Leasing is an effective financial and investment tool for the development of production. With its help, the company can modernize fixed assets and buy the necessary property.

Vehicles, production, agricultural and other equipment, etc. can be the subject of leasing. It is not allowed to make a deal on land, natural objects, property complexes or individual business units.

Conditions for obtaining equipment on lease by a legal entity

According to federal law“On financial lease”, a legal or natural person can become a lessee. This means that a deal can be concluded not only by companies, but also by citizens, regardless of the place of registration, taxation system, form of ownership and other characteristics. Let's see if this is true, shall we?

The most privileged lessees are major corporations. Many leasing companies are ready to finance transactions for them, providing favorable conditions: long terms and low interest rates.

But such companies are in no hurry to offer favorable conditions for representatives of a modest business. Conditions can be very unfavorable, this is a kind of “price for risk”. Leasing companies consider large lessees reliable, but they do not want to deal with small ones. Although this is not disclosed anywhere, the cost of services directly depends on the size of the lessee's business. You might even get rejected. Most of the refusals are received by newly registered companies that do not own or do not financial statements. Also, the presence of losses, lack of revenue, growth in accounts payable and other financial troubles can lead to refusal.

| Other ways to finance a business | |

|---|---|

Required documents for leasing

- Constituent and registration documents (charter, certificate of state registration, EDRPOU certificate, VAT payer certificate, Form No. 4-OPP), required licenses, permits, patents and other permits that indicate lawful activity.

- Orders, minutes and other documents on the appointment of the head of the company and the chief accountant, signature samples and seal imprint, a copy of the head's passport.

- Certificates from banks where there are debts.

- Certificates from the banks serving this company on the monthly turnover of funds, credit accounts for the last year.

- quarterly financial statements over the past two years.

- Tax reporting: profit and VAT declaration for the last reporting period and for the year.

- Feasibility study or business plan of the project, which indicates information: market segment, information on the receipt of funds to accounts, taxes, fees and other obligatory payments, the essence and effectiveness of the project, the size of the gross and net profit, payback and other economic information.

Important! All registration and financial documents, reporting of the enterprise are provided in the form of copies certified by the seal and signature.

When and why are additional documents required?

If the lessee is individual entrepreneur or the company uses the simplified tax system / UTII, you need to submit documents confirming the performance indicators (declaration for the simplified tax system or UTII, a book of income and expenses).

Also, the lessor may request a breakdown of accounts payable, information about the main counterparties, an audit report and other information. In not without fail a business plan for the project is provided.

Financial documents are required for evaluation financial condition the lessee, whether he will be able to make payments on time. Also rated equity, revenue, turnover and others financial indicators. This applies to small projects. For conclusion big deals the lessor conducts an in-depth analysis of the financial condition and without fail requires the provision of a business plan.

The lessee makes an application, where he indicates information about the property, the supplier, the parameters of the contract, the features of the activity, etc. Keep in mind that each leasing company independently determines the list of papers required to receive property. It mainly depends on the specifics of the activity and the associated risks.

Main results of leasing

Savings on taxes

Payments that are paid by a legal entity under a contract are accounted for as production costs. As a result, the amount of income tax is reduced. Until the property rights are transferred to the lessee, the property tax is paid by the lessor. Thanks to this, the company saves a certain part of the money.

Saving working capital

Due to the reduction in the volume of working capital, indicators of profitability and profitability are reduced. If you spend money on the purchase of expensive equipment, in the long run this can lead to unprofitable activities of the company. Leasing has a positive effect on the state of the company, since there is no withdrawal of working capital.

Development of the enterprise

Due to the receipt of new equipment, the business is successfully developing. In addition, unlike lending, leasing is possible in any financial position lessee. This is due to the fact that the second option provides income.

Reducing clearance costs

If you buy property, vehicles or equipment, you need to register it. In the case of drawing up a leasing agreement, the lessor is responsible for the execution of all documents, which saves time and money.

Many companies offer a well-known leasing program. This is a kind of rental of a necessary thing, for example, a car or production equipment. It has long been used not only abroad, but also in Russia.

Many people turn to banks for loans. This is an effective way to make money. But careful preparation of documents is required, high interest rates apply, and the time for obtaining money on a loan stretches for a long time. Great alternative - leasing for individuals. The main advantage is that at the conclusion of the contract, interest is set, which does not change during the lease. Concerning banking system, then additional costs often pop up here, for example, commissions for services. Money is pulled from you, but the law remains on the side of the banking institution.

Equipment leasing for individuals

Basically, this product is used by entrepreneurs who have not registered entity. Everyone knows that small business, especially in small towns, often does not submit reports and does not pay taxes to the state. Therefore, such illegal companies do not need the tax advantages of financial leasing. In addition, this option can become burdensome. This is due to the need to keep records and pay off payments.

From an investor's point of view, leasing for individuals provides the highest reliability of the transaction. The item (equipment or other) remains in his ownership until the end of the transaction. Therefore, less stringent requirements are imposed on the client. This is especially true of a person's creditworthiness.

Lessors believe that enterprises with non-transparent activities are the most conscientious borrowers. For example, in a small business, the subject has become freight car. It is the main source of income. To pay off the payment, the borrower does everything, even limits himself, because there is no other way to receive income.

In many European countries, such contracts with individuals account for a large share of common market. For example, in Germany this segment accounts for 9.2% of the total market. At the present time, the subject of most transactions are cars.

In Russia, such services are offered by companies: Capital Leasing Company, Own Business, Independence Land Rover, Optimum Finance.

| Other ways to finance a business | |

|---|---|

General terms

To complete a transaction with a lessor, an individual must fulfill a number of requirements. The entrepreneur must:

- have the citizenship of the Russian Federation;

- be at least 23 years of age and not older than 60 years of age;

- have relevant business experience.

To complete a transaction, you need to submit the following documents:

- passport;

- insurance pension certificate

- passport, driver's license or military ID (optional).

If an individual is an entrepreneur, then you need to provide a certificate of assignment of a TIN, registration of an individual entrepreneur or PBOYUL.

When all the documents are in hand, you need to choose a company, conclude an agreement and pick up the equipment. A legal entity becomes the owner, but in the case of a natural person, the lessee uses the object only by proxy. After the expiration of the contract and the payment of contributions, the ownership passes to the lessee. An individual must draw up documents for himself, paying all the costs of registering an object. When making a transaction, machinery, real estate and equipment are insured, but there is no need to insure life. This is due to the fact that until the end of the contract, the owner of the object is the company itself.

Leasing conditions for individuals on the example of a specific company

Conditions are calculated depending on the financial condition of the lessee.

Possible conditions on the example of Optimum Finance:

- initial payment - from 10% of the total cost of equipment;

- term - 9 months - 7 years;

- financing of delivery, installation, adjustment;

- inclusion of insurance costs in payments.

By contacting Optimum Finance, you can get drilling, mining, climatic, musical, gas station, shop, restaurant, office, manufacturing, industrial, agricultural and other types of equipment.

Advantages over lending

Companies provide leasing for individuals without any problems, as they do not risk anything. Until the end of the contract, until all payments are paid, the property belongs to the company itself. This approach reduces the risk of fraud and default compared to a credit scheme. In the latter version, the equipment or car is immediately registered to an individual.

What are the other advantages of making a deal between a company and a lessee? For example, for many programs there is no alternative in banks. This applies to the acquisition of commercial vehicles - trucks. They are not covered by the car loan program. The only way out when using the services of a bank is to obtain a consumer loan. Only this money is not enough for an expensive purchase. Perhaps renting could be an alternative? Many support this option. Just keep in mind that after the end of the lease, the property will not become yours. But when you make a deal with the lessor, you will become the owner of the equipment.

Like credit, it is a special financial instrument, which is sold by banking or other companies and allows legal entities and individuals to purchase desired products on preferential terms. This is one of the most effective modern tools for the development of production. With its help, the company can save working capital and get the necessary equipment without their withdrawal. This is a kind of long-term lease, financial relations in which the lessee and the lessor participate. The subject of the transaction may be production equipment, various kind transport, technology. Especially popular today is the leasing of equipment for legal entities.

How to use the services of leasing companies?

Unlike lending, when applying for a lease, you can get an excellent opportunity to save on income and property taxes. A company or an individual entrepreneur does not become the full owner of the property until he makes full payment for it, that is, does not redeem it. Accordingly, some tax payments are missing.

Many financial companies are ready to lease equipment to legal entities on the following terms:

- An initial payment in the amount of ten percent of the value of the subject of the transaction.

- The term of the lease agreement is up to five years.

- Interest rate is set on an individual basis.

- A potential client (legal entity) must be registered in Russia and conduct a successful entrepreneurial activity at least twelve months.

In rare cases, legal entities are denied a lease. This can happen with newly registered businesses without a certain level of income.

A package of documents: what to prepare when going to a leasing company?

Any financial organization that provides equipment on lease to legal entities imposes requirements on a mandatory package of documents. The potential lessee will need:

- Registration and constituent documents - certificates, licenses, patents, charter.

- Protocols, orders.

- Certificates from the bank about existing debts.

- Quarterly reporting documents for the last 24 months.

- Business plan of the project (at the discretion of the lessor).

- Income and VAT returns for the last year.

It is necessary to thoroughly prepare for registration, but the privileges received fully justify some of the difficulties of the preparation process. After collecting the documents, the client can apply for certain equipment. It is advisable to do this on site. financial institution and not over the internet. Approval or refusal will have to wait at least three working days. Usually applications of natural persons are considered more quickly. After accepting a positive rhenium, the bank concludes a lease agreement for specific equipment for a certain period.

What is the result?

For legal entities, this is a modern service that is especially popular and allows you to purchase industrial, industrial, medical, tire fitting and other types of equipment. It all depends on the profile of the organization. Typically, the leasing limit does not exceed 25 million rubles for the purchase of equipment.

If the application is approved, the legal entity receives the following benefits:

- Significant reduction in cash costs for registration. All expenses are covered by the lessor, since he is the owner of the property until the end of the lease agreement.

- Effective development of the company's activities - often the further existence of the organization depends on the purchase of new equipment.

- Savings in working capital - no need to use the company's cash.

- Savings in paying taxes on income and property.

Redemption and redemption

If the equipment was leased, it can be redeemed when the lease expires. To pay off the debt, payments can be made monthly or quarterly, but in strict accordance with the concluded agreement. You need to be careful about paying and pay certain amounts on time. With one or two delays, the equipment can be withdrawn from the lessee.

It provides for full or partial early repayment with the payment of cash for property. In case of full repayment, the equipment passes into the ownership of a legal entity ahead of schedule. From the point of view of overpayment, it is better to redeem quickly necessary equipment. But long-term rentals are also beneficial due to accelerated depreciation and minimal tax payments. Partial early repayment of the debt in small payments is possible, as a result of which the total amount of payments will decrease.

The average terms of financing for leasing are from two to five years. But when buying equipment worth more than ten million rubles, the period may increase to ten or twelve years at the discretion of the lessor. From a legal point of view, leasing is a rather laborious procedure, but still organizations prefer to use the services of leasing companies to purchase expensive and necessary equipment.

Equipment leasing has certain features that must be taken into account when concluding a leasing transaction.

Delivery time and terms of payment for equipment purchased on lease

In the vast majority of cases, the equipment purchased on lease is not available from the supplier. The equipment is supplied for a specific client, while the delivery time can be very long. You can buy equipment on lease that has a predetermined specification, dimensions and characteristics. Even if standard equipment is purchased, it takes time to manufacture and ship it from the factory.

In many cases, the equipment is manufactured for a specific client, taking into account the needs for productivity, the specifics of the premises in which the equipment purchased on lease will be located, and the features of connecting communications.

The terms of the supply agreement may provide for various payment schemes for equipment purchased on lease. As a rule, when placing an order for the manufacture or supply of equipment, a prepayment of a part of the cost of the equipment is made, and the remaining amount is paid upon delivery. Also, part of the amount can be paid after installation and commissioning of the equipment.

When concluding an equipment leasing agreement, the schedule of payments for leasing takes into account the delivery time of the equipment and the terms of its payment.

The most simple circuit- when the terms of the equipment purchase and sale agreement provide for an advance payment to the supplier in an amount not exceeding the lessee's advance payment under the leasing agreement. In this case, the first payments for equipment leasing begin from the moment the equipment is delivered and paid for by the leasing company.

If the amount of the prepayment to the supplier is greater than the advance of the lessee, the leasing company invests in the transaction additional funds and monthly payments for the use of these facilities may be added to the payment schedule, starting from the month in which the prepayment for the equipment is made. That is, despite the fact that the client has not yet received the equipment on lease, he must pay interest for the use in cash leasing company. This interest may also be paid not immediately, but after the equipment is received by the lessee, but in any case they will be taken into account in the payment schedule for equipment leasing.

It should be taken into account that the term of the payment schedule for equipment leasing and the immediate term of leasing may not coincide. This occurs in cases where the lessee at the beginning of the contract pays interest on the advance payment made by the leasing company for the manufacture and supply of equipment.

For example, the delivery period for equipment is 3 months, the payment schedule for equipment leasing is 36 months, with the first three payments being used to pay interest on the use of funds that the leasing company paid as an advance payment to the supplier on top of the advance payment received from the lessee. In this case, the equipment will be leased not immediately, but 3 months after the start of the contract (when it is delivered) and real term leasing will be not 36 months, but 33 months.

Installation and commissioning of equipment purchased on lease

In some cases, when buying equipment on lease, it is necessary to carry out installation and commissioning.

Installation and commissioning services can be either included in the cost of equipment and paid directly to the supplier, or carried out and paid for under a separate agreement. The contract can be concluded by both the lessee and the leasing company. All installation and commissioning costs are included in the cost of equipment purchased under leasing.

One of the issues that arises when leasing equipment that requires installation and commissioning is depreciation. Article 259 tax code RF depreciation starts from the 1st day of the month following the month of putting the property into operation. At the same time, in the letter of the Ministry of Finance of the Russian Federation No. 03-03-06 / 1/24 dated January 26, 2010, it is explained that the moment of putting the leased asset into operation for profit tax purposes is determined by the date of transfer of the leased asset to the lessee.

If it is necessary to install and start-up the equipment transferred for leasing, the scheme of interaction between the parties to the leasing transaction and the execution of documents is as follows: the subject of leasing (equipment) is transferred by the supplier directly to the lessee, at the same time, an act of acceptance of the equipment is signed and at the same time an act of transfer of equipment to leasing.

If the leased equipment is reflected on the lessor's balance sheet, starting from the next month, the leasing company may charge depreciation on the leased property, regardless of whether the equipment has been put into operation.

If the balance-holder of the property is the lessee, depreciation on the equipment received under leasing is possible only after its commissioning. Thus, the depreciation period is reduced by the terms of manufacture and delivery, as well as the period of installation and commissioning of equipment purchased under leasing.

These features must be taken into account when agreeing on the terms of leasing and the schedule of payments for equipment leasing.

Assessment of the liquidity of equipment purchased on a leasing basis

Additional information on leasing, financing conditions and requirements for clients can be found in the section Articles about leasing

Related materials

|

|

Often, it is a leasing product that becomes the only profitable solution for a small business in deciding whether to purchase a new one in order to develop its business or upgrade old equipment.

For some small business industries, this solution may be the main success in competition in this market segment.

What it is

Leasing is a financial instrument that has actually recently become known in the Russian market. It should be noted that this is a cross between a loan and a lease.

The main persons in such relations are the lessor (a financial company providing services of this kind) and the lessee (legal entity or individual).

All work and relationships are built on contractual obligations. In fact, the lessor own funds or when involving a down payment, which is paid by the lessee, buys from the manufacturer or supplier necessary equipment to his client and gives it to him for use.

At the same time, it distributes payments for a certain period, which is stipulated in the contract.

A distinctive feature of leasing, if we take the rental as a comparison, is the end result of such financial relations. At the end, the lessee becomes the full owner of the purchased equipment, but subject to the fulfillment of all obligations to the lessee.

If we take credit and leasing as a comparison, then the latter has more loyal conditions under which the client financial company have the option to choose convenient system payment (decreasing, quarterly or seasonal).

How to issue

Arrange leasing today on the territory Russian Federation Can:

- In banking structures that practice such a product in their work.

- Specialized financial institutions whose activities are aimed only at working with such programs. Many of them have well-established relationships with suppliers or they themselves have the necessary goods, for which they provide their leasing products.

- Directly with equipment suppliers who work on leasing terms and provide their product to small businesses.

Today, a lot of such organizations appear on the market, which indicates their competitive struggle. And this, in turn, affects the mitigation of conditions, therefore, before starting registration, it is recommended to study in detail the proposals of the entire market and choose the most optimal and acceptable option for yourself.

In order to arrange a lease, you must contact the selected organization. It provides you with which you need to fill out and indicate all the information required in it.

Often, such appeal documents also have a small questionnaire about the conditions for which the potential client. It is also important to prepare all the necessary documents.

The application is processed by the lessor within a few days. This period may differ for each company. But in most cases, financial companies focus on reducing the time for consideration and making their decision. During this period, they study the activities and financial side of a potential client.

Where to buy equipment for small business on lease?

There are quite a lot of companies on the leasing market today that provide special programs for cooperation with small businesses. Many lessors today are subsidiaries fairly large banking organizations or giant joint-stock companies who have a large financial flow.

Among these organizations are:

- VTBLeasing;

- UralSib;

- NomosLeasing.

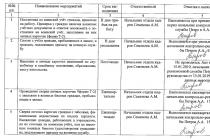

Consider some of the features and conditions for registering a leasing product, depending on who the lessor is:

Among all representatives of the financial market, you can also find companies that fight for each client and carry out registration as soon as possible, soften the conditions for both the client and the design.

Conditions

Equipment leasing for small businesses is issued under certain conditions, which each organization interprets in its own way, but at the same time relies on the average statistics for similar products in the Russian market.

The main criteria that are taken into account by small businesses when looking for partners, and its average indicators will be as follows:

- advance payment (10% of the amount of equipment);

- terms of granting the leasing contract (3 years);

- rise in price (about 4% per year).

In many ways, these data may vary depending on what kind of equipment is purchased and in what area it is used.

So, let's consider an example that clearly demonstrates changes in the main indicators of conditions depending on this factor:

Video: Lego brick machine

Required documents

In order to apply for a lease, you must fill out an application and submit a package of documents.

For a small business, this would be:

- a copy of the charter of the enterprise;

- registration certificates stating that the potential legal entity is officially registered and registered with the tax authorities;

- a copy of the order on the appointment of the head;

- his passport data (copy);

- financial statements for the last reporting period;

- bank statement on the movement of the account.

Requirements for the lessee

Often the basic requirements for a small business are the same as for any legal entity.

Consider them in the table:

To equipment

For equipment, the main requirement or, rather, the limitation put forward by leasing companies will be its cost. The table provides the average statistical amounts that are provided financial institutions for the purchase of a product, depending on its purpose and scope of use.

That is, registration is carried out for equipment, the cost of which will not exceed the specified figure.:

If you take a good look at all the offers, you can find programs that offer financing for more expensive equipment, but be aware that some conditions may be more stringent, in particular payment terms.

Timing

On average, the period for which the possibility of leasing equipment for a small business is up to 7 years. This figure may be 5 years. Not issued for less than 12 months.

If the subject of leasing relations is quite expensive, then financial companies can increase the repayment period up to 10, and some - up to 12 years. But here in question on amounts above 25 million rubles, and the terms are negotiated directly individually, taking into account many factors in the activities of a small business.

Make a deal

The first and important step in concluding a leasing transaction is the preparation and signing of the contract.

It should be understood that the whole procedure, especially when it is carried out by financial organizations, consists of two contracts:

- between the supplier and the lessor;

- between financial structure and the lessee.

But for a client of a financial company, the first part of the leasing relationship is not a key one, since he does not take documentary participation in it. The contract, which is concluded between the lessor and the lessee, is the main one for small businesses.

It indicates the subject of the transaction, all the nuances, obligations of both parties, possible force majeure circumstances and conditions for early termination. Here is an example.

The contract is important document, which should be carefully studied by the lessor before signing.

Advantages and disadvantages

Of course, leasing, like any financial transaction, has its positive and negative sides. But at the same time, it should be noted that there are much more pluses in such programs than minuses.

Consider the main positive aspects:

- the opportunity to take the necessary equipment for use with a minimum initial contribution;

- after fulfilling all the requirements of the contract, the equipment remains for use by the lessee as the owner;

- the ability to legally save on the payment of certain taxes;

- there is no need to search for collateral, since the object of leasing relations itself acts as collateral.

If we talk about the negative aspects, first of all, experts note the fact that when registering a lease, the object of such relations cannot be used as collateral in other financial transactions.

In addition, if a small business does not have the necessary amount to make an advance payment, then leasing becomes almost impossible.

Leasing today is a developing branch of financial relationships. Therefore, it is very important to familiarize yourself with the market for such services before drawing up a contract. In the fight for customers, many lessors offer very attractive products.