The Unified State Register of Individual Entrepreneurs (EGRIP) contains complete open information about individual entrepreneurs legally engaged in entrepreneurial activities in the territory of the Russian Federation. Registration of individual entrepreneurs is carried out in the bodies of the Federal Tax Service of Russia. Registers are also maintained by the Federal Tax Service of the Russian Federation. Register data is used to verify the counterparty, exercise due diligence, obtain an extract from the USRIP for an individual entrepreneur, for other purposes that require the provision of official registration data of the Federal Tax Service of Russia.

On the ZACHESTNYYBUSINESS portal, you can get information about the state registration of individual entrepreneurs, peasant (farmer) households, full open data of the USRIP for free.

The data on the portal is updated daily and synchronized with the nalog.ru service of the Federal Tax Service of Russia*.

To obtain data from the USRIP, use the search line:

To do this, enter the TIN or OGRNIP or full name of an individual entrepreneur in the search box.

With the help of the USRIP registry, you can get the following up-to-date information about the Counterparty - an individual entrepreneur (head of peasant (farmer) households, individual) free of charge:

- . IP status (active, activity terminated);

- . Date of registration, the tax authority that carried out the registration;

- . Kinds economic activity;

- . Registration in off-budget funds;

- . Other official public information.

Please note: the legal address of an individual entrepreneur is the address of his registration as an individual, therefore, it does not apply to open data and is not published. Changes to registers, changes to any data are carried out only by the Federal tax service after the official request of the Head and submission of the appropriate form for changes.

We wish you fruitful, comfortable work with the USRIP registries of the Federal Tax Service of Russia on the portal!

Your HONEST BUSINESS.RF.

* EGRIP data are open and provided on the basis of clause 1, article 6 federal law dated 08.08.2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”: Information and documents contained in state registers are open and publicly available, with the exception of information to which access is limited, namely information about documents proving the identity of an individual .

Information about individual entrepreneurs can be considered personal (personal) information about an individual who is properly registered as an individual entrepreneur. Personal data is considered to be the surname, name and patronymic indicated in the IP passport, the address of his residence (registration), the EGRIP code, TIN, the number of the certificate of state registration, and so on. All information that is not included in the list of those that are not defined by the law on the protection of personal (personal) data can be obtained from established by law okay.

The unique data of the IP are exclusively TIN and EGRIP. Last name, first name and patronymic can be the same for several people even within the same city, that is, they are not unique. Exactly an identification number the taxpayer is the main one when searching for the necessary information about the individual entrepreneur. Obtaining this kind of information may be necessary for the buyer of goods or products manufactured by the entrepreneur, or the customer of services in case of poor quality performance or violation of the terms of delivery of goods. In such situations, IP clients can file lawsuits against the entrepreneur, and the application must indicate the IP registration address. The customer of the product before making a deal may simply want to get acquainted with the information about the entrepreneur, check the legality of his activities. Information about individual entrepreneurs of this nature is contained in the USRIP - a unified register of all entrepreneurs who have passed the state registration process with the Federal Tax Service. In the unified state register, you can get the following information about the individual entrepreneur of interest:

Surname, name and patronymic, as well as date and place of birth;

Citizenship of individual entrepreneur and address of residence in the territory of the state;

Passport information, namely: series, number, authority that issued the certifying document and the date of its issue;

In the case of a foreign individual entrepreneur, information is provided regarding his certifying documents and the right to live and work;

Identification number of the person assigned to him as a taxpayer;

Information about licenses issued to the entrepreneur and types economic activity, carried out by him;

Date of registration with the Federal Tax Service, PFR and other funds;

The date of issue and the number of the state certificate confirming the registration of an individual in the status of an individual entrepreneur.

The information contained in the USRIP is available to everyone and is not confidential. An individual, an individual entrepreneur or an enterprise can obtain information about an individual entrepreneur. However, some information is closed to public access. Information about the place of residence and passport data of participants legal entity may be available if they are specified in the founding documents. The entrepreneur himself can obtain information about the person who made the request to obtain his personal data. In this case, they submit an appropriate application to the tax authority at the place of residence of the entrepreneur.

Information about individual entrepreneurs from the USRIP is issued in the form of copies of the documents required by the applicant, confirming certificates or certificates of the absence of information necessary for the applicant. The issuance of this kind of information is carried out after submitting an application to the Federal Tax Service at the place of registration of the IP and payment of the state duty within a maximum of five days. Anyone can receive information from the USRIP after submitting an application to the Federal Tax Service. You can also find out some information about the individual entrepreneur in special Internet services by entering the TIN of the entrepreneur. Statistics codes assigned to a business entity during the registration process (OKATO, OKFS and others) can be found in territorial body statistics on the place of residence of IP.

Some information about individual entrepreneurs can be found by carefully examining the products and checks issued to the client by the entrepreneur. On checks, as a rule, the full name of the entrepreneur, the number of his certificate, and sometimes the address are indicated. The packaging of products produced by IP reflects the "legal" address of the entrepreneur, which is, in fact, the address of residence of the IP. The exception is when the address of production facilities is indicated on the packaging.

Taxpayer Identification Number (TIN, read "ienen") is a special digital code that is issued to individuals and legal entities in order to streamline and control the payment of taxes.TIN plays one of the main roles in the individualization of legal entities and individuals with the status of an individual entrepreneur (IP) as taxpayers.

Check TIN and get information about the counterparty

TIN of a legal entity and individual entrepreneur

Entity receives TIN from the tax authority at the place of registration of the person simultaneously with other registration documents.Individuals with IP status can obtain a TIN in two ways:

1) simultaneously with assigning them the status of an individual entrepreneur and issuing a certificate of registration as an individual entrepreneur;2) at any time before registration as an individual entrepreneur (in this case, upon registration You don't need to get a TIN again.).

Without a TIN, an individual will not be able to obtain IP status.

Legal entities and individuals with the status of an individual entrepreneur, when concluding any contracts, are obliged indicate your TIN in the details.

TIN must be located on the seals (for individual entrepreneurs - if there is a seal).

TIN of an individual without IP status

Individual can get a TIN from the tax authority at the place of residence.Currently obtaining TIN by individuals is voluntary. Exception: TIN is mandatory for an individual when appointing him to the position of a civil servant.

In practice, when applying for other positions, they are often asked to present the TIN along with other documents. Such a requirement cannot be mandatory, as it is not reflected in Labor Code RF.

TIN check

Anyone on our site can free check the correctness of the TIN counterparty - a legal entity or an individual with the status of an individual entrepreneur, as well as the fact of making an entry on the registration of a legal entity in the Unified State Register of Legal Entities.Knowing the TIN and the name of the organization, you can get an extract from the Unified State Register of Legal Entities to check:

- reliability of documents received from the counterparty (since legal entities and individual entrepreneurs are required to indicate the TIN on any local acts and documents issued by them);

- the fact of the existence of a legal entity (there are situations when an unscrupulous counterparty acts in a transaction on behalf of a non-existent legal entity with a mercenary purpose);

- reliability of the legal address of the counterparty;

- last name, first name and patronymic of the director of the legal entity and other data on the legal entity.

An individual can via the Internet, and knowing the TIN - the amount of taxes and fees owed. TIN check individuals is carried out free of charge online.

Counterparty verification: procedure in questions and answers

Checking a counterparty by TIN is a mandatory procedure that sooner or later all business representatives face, regardless of their line of business. Is it worth it to cooperate with the counterparty, can he be trusted and make an advance payment - this is only a short list of questions that can be answered by carrying out such a procedure as checking the counterparty by TIN.

If we consider private situations, the need to check the counterparty can be useful to an accountant who wants to make sure that the activities of a potential partner of his company are transparent before concluding an agreement. By the TIN number on our website, you can get an extract about the legal entity from the Unified State Register of Legal Entities, as well as extended financial data on the legal entity.

It would be rational to present the basic information about the verification of the counterparty by TIN in the form of questions and answers in order to achieve a high degree of understanding of the need for this procedure and the features of its implementation.

What is a verification of a counterparty by TIN?

Checking a counterparty by identification number includes searching for information about him and its further analysis, aimed at determining the good faith / bad faith of a potential partner.

Who checks counterparties?

In most cases, checking the counterparty by TIN is the responsibility of employees legal service And economic department. If such structural divisions not at the enterprise, the person authorized to conclude the contract will be responsible for checking the counterparty.

Why do you need to check the counterparty?

Checking the counterparty is carried out to minimize financial risks from cooperating with him. Analysis of the data obtained by TIN will help to avoid delays in deliveries, problems with the quality of goods or services, and will make it possible to stop fraudulent schemes of the counterparty.

Besides, this check is necessary to avoid sanctions from the tax authorities: if violations are found, then the responsibility for choosing a counterparty will fall entirely on your organization. The consequences can be different (exclusion of a transaction of a dubious nature from expenses, refusal to accept VAT deduction), so it is necessary to check the counterparty.

What exactly is studied when checking a counterparty?

Features of checking the counterparty - the procedure, obligations of the parties, the criteria for which studies are carried out - are not established at the legislative level. The concept of "checking the counterparty" on this moment not registered in legal acts, is not in the Tax Code.

Along with this, in 2006, a Resolution of the Plenum of the Supreme Arbitration Court RF, which somewhat clarifies who should check the counterparty. It is devoted to the issue of assessing the validity of a person receiving a tax benefit. It may be recognized as unreasonable in court if it turns out that the taxpayer acted imprudently. In practice, this means that business representatives are responsible for checking the counterparty. In fact, in most cases, the audit is carried out by accountants.

What documents are most often requested when checking a counterparty?

The absence of a written counterparty verification scheme somewhat complicates the process. At the same time, standard practice has already been established, which involves the collection and study of such documents of the counterparty as the charter, extract from the Unified State Register of Legal Entities, certificates of state registration and registration on tax accounting, a letter from statistics, which indicates activity codes, documents proving the identity of the counterparty and confirming his authority.

Individual entrepreneur(IP)(obsolete private entrepreneur (PE), PBOYuL until 2005) is an individual registered as an entrepreneur without forming a legal entity, but in fact having many of the rights of legal entities. For individual entrepreneurs, the rules of the civil code governing the activities of legal entities are applied, except when separate articles of laws or legal acts are prescribed for entrepreneurs. ()

Due to some legal limitations (it is impossible to appoint full-fledged directors to branches in the first place), an individual entrepreneur is almost always a micro-business or small business.

according to the Code of Administrative Offenses

Fine from 500 to 2000 rubles

At gross violations or when working without a license - up to 8,000 rubles. And, possible suspension of activities up to 90 days.

From 0.9 million rubles for three years, and at the same time the amount of arrears exceeds 10 percent of the tax payable;

From 2.7 million rubles

Fine from 100 thousand to 300 thousand rubles. or in the amount of the culprit's salary for 1-2 years;

Forced labor for up to 2 years);

Arrest for up to 6 months;

Imprisonment for up to 1 year

If the individual entrepreneur fully pays the amount of arrears (taxes) and penalties, as well as the amount of the fine, then he is exempt from criminal prosecution (but only if this is his first such charge) (Art. 198, clause 3. of the Criminal Code)

Evasion of taxes (fees) on an especially large scale (Art. 198, paragraph 2. (b) of the Criminal Code)

From 4.5 million rubles for three years, and at the same time, the amount of arrears exceeds 20 percent of the tax payable;

From 30.5 million rubles

Fine from 200 thousand to 500 thousand rubles. or in the amount of the culprit's salary for 1.5-3 years;

Forced labor for up to 3 years;

Imprisonment for up to 3 years

Fine

If the amounts for criminal prosecution are not reached, then there will only be a fine.

Non-payment or incomplete payment of tax (fee) amounts

1. Non-payment or incomplete payment of tax (fee) as a result of understatement of the tax base, other incorrect calculation of the tax (fee) or other unlawful actions (inaction) shall entail the collection of a fine in the amount of 20 percent of the unpaid amount of tax (fee).

3. The acts provided for by paragraph 1 of this article, committed intentionally, entail the collection of a fine in the amount of 40 percent of the unpaid amount of the tax (fee). (Article 122 of the Tax Code)

penalties

If you are only late in paying (but not providing false information), then there will be penalties.

Penalties are the same for everyone (1/300 multiplied by the key rate of the Central Bank per day of the amount of non-payment) and are now somewhere around 10% per annum (which is not very much in my opinion, given that banks give loans at least at 17-20 %). You can count them.

Licenses

Some types of activities an individual entrepreneur can only engage in after obtaining a license or permissions. The licensed types of activities of individual entrepreneurs include: pharmaceutical, private detective, transportation of goods and passengers by rail, sea, air, and others.

An individual entrepreneur cannot engage in closed activities. Such activities include the development and / or sale of military products, the circulation of narcotic drugs, poisons, etc. Since 2006, the production and sale of alcoholic products. An individual entrepreneur cannot be engaged in: the production of alcohol, wholesale and retail alcohol (excluding beer and beer-containing products); insurance (i.e. being an insurer); activities of banks, investment funds, private pension funds and pawnshops; tour operator activity (travel agent can); production and repair of aviation and military equipment, ammunition, pyrotechnics; production of medicines (realization is possible) and some others.

Differences from legal entities

- The state duty for registration of individual entrepreneurs is 5 times less. In general, the registration procedure is much simpler and fewer documents are required.

- An individual entrepreneur does not need a charter and authorized capital but he is liable for his obligations with all his property.

- An entrepreneur is not an organization. It is impossible for an individual entrepreneur to appoint a full and responsible director.

- An individual entrepreneur does not have cash discipline and can dispose of the funds in the account as he pleases. Also, the entrepreneur makes business decisions without logging. This does not apply to work with KKM and BSO.

- An individual entrepreneur registers a business only for himself, unlike legal entities, where registration of two or more founders is possible. Sole proprietorship cannot be sold or re-registered.

- At employee The PC has less rights than the mercenary in the organization. And although in the Labor Code, organizations and entrepreneurs are equated in almost all respects, there are still exceptions. For example, when an organization is liquidated, a mercenary is required to pay compensation. When closing an individual entrepreneur, there is such an obligation only if it is spelled out in the employment contract.

Appointment of a director

It is legally impossible to appoint a director in a sole proprietorship. The sole proprietor will always be the main manager. However, it is possible to issue a power of attorney to conclude transactions (clause 1, article 182 of the Civil Code of the Russian Federation). Since July 1, 2014, for individual entrepreneurs, it has been legally possible to transfer the right to sign an invoice to third parties. Declarations could always be submitted through representatives.

All this, however, does not make the people to whom some powers are delegated directors. For directors of organizations, a large the legislative framework about rights and obligations. In the case of an individual entrepreneur, one way or another, he himself is responsible under the contract, and with all his property he himself is responsible for any other actions of third parties by proxy. Therefore, issuing such powers of attorney is risky.

Registration

State registration of an individual entrepreneur carried out by the Federal Tax Service of the Russian Federation. The entrepreneur is registered with the regional tax office at the place of registration, in Moscow - MI FTS RF No. 46 for Moscow.

Sole proprietors can be

- adult, capable citizens of the Russian Federation

- minor citizens of the Russian Federation (from the age of 16, with the consent of parents, guardians; married; adoption of a decision on legal capacity by a court or guardianship authority)

- foreign citizens living in the territory of the Russian Federation

OKVED codes for an individual entrepreneur are the same as for legal entities

Required documents for registration of an individual entrepreneur:

- Application for state registration of an individual entrepreneur (in 1 copy). Sheet B of Form P21001 must be completed at the tax office and given to you.

- Copy of TIN.

- A copy of the passport with a residence permit on one sheet.

- Receipt of payment of the state duty for registration of an individual entrepreneur (800 rubles).

- Application for the transition to the simplified tax system (if necessary).

An application for registration of an individual entrepreneur and other documents can be prepared online in a free service.

Within 5 days you will be registered as an individual entrepreneur or you will receive a refusal.

You must provide documents:

1) Certificate of state registration of an individual as an individual entrepreneur (OGRN IP)

2) Extract from a single state register individual entrepreneurs (EGRIP)

After registration

After IP registration must be registered with Pension Fund and MHIF, get statistics codes.

Also necessary, but optional for an entrepreneur, is opening a current account, making a seal, registering a cash register, registering with Rospotrebnadzor.

taxes

IP pays a fixed fee to the pension fund for the year, 2019 - 36,238 rubles + 1% of income over 300,000 rubles, 2018 - 32,385 rubles + 1% of income over 300,000 rubles. A fixed contribution is paid regardless of income, even at zero income. To calculate the amount, use the IP fixed payment calculator. In the same place, the CSC and the details of the calculus.

An individual entrepreneur can apply tax schemes: STS (simplified), UTII (imputation) or PSN (patent). The first three are called special modes and are used in 90% of cases, because. they are preferential and simpler. The transition to any regime occurs voluntarily, upon application, if you do not write applications, then the OSNO (general taxation system) will remain by default.

Taxation of an individual entrepreneur almost the same as for legal entities, but instead of income tax, personal income tax is paid (with OSNO). Another difference is that only entrepreneurs can apply PSN. Also, IP does not pay 13% of personal profit in the form of a dividend.

The entrepreneur has never been obliged to keep accounting records (chart of accounts, etc.) and submit accounting reports (only the balance sheet and the report on financial results). This does not exclude the obligation to keep tax records: declarations of the USN, 3-NDFL, UTII, KUDIR, etc.

An application for the simplified tax system and other documents can be prepared online in a free service.

Of the inexpensive programs for individual entrepreneurs, one can single out with the possibility of submitting reports via the Internet. 500 rubles / month. Its main advantage is ease of use and automation of all processes.

Help

Credit

It is more difficult to get a loan from a bank for an IP business than a legal entity. Many banks also give mortgages with tension or require guarantors.

- An individual entrepreneur does not keep accounting records and it is more difficult for him to prove his financial solvency. Yes, there is tax accounting, but they do not allocate profit there. Patent and UTII are especially opaque in this matter; these systems do not even have income records. USN "Income" is also unclear, because it is not clear how many expenses. USN "Income-Expenses", ESHN and OSNO most clearly reflect the real state of the IP business (there is a record of income and expenses), but unfortunately these systems are used less frequently.

- An individual entrepreneur himself (unlike an organization) cannot act as a pledge in a bank. After all, he is a natural person. The property of an individual can be pledged, but it is more difficult legally than a pledge from an organization.

- An entrepreneur is one person - a person. When issuing a loan, the bank must take into account that this person can get sick, leave, die, get tired and decide to live in the country, leaving everything, etc. And if in an organization you can change the director and founders at the click of a finger, then an individual entrepreneur in this case can only close, and terminate the loan agreement or go to court. IP cannot be reissued.

If a business loan is denied, then you can try to take out a consumer loan as an individual, without even disclosing plans to spend money. Consumer loans usually have high rates, but not always. Especially if the client can provide a deposit or he has a salary card in this bank.

Subsidy and support

In our country, hundreds of funds (state and not only) provide advice, subsidies, soft loans for IP. In different regions - different programs and help centers (you need to look). .

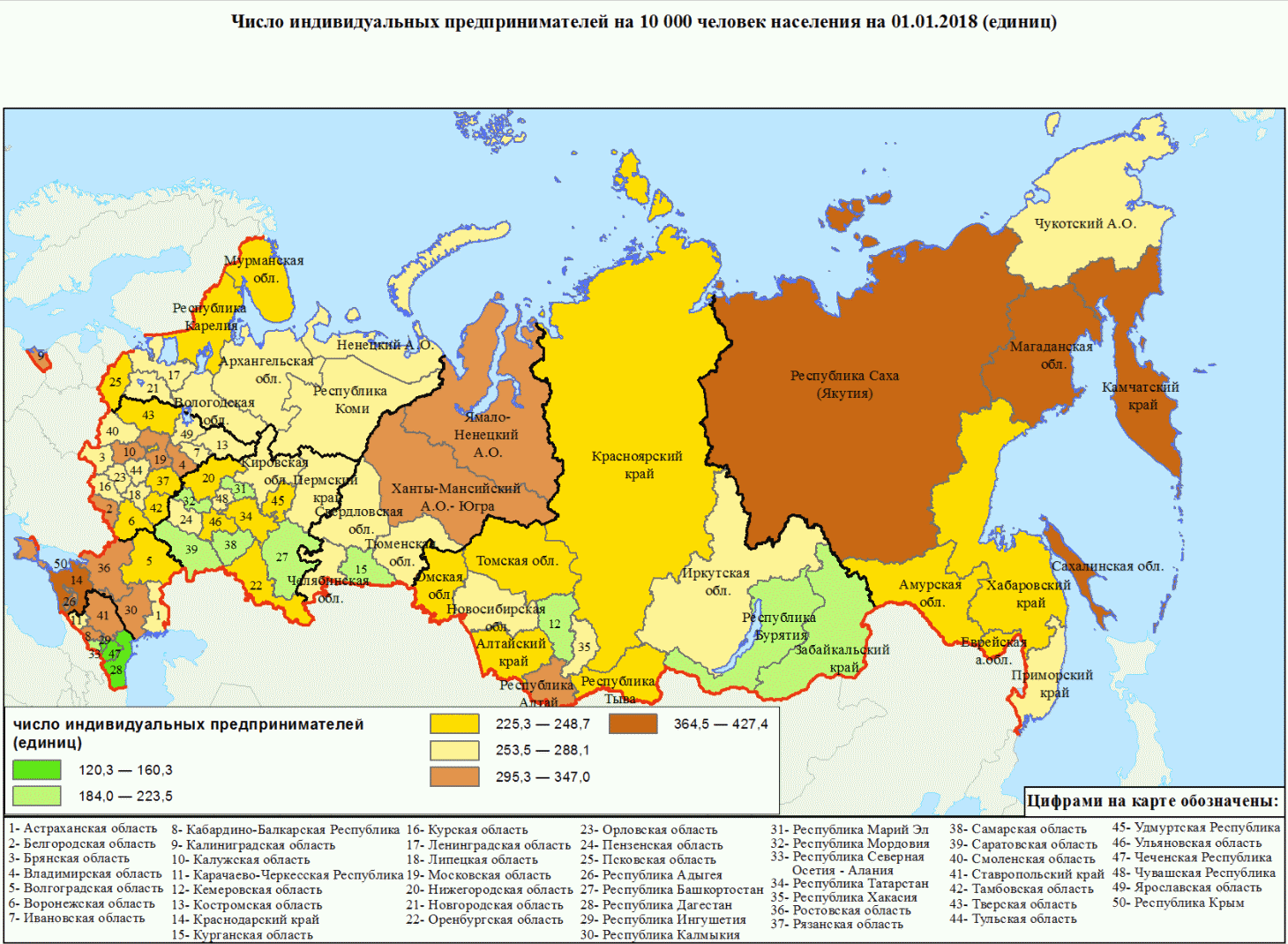

Rice. Number of individual entrepreneurs per 10,000 population

Experience

Retirement experience

If the entrepreneur pays everything to the Pension Fund regularly, then the pension period goes from the moment of state registration until the closure of the IP, regardless of income.

Pension

Under current legislation, an individual entrepreneur will receive a minimum pension, regardless of how much he pays to the FIU.

The country is undergoing an almost continuous pension reform, and therefore it is not possible to accurately determine the size of the pension.

Since 2016, if a pensioner has the status of an individual entrepreneur, then he will not have pension indexation.

Insurance experience

The insurance period for the FSS goes only if the entrepreneur voluntarily pays social insurance contributions (FSS).

Difference from employees

The Labor Code does not apply to the individual entrepreneur. It is accepted only for employees. IP, unlike the director, does not apply to mercenaries.

Theoretically, an individual entrepreneur can hire himself, assign a salary and make an entry in the work book. In this case, he will have all the rights of an employee. But it is not recommended to do this, because. Then you have to pay all payroll taxes.

Maternity can only be received by a woman entrepreneur and only on condition of voluntary insurance in social insurance. .

Allowance up to one and a half can be received by any businessman, regardless of gender. Either in RUSZN or in the FSS.

IP leave is not allowed. Because he has no concept of working time or rest time and production calendar also does not apply to it.

Sick leave is only for those who are voluntarily insured with the FSS. Calculation based on the minimum wage, the amount is insignificant, therefore, in social insurance, it makes sense to insure only mothers for maternity.

closure

Liquidation of an individual entrepreneur is an incorrect term. An entrepreneur cannot be liquidated without violating the Criminal Code.

IP closing happens in the following cases:

- in connection with the adoption by an individual entrepreneur of a decision to terminate activities;

- in connection with the death of a person registered as an individual entrepreneur;

- by court order: by force

- in connection with the entry into force of a court decision deprivation of the right to engage in entrepreneurial activity;

- in connection with the cancellation of the document (delay) confirming the right this person reside in the territory of Russia;

- in connection with the adoption by the court of a decision on the recognition of an individual entrepreneur as insolvent (bankrupt).

Databases for all IPs

Contour.Focus website

Partially free Contour.Focus The most convenient search. It is enough to enter any number, surname, name. Only here you can find OKPO and even accounting information. Some information is hidden.

USRIP extract on the website of the Federal Tax Service

For free Federal Tax Service database EGRIP information (OGRNIP, OKVED, PFR number, etc.). Search by: OGRNIP / TIN or full name and region of residence (patronymic name is not required).

Bailiffs Service

For free FSSP Learn about enforcement proceedings for the collection of debts, etc.

With the help, you can keep tax records on the simplified tax system and UTII, generate payments, 4-FSS, Unified settlement, SZV-M, submit any reports via the Internet, etc. (from 325 r / month). 30 days free. On first payment. For newly created IPs now (free of charge).

Question answer

Can I register on a temporary basis?

Registration is done at permanent residence. To what is indicated in the passport. But you can send documents by mail. By law, it is possible to register an individual entrepreneur at the address of temporary registration at the place of stay, ONLY if there is no permanent residence permit in the passport (provided that it is more than six months old). You can conduct business in any city of the Russian Federation, regardless of the place of registration.

Can an individual entrepreneur register himself for work and make an entry in the labor himself?

An entrepreneur is not considered an employee and does not make any entries in his employment record. Theoretically, he can apply for a job himself, but this is his personal decision. Then he must conclude with himself employment contract, make an entry in work book and pay deductions as for an employee. It's unprofitable and makes no sense.

Can an IP have a name?

An entrepreneur can choose any name for free, which would not directly conflict with the registered one - for example, Adidas, Sberbank, etc. In the documents and in the plate on the door, there should still be an IP full name. He can also register a name (register a trademark): it costs more than 30 tr.

Is it possible to work?

Can. At what you can not report at work that you have your own business. It does not affect taxes and fees in any way. Taxes and fees of the FIU must be paid - both as an individual entrepreneur and as a mercenary, in full.

Is it possible to register two sole proprietorships?

IP is just the status of an individual. It is impossible to become an IP twice at the same time (get this status if it already exists). TIN is always the same.

What are the perks?

There are no business benefits for the disabled and other privileged categories.

Some commercial organizations also offer their discounts and promotions. Online accounting Elba for newly created IP is now the first year as a gift (free of charge).

To bring your business to the top of the business "Olympus", you need not only to masterfully conduct business, but also to understand people. AND we are talking not at all about brilliant intuition, but about competent verification of a future partner. After all, along with the rapid growth of competition, the number of fraudsters is also growing, especially among small entrepreneurs who cannot afford paying taxes.

Trust, but verify, and the best option is verification of IP by TIN or full name on the website of the Federal Tax Service, with which you can find out all the information about the counterparty and reveal its secrets, for example, the lack of a license or hidden bankruptcy.

How to check IP by TIN

When a citizen passes state registration as an individual entrepreneur, all information about him is entered in the USRIP - a unified register of individual entrepreneurs. They are stored there forever, even after liquidation. If, in the course of work, any registration data changes, the entrepreneur is obliged to notify tax office so that its employees make changes to the registry.

You do not need to report a change of surname, passport or place of residence, the IFTS monitors the relevance of such data on its own.

The information stored in the USRIP is not classified. Each individual has the right to check any individual entrepreneur through the service on the IFTS website, knowing only the TIN or full name and the region of the entrepreneur of interest.

No panic! Personal data, such as residential address, passport number and series, bank account, are not provided to unauthorized persons. They can only be obtained by the entrepreneur himself with a personal appeal to the tax authority.

Verification algorithm

To get information, go to the official website of the IFTS and click on the tab "Business Risks". Then set your search criteria:

- In the topmost field, click on "Individual Entrepreneur / Peasant Farm";

- In the "Search by" field, select the option with the data you know - PSRN and TIN or full name and region of residence.

If you chose to search for an individual entrepreneur by OGRNIP or TIN, indicate the 12-digit taxpayer identification number or the 15-digit number under which he is listed in the register of individual entrepreneurs. And if full name / region - last name, first name, patronymic and region of residence of a businessman. Then enter the numbers from the picture and click "Find".

Using the service, you can also check the reliability of a legal entity. The principle of action is the same, but since jur. person acting on behalf of the whole organization, when choosing the second search option, you should indicate its legal name, and not the full name of an individual citizen.

Result of checking

If a citizen has not undergone mandatory registration with the USRIP, the system will not find information about him. The absence of a check result indicates that the businessman is carrying out his activities illegally., and the registration documents provided by him are false.

If the individual entrepreneur you specified is listed in the USRIP, the system will issue a document for download in PDF format with the following information:

- about an individual;

- about registration;

- about the main view entrepreneurial activity and additional;

- on accounting with the tax authority;

- about the changes made;

- on bankruptcy and liquidation procedures.

But if you specified the full name and region of the businessman, a list with all namesakes will appear on the page. Select the appropriate option and click on the full name, the data document will be downloaded to your computer.

How to find out your or someone else's TIN

With the help of the Business Risks service, you can not only verify the reliability and solvency of the counterparty, but also find out the TIN of any individual entrepreneur by last name. You need to find the object of business you are interested in according to the same scheme as mentioned above, for this:

- select the item "Individual entrepreneur" and search by full name;

- indicate the surname, name, patronymic and region;

- enter captcha;

- click Find.

The system will give you a list of all IPs with that name. Their TIN, OGRNIP, date of registration will be immediately indicated. Just choose the props you need.

It is not uncommon for an entrepreneur to find out his own TIN. For example, if you need to fill out some paper, but there is no registration certificate at hand, which contains all the basic details. You can find out the TIN of an IP that belongs to you in two ways:

- through the service of the Federal Tax Service;

- through the service "Gosuslug".

Both portals provide the service for free, but on the second one you will have to go through a simple registration procedure. Of the details, you will need the full name, place and date of birth, the number and series of the passport or other document confirming the identity, the date of its issue.

To find out the TIN of an individual entrepreneur, go to the website, fill in all the fields, enter the numbers from the picture and send a request.

How to get an extract

The PDF file obtained as a result of verification in the Business Risks service does not have any legal force. It is intended exclusively for information assessment counterparty. If a businessman needs a document with legal significance, for example, to confirm the legality of a transaction before the tax service, he can order it in several ways:

Any individual can receive an extract, it will contain only general information about IP, as well as an information copy, but it can appear in any business as an official document. To receive it you will need:

- Arbitrary statement and its copy.

- Receipt of payment of the state duty in the amount of 200 rubles for a regular statement or 400 rubles for an urgent one.

- A power of attorney certified by a notary, if a representative applied for a paper.

The above method is costly as a fee is payable for each copy of the extract requested. If it will be checked a large number of entrepreneurs, it is better to resort to a free online option:

The completed statement will be displayed in your list of applications, download it to your computer and print it. But note: to open a PDF file with electronic signature, will have to install software Crypto Pro version 3.6 or higher.

Other services to check

You can find information about IP not only on the website of the Federal Tax Service. Although this portal is the most accessible, reliable and, moreover, free, it can be used to find out not all the important information.

The list of official sites that provide information from the database of entrepreneurs includes:

| Website: | What can you find out | How to find out |

|---|---|---|

| SAC of Russia (Federal Arbitration Court) | A complete list of ongoing and completed litigation. |

|

| bailiff portal | A complete list of completed trials for which a court decision has already been made. |

|

| "Contour-Focus" | Information about the counterparty and a simplified version of the extract without legal significance. |

|

If you don't check out your partner

To reduce the risks for your business, you should not blindly trust partners. Entering into business relationship, ask them for a package of papers confirming the reality of the existence of an individual entrepreneur and allowing you to assess the reliability of the company. And also check the counterparty in all possible services to avoid such unpleasant situations as:

- delay in payment for goods/services;

- non-receipt of the goods you paid for;

- being involved in fraudulent schemes;

- inability to deduct VAT;

- signing an agreement with a future bankrupt.

And if the tax authorities come to the conclusion that the company knew about the unreliability of the partner, then they will have to prove their non-involvement in fraud already in court. Therefore, in addition to checking the IP, it is also worth getting an extract to provide it as evidence of your innocence.