unit price and average variable costs are required:

Tb \u003d POSTz / (Ts1 - SrPEREMz), Where:

- Tb - breakeven point;

- POSTz - fixed expenses;

- C1 - price per unit. products;

- Avperemz - average variable costs per unit of output.

The break-even point is an indicator that allows you to see the boundary beyond which the company's activities begin to make a profit, as well as analyze the dynamics of the impact of changes in costs on the volume of production and profit of the organization. The decrease in the break-even point at constant variable costs is positively assessed, this signals an increase in the efficiency of the enterprise's expenses. The growth of the indicator should be assessed positively when it occurs against the background of an increase in sales volumes, that is, it indicates an increase and expansion of the scope of activities.

The break-even point is an indicator that allows you to see the boundary beyond which the company's activities begin to make a profit, as well as analyze the dynamics of the impact of changes in costs on the volume of production and profit of the organization. The decrease in the break-even point at constant variable costs is positively assessed, this signals an increase in the efficiency of the enterprise's expenses. The growth of the indicator should be assessed positively when it occurs against the background of an increase in sales volumes, that is, it indicates an increase and expansion of the scope of activities.

Thus, accounting, analysis and control of fixed costs, reducing their load per unit of output are mandatory measures necessary for each enterprise to achieve competent resource and capital management.