NAVIGATION Summary 2. Problem 3. Solving the problem 4. Business features 5. How it works 6. Scaling 7. Market analysis 8. Large companies 9. Medium-sized companies 10. MFO project 11. MCO / LLP project 12. How we differ 13. Promotion channels 14. Technological aspects 15. financial model 16. Project start-up costs 16. SWOT analysis of the project 16. Risks 14. Goal chart 15. Method of project financing 16. Team 17. Postscript

SUMMARY 3 Investments Single bachelors The essence of the project Single bachelors Financial indicators Single bachelors Launch of a microfinance project Total 500 million tenge Borrowed 500 million tenge Own 0 Non-financial indicators Single bachelors Office location - Almaty Number of points of sale - 2 plus control superstructure Staff 34 Planning horizon 6 years NPV IRR Payback period 4 years. 4 Disc. payback period 6 years. The MCO/LLP business was not included in the analysis.

MARKET FINANCIAL MARKET OF CLIENTS The number of MFIs decreased from 415 in mid-2015 to 71 per year. The market as a whole is shrinking Banks have reduced the supply of money Money has risen in price, there is no tenge liquidity, deposits by 80% in foreign currency 4 Credit history is deteriorating Business is declining working capital Deferred demand arises in households Clients are left without financing Crisis puts pressure on business PROBLEM

Business credits 5 Payday loans (off-line) SOLVING THE PROBLEM One “roof” MFI Single bachelors MCO / LLP Single bachelors Microfinancing payday for amounts up to 150 thousand tenge. The company is an ordinary LLP. Loans up to 18 million tenge. Subject to the regulation of the National Bank. Three businesses Payday loans (on-line) Two companies Work with clients in the office and via the Internet - choice: Off-line immediately On-line in the future

BUSINESS FEATURES 6 Business Min Authorized capital Max Credit rate NBK regulation Notes Credit partnership 100 MCI56% Yes Only Lombard members are credited 100 MCI Unlimited No Provision of loans secured by movable property. Accounting, storage and sale of jewelry MFI 30 million tenge 56% Yes Unsecured loans, secured loans, group loans MCO / LLP100 MCI Unlimited No Mainly online lending. Short-term credits - “credits before salary”

7 HOW IT WORKS Sales Channels Single Bachelors Offices Clients Single Bachelors Products Single Bachelors Business Classic Business Express Agro Lombard Consumer (?) Clients Single Bachelors Products Single Bachelors Paycheck to Paycheck Sales Channels

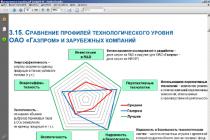

PROBLEM 9 1. State: - Samruk-Kazyna - Kaz Agro - other state-owned companies 2. Oil and gas companies: TCO, KPO, SNPC, Lukoil, Agip 3. Mining and Metallurgical Companies: - Arcelor Mittal Temirtau - ENRC - Kazakhmys Level I. Great. Business structures of representatives of the establishment II Level. Large (Business&Power) Level III. Large (other companies) Transport Communications Construction TradeFMCGProcessing industry Power generation Oil and gas complex, except for the giants MMC, except for the giants Agriculture Transnational commodity companies Oil Metal IV Level. Medium business (services for large business) Level V. Small "white" business VI Level. Small "grey" business and self-employed population MARKET ANALYSIS

10 MARKET ANALYSIS Large amounts of loans Targeted loans Large and medium-sized communities High income levels Low delinquency rates Small amounts of loans Non-targeted loans Small communities Low income level High delinquency Sectoral structure of macro indicators SMEs Sources of funds for operations 25% Bank customers MFI customers Microfinance institutions are a conditional bridge for entrepreneurs between "financial isolation" and bank lending.

11 MARKET ANALYSIS City Population, thous. near Aktau Temirtau Turkestan Kokshetau Taldykorgan Ekibastuz Rudny 114 Term Work with delay Rate Required. to the intended purpose Financial requirements Decision-making time Requirements for the document package Requirements for collateral Better in an MFI Better in a bank

12 MARKET ANALYSIS 1577 MFOs per year Total MFOs Operating Active 71 MFOs per year Total MFOs Expert review microcredit market capacity, mln. USD MFOLs pawnshops OtherGrey market Factoring, Internet credits, payday credits Value of MFO assets per 1 bln tenge MCO / LLP

13 Demographic pressure 2%2% population growth per year Almaty MARKET ANALYSIS 63% entrepreneurial goals 22% Share of SMEs in the country's GDP 28% Share of SMEs in workforce countries 26% The share of SMEs in Almaty and Almaty region in the total number of SMEs LE 170 thousand The total number of SMEs IP 978 thousand 5% Astana to metropolitan areas.

14 LARGE COMPANIES Name Market share by assets Number of customers Volume of credit.port.% overdue Profitability of KMF39.4%128 thousand 29.7 billion tons 1.5-4%ROA - 5.6% ROE % MCO Serta16.8% 7 thousand 15 billion tons with Tsesna Bank Orda Credit Group: MCO Arnur Credit, MCO Nur Credit 13.4% 20 thousand 8.0 billion tons 8% ROA - 5.6% ROЕ % Toyota Fin.Service 10.2% -5.4 billion .t-ROA % ROE % Yrys 8.13%4 thousand 5.6 bln. 73%5 thousand 0.96 billion tons 2%- Kaz Credit Line1.26%-1.0 billion tons-- Bereke 1.2%7.5 thousand 0.9 billion tons 2.75%ROA % ROE % Shinhan Finance 0.93%-Affiliate with Shinhan Bank 1 Loan 0.74%-0.6 billion tenge-ROA % ROЕ%

15 MEDIUM-SIZED COMPANIES Name Market share by assets Number of clients Volume of credit.port. % overdue Yield Soyuz kredooit 0.65%-0.58 billion-ROA - 5.08% ROE - 33.6% Astana Finance (Ab. with Astana Group) 0.63%-0.56 billion tons-ROA – 3.0% ROE – 14.48% Kazmikrokredooit 0.4%-0.3 bln. 3 billion tons-ROA – 4.29% ROE – 22.28% Atyrau Micro Finance center 0.37%-0.29 billion tons-ROA - 7.71% ROE - 7.75% Esil Finance 0.3%-0.25 billion tons-ROA - 4.89% ROE - 21.49% STAR0.24%-0.17 bln.t-ROA – 3.04% ROE – 3.04% Retail Credit (av. C Bank Astana) 0.2% 400.17 bln.t 0.5%ROA – 5.94 % ROE – 23.81% Credital0.17 % -0.12 bn t-ROA – 19.25% ROE – 19.34% Part Capital 0.14%-0.1 bn t-ROA – 16.0 % ROE – 26.34% Other 13 MFIs (aggregate) 0.73%-0.42 bn.t-- Total 100% .8 bn.t 5%ROA – 5.15% ROE – 20.88%

MFI PROJECT 16 Status Rate Single bachelors Loan term Single bachelors 6-8 months. max 12 months Penalties Single bachelors max loan amount Single bachelors Number of branches Single bachelors Issuance Single bachelors Issuance of credits only through the bank 1-2% for each day of delay Collateral 40-50%, average 45%, commission 2% Unsecured 50-55%, average 52%, commission 5.5% Collateral max 5 million, average 3 million tenge, Unsecured max 1 million, average 400 thousand tenge Single bachelors The assessment is based on the income and collateral of the borrower Expected delay Single bachelors 2% / year - for secured loans, 4-6% / year for unsecured loans Loans Single bachelors 90% Secured 10% Unsecured 2

PROJECT MKO / LLP 17 Status Rate Single bachelors Loan term Single bachelors 3-30 days Penalties Single bachelors max loan amount Single bachelors Number of branches Single bachelors Issuance Single bachelors Issuance of credits only through the bank 1-2% for each day of delay %, average 400%, commission 0% max 150 thousand tenge average 40 thousand tenge 1 Credooitosp. Single bachelors Scoring according to BKI Expected delay Single bachelors 20% / year

WHERE WE DIFFER 18 We use group financing to reduce credit risks We focus on the pledge of liquid property When pledging vehicles, we use options A) mortgage B) installation electronic system control When pledging housing, we do not accept housing with children When issuing a loan 5 For large amounts, we apply a repurchase agreement When returning a loan When delaying from the 1st day, we connect a call center A person with shoulder straps is required

20 TECHNOLOGICAL ASPECTS Communication and document management system Loan accounting system integrated with the accounting system Data exchange system with State Commercial Bank and PKB Scoring system Notification system (sms-mailing, - mailing) Bitrix24 Contact Center website + Turnkey Lender website automated Application and behavioral scoring from PKB Not selected Not selected Process Outsourcing Collection Minimum required package documents for organizing MFI business 1. Credit policy 2. Collateral policy 3. Accounting policy 4. Regulations for working with credits 5. Regulations on the credit and tariff committee 6. Regulations for working with problem credits 7. Regulations for interaction with the regulator, BKI 8. Regulations for cash transactions 9. Rules for calculating provisions 10. Job Descriptions

FINANCIAL MODEL 21 BALANCE SHEET ASSETS Money Loans to customers: Agro credits Consumer credits Business credits Distressed credits Provision for credits Total credits Fixed assets: Equipment, furniture, etc. Intangible assets Total fixed assets TOTAL ASSETS LIABILITIES Other credits Trade debt Deferred income Total liabilities EQUITY Paid-in capital Retained earnings Reserves Total equity TOTAL LIABILITIES AND EQUITY Calculations are made excluding MCO / LLP business 000 KZT

FINANCIAL MODEL 22 18% 9% 73% Total 100% Without taking into account market influence, the growth dynamics of the loan portfolio is limited by 2 factors: 1) The size of investments and/or borrowed funds; 2) Labor productivity and the number of credit officers. Loan portfolio structure Agro-credits Cons. credits Business - credits 000 KZT

FINANCIAL MODEL 23 OP&I Interest income Interest expense Net interest income Fee and commission income Personnel expenses General and administrative expenses Depreciation of intangible assets0100 Depreciation of IA Provisions for problem loans Profit before taxes Income tax Net profit Net income margin-12%39%43%44% 000 KZT

FINANCIAL MODEL OF KZT ODS Operating flow Net income Depreciation and amortization Adjustments to accounts receivable and creditors Net cash Investment flow CAPEX Net cash Financial flow Loans to customers Loans repaid by customers Equity investments Net cash CASH INCREASE Cumulative net cash flow Discounted cash flow since accumulation

FINANCIAL MODEL KZT Indicator Sustainability and profitability Operational sustainability 88%198%221%225%226%227% Return on assets (ROA)-3%16%15%13%11%9% Return on equity (ROE)-3%17% 14%12%10% Portfolio growth 286%121%74%53%40% Borrower growth 176%92%42%25%17% Asset/liability management Gross portfolio return 81%157%146%137%128%120% Net interest margin 100% Portfolio to assets 108%105%92%82%75%69% Debt to equity 0% Leverage1.1x 1.0x Efficiency and productivity Total headcount (end of period)34 Loan officers (end of period)10 Portfolio (thousand tenge) per credit officer Profitability EBITDA margin-12%49%54% 55% Net profit margin-12%39%43%44%

27 Stages of project implementation Costs, thousand KZT 1 month.2 months.3 months.4 months. 1. Registration of MFIs in the justice authorities Obtaining permission from the Credit Bureau (State Credit Bureau) Obtaining a license from the National Bank Approval of products and agreements with the National Bank Renting premises passage of the State Clinical Hospital Installation of a video surveillance system, fire alarms and recording the process of signing contracts Purchase of equipment, furniture, safes Automation based on 1C MFI Recruitment of employees 12. Obtaining a loan from the Bank 13. Starting work of the MFI Provisions for contingencies 750 Total expenses PROJECT LAUNCH EXPENSES

SWOT-ANALYSIS OF THE PROJECT 28 Strengths Weaknesses Presence of a result-motivated team Experience in banking structures, retail and MS Presence of a call center No experience in implementing full-fledged independent financial projects Team not fully formed Requires financial leverage Opportunities Threats Entry into the market of competitors with stronger finance and marketing Changing market preferences, changing ecosystem Crisis – good time to open a business with “anti-crisis” value Skim the cream and sell the business

RISKS 29 RISK LEVEL OF RISK METHOD OF LEVELING Incorrect business model Medium Reorientation to another market / market segment Incorrect marketing strategy Medium Reorientation to another market / market segment Poor organization of processes and procedures. High Detailed description of all processes, implementation of CRM for control Change of key employees High Motivation through options for future profit Lack of funding Medium Project initially has a low financial barrier to entry, but high marketing costs Emergence of competitors with a similar product High Outstripping occupation of a free market niche Change in market preferences Low No

GOALS GRAPH 30 Go to strategic planning Transition to strategic planning tactical planning Funding 0-th period + 2 months. Test launch of the project Break-even + 12 months. + 6 months Achievement of planned indicators Achievement of net profit+ 6 months + 3 months Making a decision on scaling the project / leaving the project + 3 months. Team

METHOD OF PROJECT FINANCING 31 1 Contribution to the Authorized Fund 30 million tenge (minimum required amount) 2 Further, the project can be funded in 2 main options or their combinations A. Direct financing B. Financing through a credit-deposit scheme in a bank. This scheme provides that the sum of the available limit and the loan balance is less than the amount of the deposit. Advantages - money always "works", even if the MFI's business has not yet reached the project portfolio indicators. Indicative indicators: Deposit in tenge, rate on deposit 10%, rate on credit 13% Deposit in foreign currency, rate on deposit 4%, rate on credit 20% A mixed scheme is possible.

TEAM 32 Operations Director: Barak H.O. Role: Experience: Education: Employees Outsourcing: IT Collection Partly Marketing Chief Accountant Loan Officers Underwriters Operations Director: Unknown A.S. Role: Experience: Education: 4 Assessor 5 Lawyer 6 SA

Description of the presentation on individual slides:

1 slide

Description of the slide:

Microfinance organizations: How not to fall into credit slavery? Lecturer: Khoroshavtseva O.A.

2 slide

Description of the slide:

What does MFI mean? MFI (microfinance institution) is commercial structures lending to individuals, including individual entrepreneurs. The size of their capital exceeds 70 million rubles. They are accountable to the Bank of Russia, although they are not directly related to banks.

3 slide

Description of the slide:

4 slide

Description of the slide:

What activities does the MFI conduct? The main activity of the micro financial institutions- issuance of loans to individuals, incl. and via the Internet. At the same time, most companies specialize in small short-term microloans. Services are provided to all categories of citizens on the basis of a Russian passport. The average loan amount in many MFIs is 5,000 - 15,000 rubles. The amount of the daily commission ranges from 1.5 to 2.2%, and the term for using money is from 5 to 30 days.

5 slide

Description of the slide:

Regular borrowers can borrow large amounts at reduced interest rates. The maximum loan amount is 100,000 rubles. The term of disposition of money reaches 1 year. When providing additional documents and confirming solvency, borrowers are offered preferential terms.

6 slide

Description of the slide:

7 slide

Description of the slide:

Additionally, microfinance organizations can attract funds from individuals at interest rates that are several times higher than bank rates. But such deposits are not insured at the state level.

8 slide

Description of the slide:

How do you know if an MFI is real? To avoid deception, take loans only from those MFIs that work officially. The activities of such structures are regulated by a special law “On microfinance activities of microfinance organizations”. The document clearly delimits the rights and obligations of the parties to the lending process, as well as outlines the features of the creation and operation of such structures. Each official company included in a special register, a list of which can be found on the official website Central Bank RF. For example, such firms include Credito 24, SMS Finance, Money Man.

9 slide

Description of the slide:

10 slide

Description of the slide:

In the process of registering a new company, a license for microfinance activities is issued. You can see copies of licenses and other statutory documents on the official services of MFIs, in special sections.

11 slide

Description of the slide:

How is an MFI different from a bank? Banks and MFIs are not direct competitors because their activities and goals are different. But within the framework of providing consumer loans, the advantages of microfinance organizations are obvious:

12 slide

Description of the slide:

13 slide

Description of the slide:

14 slide

Description of the slide:

Microfinance organizations (MFIs) can be a real lifesaver in some specific situations - for example, when you need to urgently receive a small amount before salary. It is assumed that the client repays small loans almost immediately, and this story does not turn into a long epic with huge debts. But if everything in life was as it is supposed to be from the very beginning! Unfortunately, clients often find themselves in real bondage, and not always through their own fault. They may be deceived by employees of these companies or not fully aware of what they are agreeing to when entering into an agreement.

15 slide

Description of the slide:

16 slide

Description of the slide:

There are also restrictions on the activities of MFIs: it is impossible to issue a loan in foreign currency; a microloan should not be more than 1 million rubles; you can not put pressure on the client in order to conclude the most beneficial contract for the organization. If an MFI offers you anything on this list, it is breaking the law! You should not agree to those conditions that are obviously unfavorable for you.

17 slide

Description of the slide:

We have all heard stories about the "slave" of MFI clients who inadvertently agreed to unfavorable terms and signed the contract without reading it. Many aspects of the activities of MFIs are still controversial, poorly understood, and there is room for speculation and violations. To improve this situation, in July 2017, the Central Bank approved a standard to protect the clients of microfinance organizations. This standard somewhat toughened the conditions for the activities of MFIs; it is designed to protect, first of all, the interests of clients.

18 slide

Description of the slide:

The following changes have been made: You cannot provide a borrower with more than 10 loans per short term(up to 30 days) per year; clients can apply with questions and claims to MFIs (they are obliged to respond), they should receive a response within 15 working days; MFI employees are required to record and store conversations with clients conducted through all available communication channels: telephone, correspondence on the Internet, paper correspondence. Digital certificates must be stored for six months, and paper documents for a year; once again separately noted that MFI employees cannot put pressure on clients in order to force them to enter into unfavorable agreements (for example, use a certain service or sign a new microloan agreement with worse conditions); it is forbidden to reward employees of MFIs solely on the basis of the number of contracts concluded. This will avoid a situation of unhealthy competition within microfinance organizations, which forces employees to take any measures in order to receive good remuneration.

19 slide

Description of the slide:

Naturally, these measures still will not protect against all problems associated with MFIs. Unscrupulous market players find gullible clients and force them to get involved in colossal debts, which sometimes become an unbearable burden: after all, if payment is delayed, the amount of debt, taking into account the high interest rates on microloans, becomes quite huge. However, fortunately, even the imperfection of the legislation or its non-compliance often does not become a cause of injustice.

20 slide

Description of the slide:

21 slide

Description of the slide:

An example of an MFI client was counted 730% on a microloan, the total payment amount turned out to be huge. But after examining the case materials, the court ruled that interest cannot be accrued on the entire amount and in the amount that the microfinance organization initially insisted on. And he made a decision that significantly facilitated the conditions for payment.

22 slide

Description of the slide:

A resident of the city of Ivanovo turned to an organization issuing microloans and concluded an agreement with it, according to which he received a loan of 10,000 rubles for a period of 15 calendar days. The most interesting aspect of this agreement was that the loan was issued under ... 730% per annum! Not having received the amount due under the contract from the borrower in due time, the organization went to court. In a statement, its representatives demanded that the client pay both principal and interest on the debt. The court of first instance ordered the defendant to pay a relatively modest amount: only 15,000 rubles of interest and 700 rubles of a fine for delay. Not satisfied with this decision, the organization went ahead and filed an appeal. During the second consideration of this case, the decision of the court of first instance was canceled regarding the collection of interest on the loan. And they appointed a much larger payment, determined at the rate of 730% per annum! Now the man owed 93,400 rubles! The total debt (with a fine and legal costs paid by the losing party) amounted to 107,100 rubles. Naturally, this state of affairs did not suit the defendant, and he, in turn, filed a cassation appeal in which he asked to cancel the second decision and recognize the appeal decision as illegal. Proceedings After examining the case materials, the court drew attention to the terms of the contract, which was concluded by the microfinance organization and the borrower. On the one hand, the ability to specify in the agreement an interest rate that would be higher than the refinancing rate at the time of the transaction is enshrined in legislation. The interest rate is determined by agreement of the parties. And the Court of Appeal is right in taking this circumstance into account when making its decision. On the other hand, it was not taken into account that situations similar to the one under consideration are regulated, among other things, by No. 151-FZ “On Microfinance Activities and Microfinance Organizations” (hereinafter referred to as the Law on Microfinance Activities). And it states that microfinance organizations provide loans at a higher interest rate only on the conditions that the amounts are small and the term is not long. At the same time, it is important to ensure that the conditions are not openly onerous for the borrower and at the same time do not violate the financial interests of the organization that issues the loan. If you try to extend the terms of such a short-term contract for a longer period, then the purpose of the activities of microfinance organizations is distorted, since it turns out that the interest is super high and the duration of the period for which it is charged is long. And this already violates the requirements of reasonableness and fairness, which, among other things, the contract must meet. If the terms of a short-term agreement are extended, the purpose of the activity of microfinance organizations is distorted, how does it happen that both the interest rate is super high and the duration of the period for which it is charged is long? 15 calendar days, but this is incorrect and contradicts the essence legislative regulation microloan agreements, because it makes the agreement with ultra-high interest virtually indefinite. Based on the foregoing, the Supreme Court exempted the defendant from paying huge interest and recalculated the amount of the debt. In making its decision, the court was guided by the following rules: Art. 421 of the Civil Code of the Russian Federation states that citizens and legal entities are free to conclude a contract. In paragraph 1 of Art. 809 of the Civil Code of the Russian Federation specifies that the lender has the right to receive interest from the borrower, the amount of which is established in the contract. According to Art. 333 of the Civil Code of the Russian Federation, a unilateral reduction in the interest rate under the agreement is not allowed. But at the same time, in paragraph 9 of part 1 of Art. 12 of the Law on Microfinance Activities specifies that a microfinance organization does not have the right to accrue interest to a borrower if the amount of interest and other payments accrued under the agreement reaches four times the amount of the loan. In this regard, the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation believes that the calculation of the debt for the remaining period (passed from the moment of applying to the court and until the date of the consideration of the case) at a rate of 730% cannot be taken into account, and therefore, it is necessary to reduce the percentage charged interest. As a result, they were determined on the basis of the weighted average interest rate calculated by the Bank of Russia (17.53% per annum). And thus, the amount that the defendant owed to the lender is only 2170.84 rubles. Thus, Supreme Court did not release the defendant from paying the microloan debt, but significantly reduced its size, based on the principle of fairness and reasonableness.

23 slide

Description of the slide:

Do you think this court decision is fair? And are ultra-high interest rates on microloans justified?

24 slide

Description of the slide:

The main "safety rules" when concluding contracts with MFIs: Carefully study the contract, especially the small print. Feel free to ask if there's something you don't understand. Often misunderstandings happen precisely because some points are not clarified, and clients do not ask the right questions to MFI employees. Take only the amount that you are guaranteed to be able to pay within the agreed time frame. The area of "application" of microloans is very specific, and can be a real salvation in some situations, or a trap in others. Do not succumb to provocations and pressure. Remember that you and only you need, the interests of MFI employees should not become the reason for concluding contracts that are unfavorable for you.

25 slide

Description of the slide:

If you understand that you will not be able to pay off the microloan at the agreed time, do not panic. Try to pay off your debt as quickly as possible. If an MFI violates your rights, accrues interest on the amount for which it has no right to accrue, or puts pressure on you (including with the help of collectors), go to court. It is possible that he will take your side. You still have to pay off the debt, but without the colossal interest that is unfairly accrued.

26 slide

Description of the slide:

27 slide

Description of the slide:

28 slide

Description of the slide:

If a person has made a delay, it is advisable to immediately contact an employee of the microfinance company, explain the situation and name the expected date of payment. MFIs are no less interested in a peaceful settlement of the problem than borrowers, so the likelihood of finding a compromise at the initial stage is very high. The decision in each case is made personally - the operators will suggest the best way out of the situation, if the person is really interested in solving this problem.

Permitted operations (2 of 2) :

motivated to refuse to conclude a microloan agreement;

carry out, along with microfinance activities, other activities subject to the restrictions established by law, including issuing other loans and providing other services in the manner determined federal laws and constituent documents;

attract funds in the form of loans, voluntary (charitable) contributions and donations, as well as in other forms not prohibited by federal laws, subject to the restrictions established by law.

It is worth noting that MFIs have the right to provide the information they have to credit bureaus.

Microfinance organizations (MFIs)

Prohibited operations:

Attract funds from individuals;

Act as a guarantor for the obligations of its founders;

Issue loans in foreign currency;

Change interest rates unilaterally and (or) the order of their determination

Apply to Borrower who repaid the microloan amount in full or in part ahead of schedule and in advance in writing

notifying the microfinance organization of such intention at least ten calendar days in advance, penalties for early repayment of a microloan;

Carry out any kind professional activity in the securities market;

Issue a microloan (microloans) to the borrower if the amount

principal debt of the borrower to the microfinance organization for

microloan agreements in the event that such a microloan (microloans) is granted will exceed one million rubles.

Varieties of microfinance organizations

savings and loan associations.

Attract savings deposits and place them mainly in mortgage loans. Common in the USA

Credit Unions. Created by a certain circle of founders close to the place of residence or professional activity ( e.g. credit unions of doctors, teachers, miners, etc..). The goal is to increase the efficiency of using Money and provision of soft loans

Mutual credit societies - organizations,

whose activities have common features with credit unions, but they unite legal entities, as a rule, close in professional affiliation.

Banking system

The banking system is

a set of banks and non-bank credit institutions operating in the economy within the framework of a single financial and credit

and legal mechanism.

IN in accordance with Art. 2 of the Law "On banks and banking”, the Russian banking system includes the Central Bank of the Russian Federation (Bank of Russia), credit institutions, as well as

representative offices Financial markets and banking banking business. USUE

Maramygin M.S.

Classification features |

banking systems (1 out of 5) |

by the degree of state participation in banking |

accounting and distribution model of banking |

market model of the banking system. |

in order of relationship |

emerging between credit |

organizations: |

single-tier banking system; |

Maramygin M.S. |

Signs of classification of banking systems (2 out of 5)

Accounting and distribution model of the banking system implies the monopoly right of the state to carry out banking operations.

Character traits:

● state monopoly on banking operations and establishment of banking institutions;

● single vertical in the banking system; ● unified policy of relations with clients;

● state responsibility for the performance of banks;

● administrative appointment of bank managers government bodies;

● a narrow range of credit institutions in the country

Signs of classification of banking systems (3 out of 5)

Market model of the banking system built on the principles of private property and competitive activity in the banking sector of the economy

Character traits:

● the role of the state is limited to establishing the basic principles and parameters of development.

● banking sector management is decentralized.

● the presence in the banking system of a significant number of private banks with the obligation of the state to maintain order in the national economy

Signs of classification of banking systems (4 out of 5)

One-tier banking option

The system is characteristic either for the initial stages of the formation of this activity, which implies the existence in the economy of a small number of banks of the same type. Either this is characteristic of a totalitarian economy, in which only state-owned credit institutions operate.

Signs of classification of banking systems (5 out of 5)

Multilevel banking system

involves the division of credit institutions into several levels. Regardless of the number of allocated levels, the first is always the Central Bank(or other body performing its functions).

Within the framework of the functioning of multi-level banking systems, one can single out

two-tier and three-tier systems

Multilevel banking system

Two-tier banking systemis the most widespread in the modern world.

The second level is represented by banks and special financial and credit institutions.

Three-tier banking system.

The second level includes only banking institutions, and the third level includes special financial and credit institutions.

Loan products sold by OJSC "SME Bank" Through Microfinance Organizations and Factoring Companies. Regional Fund. Microloan of the 1st level. Microloan 1st level Plus. Factoring - Company. * Depending on the collateral provided by the partner. 10. Credit cooperative of the 2nd level. Providing loans to SMEs. Provision of microcredits to SMEs. Providing microloans to SMEs. Providing microloans to SMEs. Financing of SMEs against the assignment of a monetary claim. State guarantee of the subject of the Russian Federation; bank guarantee; Guarantee of the regional guarantee fund; Pledge of securities. Pledge of rights on loans. Bank guarantee; Guarantee of the regional guarantee fund; Guarantees of shareholders, participants, heads of MFIs pledge of securities; Pledge of rights (claims) on loans. bank guarantee; Pledge of securities. Target. Max amount to the SME subject / Term / Rate. bank guarantee; Guarantee of the regional guarantee fund; Pledge of securities; Pledge of real estate; Guarantee of legal entities and managers of the Credit Cooperative of the 2nd level / 1st level. State guarantee of the subject of the Russian Federation; bank guarantee; Guarantee regional fund; Guarantees of shareholders, participants; Pledge of securities, real estate; Pledge of rights (claims) on loans. Security.

Slide 10 from SME Bank presentation to economics lessons on the topic "Bank"Dimensions: 960 x 720 pixels, format: jpg. To download a free slide for use in an economics lesson, right-click on the image and click "Save Image As...". You can download the entire presentation "SME Bank.pptx" in a zip-archive of 1526 KB.

Download presentationBank

"Rosgosstrakh Bank" - Chief Managing Director. ATM network. Story. Rus-Bank. Large bank. Activity. Enterprise lending. Achievement of leadership positions. Motto. financial products. Megatrastoil. Joint Stock Commercial Bank. Authorized capital. Rosgosstakh bank.

"Salary project of Sberbank" - Salary project. What are the benefits of a salary project for employees. Bonuses for leaders. What is a payroll project? Payroll options. Why in the savings bank. Mobile bank. Middle managers. Types of cards issued within the framework of projects. What is the benefit of the Sberbank salary project for the organization.

Alfa-Bank - Lean-method in banking processes. Process research. Process cards. Expert evaluation of processes. Application of Lean-methods in banking IT. Selection of processes for improvement. How to get the maximum effect. Lean is a technique for improving process efficiency and eliminating waste. Conditions for choosing Lean projects.

"SME Bank" - Microfinance organizations. Partners of OJSC "SME Bank". Loan products sold by OJSC SME Bank through partner banks. JSC "SME Bank" - the history of creation. Innovations in the SME Bank program. Favorable external environment for SMEs. Loan products sold by SME Bank OJSC. Refinancing of the non-commercial sector.

"Commercial Banks of Kyrgyzstan" - Completed by: Andashbekov Meder. JSC "Akylinvestbank" JSC "Zalkar Bank" OJSC Investbank "Issyk-Kul". JSC rk "amanbank" OJSC "Aiyl Bank" JSC "KyrgyzCredit Bank" CJSC "BTA Bank" CJSC "Manas Bank" CJSC "Kyrgyz Investment and Credit Bank.

Presentation on the topic: PRESENTATION FOR INVESTORS ORGANIZATION OF MICROFINANCE BUSINESS 2016» - Transcript:

1 PRESENTATION FOR INVESTORS MICROFINANCE BUSINESS ORGANIZATION Almaty 2016

2 NAVIGATION Summary 2. Problem 3. Problem Solving 4. Business Features 5. How It Works 6. Scaling 7. Market Analysis 8. Large Companies 9. Medium Companies 10. MFI Project 11. MCO / LLP Project 12. How We Differ 13 Promotion channels 14. Technological aspects 15. Financial model 16. Project start-up costs 16. SWOT analysis of the project 16. Risks 14. Gravity of goals 15. Method of project financing 16. Team 17. Postscript

3 SUMMARY 3 Investments Single bachelors Project essence Single bachelors Financial indicators Single bachelors Launch of microfinance project Total 500 mln. tenge Borrowed 500 mln. people Planning horizon 6 years NPV IRR Payback period 4 years. 4 Disc. payback period 6 years. The MCO/LLP business was not included in the analysis.

4 MARKET FINANCIAL MARKET OF CLIENTS The number of MFIs decreased from 415 in mid-2015 to 71 per year. The market as a whole is shrinking Banks have reduced the supply of money Money has risen in price, there is no tenge liquidity, deposits by 80% in foreign currency capital Deferred demand arises in households Clients are left without financing Crisis puts pressure on business PROBLEM

5 Business credits 5 Payday loans (off-line) SOLVING THE PROBLEM One “roof” MFI Single bachelors MCO / LLP Single bachelors Microfinancing payday for amounts up to 150 thousand tenge. The company is an ordinary LLP. Loans up to 18 million tenge. Subject to the regulation of the National Bank. Three businesses Payday loans (on-line) Two companies Work with clients in the office and via the Internet - choice: Off-line immediately On-line in the future

6 BUSINESS FEATURES 6 Business Min Authorized capital Max Credit rate NBK regulation Note Credit partnership 100 MCI56% Yes Credit partnership only Lombard 100 MCI Unlimited No Provision of credit secured by movable property. Accounting, storage and sale of jewelry MFI 30 million tenge 56% Yes Unsecured loans, secured loans, group loans MCO / LLP100 MCI Unlimited No Mainly online lending. Short-term credits - “credits before salary”

7 7 HOW IT WORKS Sales Channels Single Bachelors Offices Clients Single Bachelors Products Single Bachelors Business Classic Business Express Agro Lombard Consumer (?) Clients Single Bachelors Products Single Bachelors Paycheck to Pay Loan Sales Channels Single Bachelors Offices Internet LLP

8 ZOOMING 8 Almaty (off-line) Almaty (off-line + on-line) Other regions? Kazakhstan? The project is easily scalable

9 PROBLEM 9 1. State: - Samruk-Kazyna - Kaz Agro - other state-owned companies 2. Oil and gas companies: TCO, KPO, SNPS, Lukoil, Agip 3. Mining and Metallurgical Companies: - Arcelor Mittal Temirtau - ENRC - Kazakhmys I Level. Great. Business structures of representatives of the establishment II Level. Large (Business&Power) Level III. Large (other companies) Transport Communications Construction TradeFMCGProcessing industry Power generation Oil and gas complex, except for the giants MMC, except for the giants Agriculture Transnational commodity companies Oil Metal IV Level. Medium business (services for large business) Level V. Small "white" business VI Level. Small "grey" business and self-employed population MARKET ANALYSIS

16 MFI PROJECT 16 Status Rate Single bachelors Loan term Single bachelors 6-8 months. max 12 months Penalties Single bachelors max loan amount Single bachelors Number of branches Single bachelors Issuance Single bachelors Issuance of credits only through the bank 1-2% for each day of delay Collateral 40-50%, average 45%, commission 2% Unsecured 50-55%, average 52%, commission 5.5% Collateral max 5 million, average 3 million tenge, Unsecured max 1 million, average 400 thousand tenge Single bachelors Evaluation is based on the income and collateral of the borrower Expected delinquency Single bachelors 2% / year - for secured loans, 4-6% / year for unsecured loans Loans Single bachelors 90% Secured 10% Unsecured 2

17 MCO / LLP PROJECT 17 Status Rate Single bachelors Loan term Single bachelors 3-30 days Penalties Single bachelors max loan amount Single bachelors Number of branches Single bachelors Issuance Single bachelors Issuance of credits only through the bank 1-2% for each day of delay%, average 400%, commission 0% max 150 thousand tenge average 40 thousand tenge 1 Credooitosp. Single bachelors Scoring according to BKI Expected delay Single bachelors 20% / year

18 HOW WE DIFFER 18 We use group financing to reduce credit risks We focus on collateral of liquid property When pledging vehicles, we use options A) mortgage B) installing an electronic control system When pledging housing, we do not accept housing with children When issuing a loan 5 For large amounts, we use a buyback agreement Upon return of the credit In case of delay from the 1st day, we connect a call center We need a person with epaulettes

21 FINANCIAL MODEL 21 BALANCE LINE ASSETS Money Loans to customers: Agro-credits Consumer credits Business credits Distressed credits Provision for credits Total credits Fixed assets: Equipment, furniture, etc. Intangible assets Total fixed assets TOTAL ASSETS LIABILITIES Other credits oator debt Income of future periods Total liabilities EQUITY Paid-in capital Retained earnings Reserves Total equity TOTAL LIABILITIES AND EQUITY Calculations are made excluding MCO / LLP business 000 KZT

22 FINANCIAL MODEL 22 18% 9% 73% Total 100% Excluding market influence, the growth dynamics of the loan portfolio is limited by 2 factors: 1) The size of investments and/or borrowed funds; 2) Labor productivity and the number of credit officers. Loan portfolio structure Agro-credits Cons. credits Business - credits 000 KZT

23 FINANCIAL MODEL 23 OP&I Interest income Interest expenses Net interest income Fee and commission income Personnel expenses General and administrative expenses Depreciation of intangible assets0100 Depreciation of IA Provisions for problem loans Profit before taxes Income tax Net profit Net income margin-12%39%43%44% 000 KZT

24 FINANCIAL MODEL 24 Dynamics of income and expenses 17% 83% Total 100% Fee and commission income Interest income 46% 21%1%31% 100% Personnel expenses General and administrative expenses. expenses Provisions Depreciation 000 KZT

25 FINANCIAL MODEL OF KZT ODF Operating flow Net income Depreciation and amortization Adjustments to accounts receivable and creditors Net cash Investment flow CAPEX Net cash Financial flow Loans to customers Loans repaid by customers Capital investments Net cash CASH INCREASE Accumulated net cash flow Discounted flow with accumulation

26 FINANCIAL MODEL OF KZT Indicator Sustainability and profitability Operational sustainability 88%198%221%225%226%227% Return on assets (ROA)-3%16%15%13%11%9% Return on equity (ROE)-3%17 % 14%12%10% Portfolio growth 286%121%74%53%40% Borrower growth 176%92%42%25%17% Asset/liability management Gross portfolio return 81%157%146%137%128%120% Net interest margin 100% Portfolio to assets 108%105%92%82%75%69% Debt to equity 0% Leverage1.1x 1.0x Efficiency and productivity Total headcount (end of period)34 Loan Officers (end of period )10 Portfolio (thousand tenge) per 1 credit officer Profitability EBITDA margin-12%49%54%55% Net profit margin-12%39%43%44%

28 SWOT-ANALYSIS OF THE PROJECT 28 Strengths Weaknesses Presence of a result-motivated team Experience in banking structures, retail and MS Presence of a call center No experience in implementing full-fledged independent financial projects Team not fully formed Requires financial leverage Opportunities Threats Entry into the market of competitors with stronger finances and marketing Changing market preferences, changing ecosystem Crisis is a good time to open a business with “anti-crisis” value Skim the cream and sell the business

29 RISKS 29 RISK LEVEL OF RISK METHOD OF LEVELING Incorrect business model Medium Reorientation to another market / market segment Incorrect marketing strategy Medium Reorientation to another market / market segment Poor organization of processes and procedures. High Detailed description of all processes, implementation of CRM for control Change of key employees High Motivation due to options for future profits Lack of funding Medium The project initially has a low financial entry barrier, but high marketing costs Emergence of competitors with a similar product High Preemption of a free market niche Change in preferences Market Low No

30 SCHEDULE OF GOALS 30 Transition to strategic planning Transition to strategic planning Tactical planning Obtaining funding 0-th period + 2 months. Test launch of the project Break-even + 12 months. + 6 months Achievement of planned indicators Achievement of net profit + 6 months. + 3 months Making a decision on scaling the project / leaving the project + 3 months. Team

31 PROJECT FINANCING METHOD 31 1 Contribution to the Authorized Fund 30 million tenge (minimum required amount) 2 Further, the project can be funded in 2 main options or their combinations A. Direct financing B. Financing through a credit and deposit scheme in a bank. This scheme provides that the sum of the available limit and the loan balance is less than the amount of the deposit. Advantages - money always "works", even if the MFI's business has not yet reached the project portfolio indicators. Indicative indicators: Deposit in tenge, rate on deposit 10%, rate on credit 13% Deposit in foreign currency, rate on deposit 4%, rate on credit 20% A mixed scheme is possible.

32 TEAM 32 Operations Director: Barak H.O. Role: Experience: Education: Employees Outsourcing: IT Collection Partly Marketing Chief Accountant Loan Officers Underwriters Operations Director: Neizvestnaya A.S. Role: Experience: Education: 4 Assessor 5 Lawyer 6 SA

Permitted operations (2 of 2) :

motivated to refuse to conclude a microloan agreement;

carry out other activities along with microfinance activities, subject to the restrictions established by law, including issuing other loans and providing other services in the manner prescribed by federal laws and constituent documents;

attract funds in the form of loans, voluntary (charitable) contributions and donations, as well as in other forms not prohibited by federal laws, subject to the restrictions established by law.

It is worth noting that MFIs have the right to provide the information they have to credit bureaus.

Microfinance organizations (MFIs)

Prohibited operations:

Attract funds from individuals;

Act as a guarantor for the obligations of its founders;

Issue loans in foreign currency;

Unilaterally change interest rates and (or) the procedure for their determination

Apply to a borrower who repaid the microloan amount in full or in part ahead of schedule and in advance in writing

notifying the microfinance organization of such intention at least ten calendar days in advance, penalties for early repayment of the microloan;

Carry out any kind of professional activity in the securities market;

Issue a microloan (microloans) to the borrower if the amount

principal debt of the borrower to the microfinance organization for

microloan agreements in the event that such a microloan (microloans) is granted, will exceed one million rubles.

Varieties of microfinance organizations

Attract savings deposits and place them mainly in mortgage loans. Common in the USA

credit unions. They are created by a certain circle of founders close to the place of residence or professional activity (for example, credit unions of doctors, teachers, miners, etc.). The goal is to increase the efficiency of the use of funds and the provision of preferential loans

Mutual credit societies - organizations,

whose activities have common features with credit unions, but they unite legal entities, as a rule, close in professional affiliation.

Banking system

The banking system is

a set of banks and non-bank credit institutions operating in the economy within a single

and legal mechanism.

In accordance with Art. 2 of the Law "On Banks and Banking", the Russian banking system includes the Central Bank of the Russian Federation (Bank of Russia), credit institutions, as well as

representative offices

Classification features

banking systems (1 out of 5)

by the degree of state participation in banking

market model of the banking system.

in order of relationship

emerging between credit

single-tier banking system;

multilevel banking system.

Signs of classification of banking systems (2 out of 5)

the model of the banking system implies the monopoly right of the state to carry out banking operations.

● state monopoly on banking operations and establishment of banking institutions;

● single vertical in the banking system; ● unified policy of relations with clients;

● state responsibility for the performance of banks;

● administrative appointment of bank managers by state bodies;

● a narrow range of credit institutions in the country

Signs of classification of banking systems (3 out of 5)

The market model of the banking system is built on the principles of private ownership and competitive activity in the banking sector of the economy

● The role of the state is limited to establishing the basic principles and parameters of development.

● management of the banking sector is decentralized.

● presence in the banking system of a significant number of private banks with the obligation of the state to maintain order in the national economy

Signs of classification of banking systems (4 out of 5)

One-tier banking option

The system is characteristic either for the initial stages of the formation of this activity, which implies the existence in the economy of a small number of banks of the same type. Either this is characteristic of a totalitarian economy, in which only state-owned credit institutions operate.

Signs of classification of banking systems (5 out of 5)

Multilevel banking system

involves the division of credit institutions into several levels. Regardless of the number of allocated levels, the first is always the Central Bank (or another body that performs its functions).

Within the framework of the functioning of multi-level banking systems, one can single out

two-tier and three-tier systems

Multilevel banking system

The two-tier banking system is the most common in the modern world.

The second level is represented by banks and special institutions

Three-tier banking system.

The second level includes only banking institutions, and the third level includes special financial and credit institutions.

Microfinance organizations presentation

Presentation for the speech by I.A. Kochetkova at FINFIN 2018 - about the socialization of MFI-version 1

Dear members of SRO "Unity",

in connection with technical work

The personal account is temporarily closed.

We apologize!

SRO "Unity" is working on

identifying organizations that carry out

illegal microfinance activities.

For this reason, we kindly ask you to guide

available information:

Consultation on software issues and transition to ENP and OSBU

hot audience

- 0% bounce

- high viewing depth

- the ability to promote the brand, to form a positive image

- adequate value for money (2000 rubles per month for everything!)

- high ranking in search engines

- Convenient services for attracting hot customers (Unified database of loans and investments of the Russian Federation).

Rehabilitation of the industry's image: unlimited access to text materials from partners.

- Remote press center (assistance in writing press releases, interviews, making banners).

Group of companies "International Financial Center" (IFC) started its activity since the establishment in 1998 training center MFC, which immediately took a leading position among specialized centers for training and advanced training of financial professionals, including in the stock market, and since 1998 has been one of the leaders in the Russian market of related services. On the basis of the MFC Training Center, the following were created: the MFC Institute, MFC-Consulting, recruitment agency, International Financial Center (St. Petersburg), Center for Professional Attestation and Certification.

To date, the MFC Institute is a methodological and organizational leader in the field of training, retraining of accountants as part of the transition to the chart of accounts and industry accounting standards (OSBU) of the Bank of Russia for non-credit financial institutions (NFOs), including MFIs, CPCs, ZhNK , SKPK and pawnshops. Developed and implemented optimal learning system , learning programs and the corresponding training schedule based on years of experience (since 1998):

Designed and adapted specialized training programs for participants in the microfinance market .

Low affordable tuition for "small" participants financial market and, in general, for participants in the microfinance market.

Free webinars on introductory issues of accounting and financial reporting for MFIs, CCCs, ZhNKs, ACCCs, pawnshops.

MFIs, CPCs, WOCs, SKPCs and pawnshops that have indicated the MFC Institute in the training plan (changes / additions to the training plan) are provided with an additional discount of 20 percent.

Handouts, visual, educational and methodological materials, knowledge control tools (in total - more than 500 pages) have been prepared and are actively used.

Are attracted highly qualified teachers , available material using practical examples from financial and economic activities MFI, CPC, ZhNK, SKPK and pawnshops .

Unique experience in training participants in the microfinance market in the field of the chart of accounts and OSBU .

Training is actively conducted using online technologies through Internet broadcasts. The MFC Institute has its own high-tech infrastructure for organizing Internet broadcasts and distance learning and interacts with the largest and most reliable service for organizing online broadcasts today.

Extensive opportunities for accountants and auditors of microfinance market participants not to "lock in" only on industry (microfinance) specifics, but also to comprehensively study accounting and financial reporting for NFIs, to become a specialist general profile and build a career in accounting, financial reporting, or auditing different types of NFIs.

Microfinance organizations "Money Men" and "MigCredit" debunked the myths about consumer lending in Russia

On November 14, the microfinance organizations "Money Men" and "MigCredit" held a press conference "Consumer lending in Russia: myths and reality."

The main topic of the press conference was an attempt to debunk some of the myths about unsecured consumer lending in Russia. CEO, Chairman of the Board of the MigCredit MFC Laura Fainzilberg and Managing Director of the Money Men microfinance organization Alexander Dunaev cited a number of facts and figures indicating that the current level of debt load of the population in the country is not only not critical, but is significantly inferior to that of the majority countries with developing and developed economies.

Unsecured retail lending market in Russia

An important aspect of the growth of lending in the country was the development of the overall financial infrastructure in the country. This is evidenced by the growth in the number of credit histories and the increased availability of information from credit bureaus for financial institutions. According to various data, today from 20% to 24% of potential borrowers do not have a credit history. The availability of real-time information on borrowers' credit discipline and existing credit burden, in turn, stimulated the development of the express lending market. In addition, the factors that ensured the growth of the unsecured court market include the lack of long-term available funding, the growth of financial literacy of the population and the possibility of building scalable intra-bank operational processes.

Currently, the segment of cash loans, credit cards and POS-loans makes up 63.5% of the total volume of retail loans.

Despite increased attention to monoliner banks in terms of the country's population's debt burden (Russian Standard, HCF, Renaissance Credit, TCS, etc.), their joint share in the unsecured lending market does not exceed 15% of the total retail lending market.

The share of income of Russians allocated for servicing loans in 2012 was 17%. For example, in Turkey, where the question of the debt load of the country's citizens is not raised at all, this figure is 30%. The share of income allocated to debt servicing among Russians is also lower than in Hungary, Poland, the Czech Republic and other European countries.

On average, in Russia, there are 1.3 thousand dollars of consumer loans for every economically active resident, which is almost 30% lower than the same indicator in Poland.

At the same time, 52% of the economically active population in Russia have no loans at all.

In the credit card market, Russia lags far behind economically developed and developing countries in terms of issues. There are only 155 credit cards per thousand Russians, while in the US there are 1,701 credit cards per thousand inhabitants.

According to the results of the first half of 2013, the share of borrowers with two to five active loans decreased by 5 basis points compared to the second half of 2012. At the same time, the share of borrowers with 5 loans is less than 1% of the total number of borrowers.

The trend is associated with reductions in risky unsecured lending programs.

Financial institutions are adjusting their credit policy in the direction of tightening requirements for borrowers, which indicates, among other things, effective work market mechanisms of self-regulation in the retail lending market.

The quality of loan portfolios is stable

Overdue debt in Russia is stable, and since 2010 has a general downward trend.

The cumulative ratio of overdue consumer debt in the second quarter of 2013 shows a positive trend compared to the same period in 2012 (4.6% vs. 4.8%).

IFC: myths and reality

The volume of IFC loans does not affect the level of the population's credit burden. The IFC market shows strong growth rates, having increased from 30 billion rubles. in 2010 to 48 billion rubles. In 2012.

According to the results of 2013, the volume of the microfinance market is predicted to grow to 85 billion rubles. At the same time, only 45% of IFC's assets are financed by individuals for consumer needs.

With excessive public attention to the microfinance market in terms of its impact on the level of credit burden on the population, the volume of IFC loans is insignificant in comparison with the banking sector. The total portfolio of the IFC (including lending to small and medium-sized businesses) in relation to the volume of bank lending is only 0.18%.

IFCs do not issue loans online to “everyone in a row”. Along with the growth of the IFC market, there is a strong trend towards improving risk management systems. The average level of approval of applications for a loan "MigCredit" during 2013 is 13.3%, the same indicator for "Money Men" - 10%.

It is important for the IFC to issue a loan to someone who intends to repay the borrowed funds. At the same time, it is necessary to build trusting relationships with the prospect of long-term cooperation. Microfinanciers are raising future clients of banks, returning clients back to the rut of institutionalized monetary relations. So, applying to the IFC can improve the credit history of borrowers. In the future, this will give them access to banking products.

IFC clients are not marginalized, but ordinary taxpayers with low incomes

Today, more than 20 million people of the economically active population of Russia do not have access to banking products. At the same time, slightly more than 1.5 million Russians have used IFC services to date, which indicates the potential of the market.

The difference between IFC and banks, which has become the basis for the birth of the myth of the marginality of clients, is the willingness of the IFC to lend to people with an imperfect credit history.

Laura Fainzilberg:“Over the past few months, the public has been actively discussing issues related to unsecured consumer lending in Russia. One of the main theses in the information flow is the position that the consumer lending market in the country is overheated, the population is overburdened, i.e. has an excessive debt load. However, for most financiers, it is obvious that the level of credit burden in the consumer lending sector currently does not pose a threat to the country's economy. We conducted a study of the lending market, summarized disparate data confirming this statement.”

Alexander Dunaev: « Russian market microfinance is growing at a steady pace, which indicates a stable demand for the service from both individuals and small and medium-sized businesses. Naturally, this growth attracts the attention of the media and the mega-regulator, which requires an increased degree of openness and transparency in our industry. We tried to bring clarity by looking at objective facts in order to show the fair state of affairs in the consumer lending market in general, and in the microfinance market in particular.”

Mikhail Mamuta, Chairman of the Council of SRO NP "Unification of the World", President of NAMMS in his speech, he assessed the impact of the mega-regulator's initiatives on the future of unsecured consumer lending in Russia.

The article was written based on materials from sites: studfiles.net, sro-mfo.ru, moneyman.ru.