We continue filling out the declaration for the standard tax deduction.

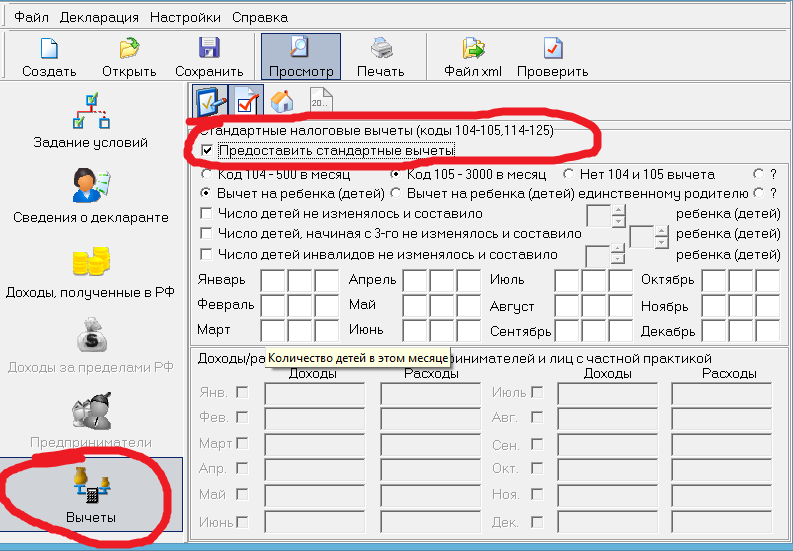

Go to the "Deductions" tab (bottom left). The window opened:

We fill this window.

It corresponds to sheet G1 of the declaration form. Check the "Give standard deductions" checkbox (if it is not checked).

Then select your type of deduction from the first line. Deduction for yourself. Code 104 is a deduction of 500 rubles, code 105 is a deduction of 3,000 rubles. If you don’t have a deduction “on yourself”, then check the box “no 104 and 105 deductions”.

Next, fill out the deduction for the child. If you qualify for a single deduction, select the child(ren) deduction; if you are eligible for a double deduction as a single parent, select the single parent child deduction. If the number of children has not changed during the year, check this box and write the number of children. The program will automatically put down the same number for all months. If the number of children has changed during the year, fill in the boxes manually. There are three boxes next to each month. In the first window we put the number of children 1 or 2. In the second window we put the number of children, starting from the third, that is, there are only three children, we put 1. If there are only 5 children, we put 3. In the third window we write the number of children with disabilities. Here's what happened in our example:

Completing a return for a standard deduction

The calculation of standard deductions will be carried out according to the source for which you check the “Calculate from this source” box when you filled in the income data in the first part of the filling.

If you received real help in filling out the declaration and were satisfied, we ask you to help the development and prosperity of the site! To do this, you can transfer a small amount using the special form below. Thank you!